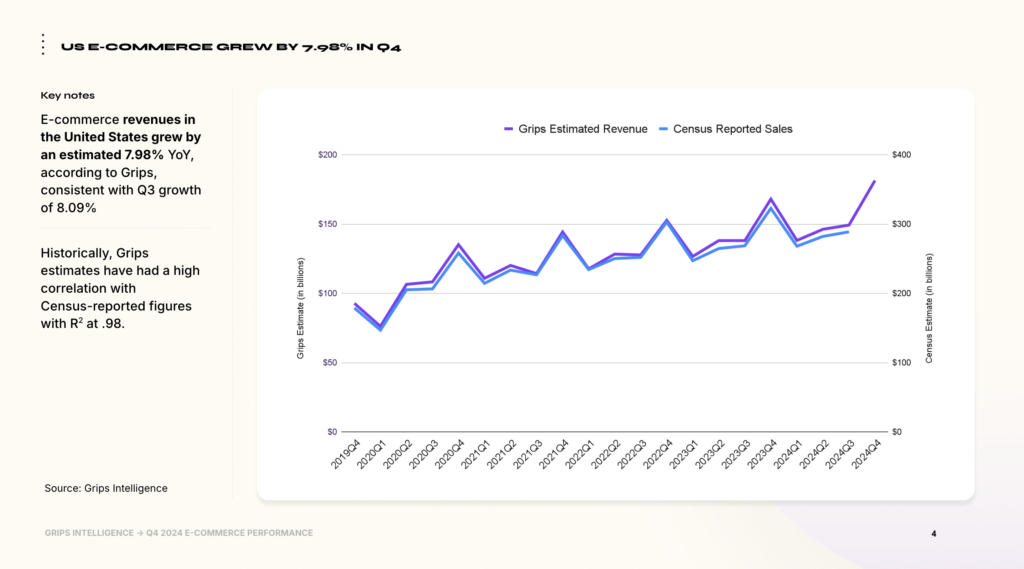

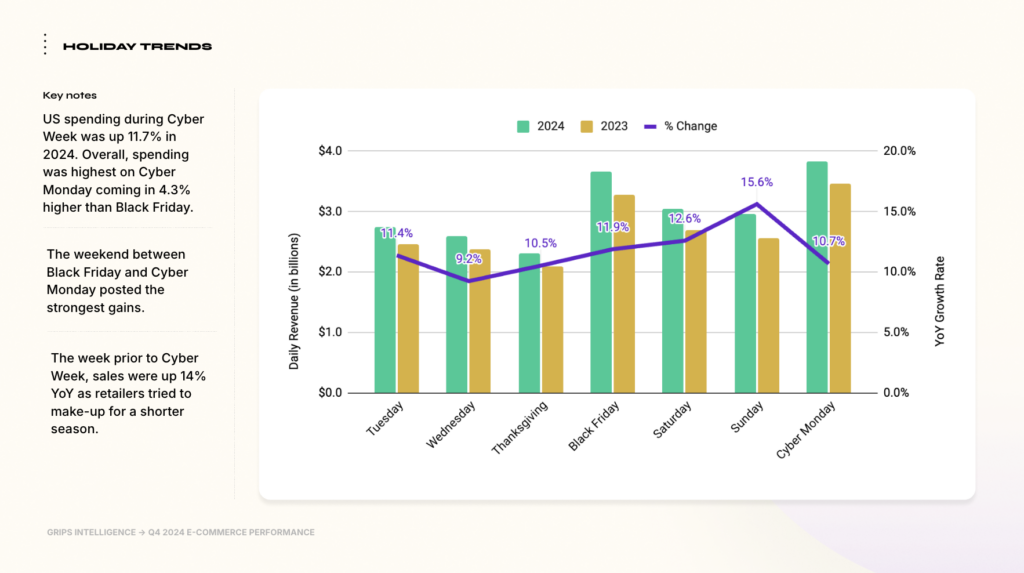

The U.S. e-commerce market demonstrated consistent strength during Q4 2024, with overall revenues increasing by 7.98% year-over-year (YoY), mirroring the growth rate of 8.09% in Q3. Cyber Week played a critical role, driving an 11.7% increase in sales compared to the same period in 2023. These results highlight the resilience of online retail amidst economic uncertainties.

State of E-commerce Report: US

Overview of U.S. E-Commerce Growth in Q4 2024

Key Holiday Trends

- Top Revenue Days: Black Friday generated the highest overall revenue, followed by Cyber Monday. However, not all categories followed this trend. Categories like apparel and electronics saw stronger performance on Black Friday, while mass-market categories, including beauty, tended to perform better on Cyber Monday.

- Days with the Most Growth: The Sunday before Cyber Monday posted the highest week-over-week (WoW) growth at 15.6%, reflecting increased consumer activity leading into Cyber Monday.

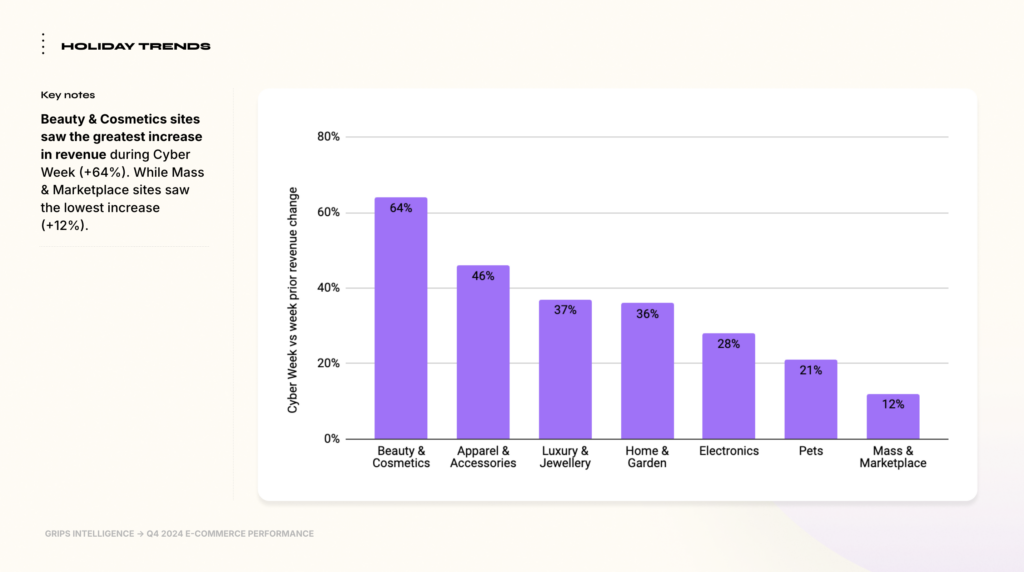

- Cyber Week Reliance: Certain categories, such as beauty and cosmetics, experienced a 64% revenue increase during Cyber Week compared to the prior week. This reliance on Cyber Week highlights their dependence on holiday promotions to drive sales, which may signal vulnerabilities for periods outside peak shopping times.

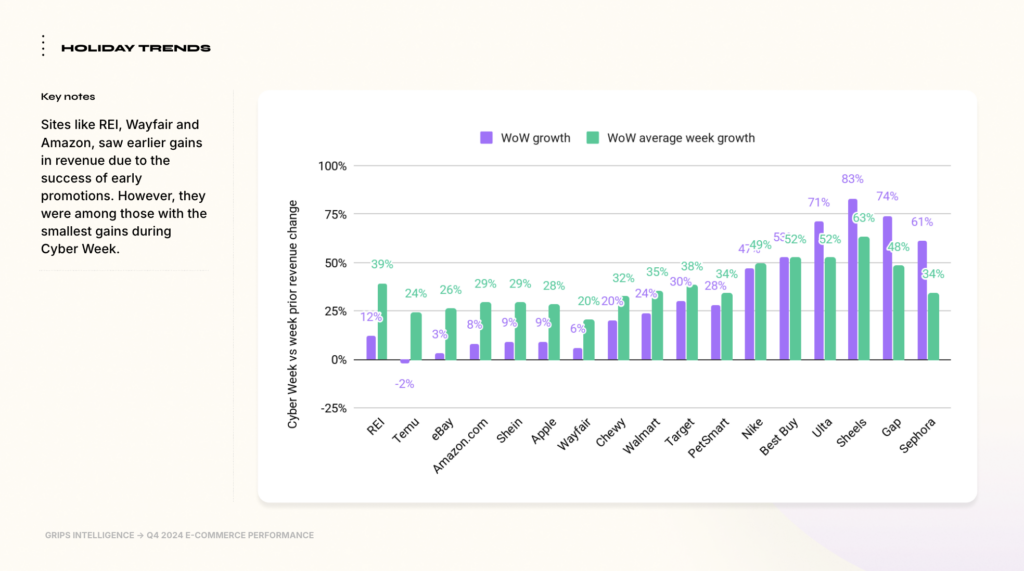

- Early November Sales: Retailers that successfully launched early November sales often saw lower increases in revenue during Cyber Week. This indicates that early promotions can diminish the impact of Cyber Week sales as consumer spending evens out over the month.

Retailer-Specific Performance by Category

Using Q4 versus Q3 US revenue change data, the following insights emerged:

Apparel & Accessories:

Top Performers:

- Gap.com: Delivered $901.47M in Q4 revenue, with a 75.2% QoQ increase, benefiting from strong seasonal demand and promotions.

- Nordstrom.com: Achieved $776.53M in revenue, reflecting a 25.2% QoQ growth, driven by its curated holiday collections.

- Shein.com: Reached $700.98M in revenue, with an 11.6% QoQ increase, continuing to leverage its affordability and fast-fashion appeal.

Fast Movers:

- AloYoga.com: Achieved $201.5M, a 197.1% QoQ increase, driven by demand for premium athleisure.

- LLBean.com: Generated $343.4M, a 93.6% QoQ increase, benefiting from seasonal demand for outdoor and winter apparel.

- TheChildrensPlace.com: Recorded $101.9M, a 79.2% QoQ growth, leveraging holiday-focused campaigns.

- Ugg.com, CanadaGoose.com, Sorel.com, and Bombas.com: Seasonal demand for winterwear and giftable items drove strong performance across these retailers, with an average QoQ growth exceeding 150%.

Beauty:

Top Performers:

- Ulta.com: Delivered $409.04M, achieving a 42.5% QoQ growth, driven by exclusive holiday sets and promotions.

- Sephora.com: Reached $197.95M, marking a 63.4% QoQ increase, leveraging its strong holiday campaigns.

- BathandBodyWorks.com: Achieved $163.65M in Q4 sales, benefiting from its strong positioning in giftable items.

Fast Movers:

- GiorgioArmaniBeauty-USA.com: Delivered $22.6M, a 145.7% QoQ increase, driven by luxury branding and holiday gifting.

- SummerFridays.com: Achieved $7.2M, reflecting a 187.1% QoQ growth, fueled by demand for clean beauty products.

- Warmies.com: Generated $5.7M, a 195.6% QoQ increase, highlighting the popularity of comfort-driven beauty and self-care.

- MakeupByMario.com: Earned $3.8M, with a 121.4% QoQ growth, leveraging its celebrity-backed brand and holiday promotions.

Consumer Electronics:

Top Performers:

- Apple.com: Delivered $5.37B in Q4 revenue, a 5.7% QoQ increase, supported by new product launches and strong holiday deals.

- Samsung.com: Reached $3.62B, a 4.7% QoQ growth, fueled by demand for smart home devices and smartphones.

- BestBuy.com: Achieved $3.44B, reflecting a 30.9% QoQ increase, driven by promotions on gaming and home electronics.

Fast Movers:

- AragonSNS.com: Recorded $2.62M, a 396.6% QoQ increase, driven by demand for premium home theater and smart home systems.

- DynNexDrones.com: Generated $88.3K, reflecting an 884.7% QoQ growth, fueled by niche drone sales during the holiday season.

- Thermoworks.com: Delivered $15.66M, a 71.2% QoQ increase, driven by seasonal demand for precision cooking tools.

- Adorama.com: Achieved $20.47M, reflecting a 118.2% QoQ growth, boosted by promotions on photography and video equipment.

Luxury and Jewelry:

Top Performers:

- Kay.com: Delivered $197.61M, a 60.5% QoQ increase, driven by strong holiday promotions and targeted campaigns.

- Zales.com: Reached $173.25M, marking a 96.4% QoQ growth, fueled by demand for mid-range jewelry.

- BrilliantEarth.com: Achieved $152.50M, with an 18.7% QoQ increase, showcasing its appeal among ethically sourced jewelry buyers.

Fast Movers:

- WearFelicity.com: Recorded $7.17M, a 320.5% QoQ increase, driven by charm-based and trend jewelry.

- EvesAddiction.com: Delivered $1.95M, a 200.1% QoQ growth, with a focus on customizable jewelry and holiday gifts.

- Oradina.com: Achieved $6.3M, leveraging fine gold jewelry and holiday promotions.

- BaubleBar.com: Reached $11.2M, highlighting affordable statement jewelry that appeals to holiday shoppers.

Home & Garden:

Top Performers:

- HomeDepot.com: Led the category with $4.35B, reflecting a 3.0% QoQ increase, benefiting from a strong focus on home improvement products.

- Lowes.com: Delivered $1.90B, a 8.2% QoQ growth, supported by its wide selection of seasonal products.

- HarborFreight.com: Gained a 9.5% QoQ increase, earning $432.71M, reflecting demand for tools and hardware.

Fast Movers:

- UncommonGoods.com: Delivered $60.46M, a 330.6% QoQ increase, driven by unique and giftable home items.

- SurlaTable.com: Achieved $78.83M, reflecting a 154.2% QoQ growth, boosted by demand for premium cookware and holiday entertaining.

- ShopTerrain.com: Generated $15.44M, a 76.5% QoQ increase, benefiting from its focus on holiday decor and outdoor products.

- All-Clad.com: Recorded $9.63M, a 72.6% QoQ growth, driven by strong demand for premium kitchenware during the holiday season.

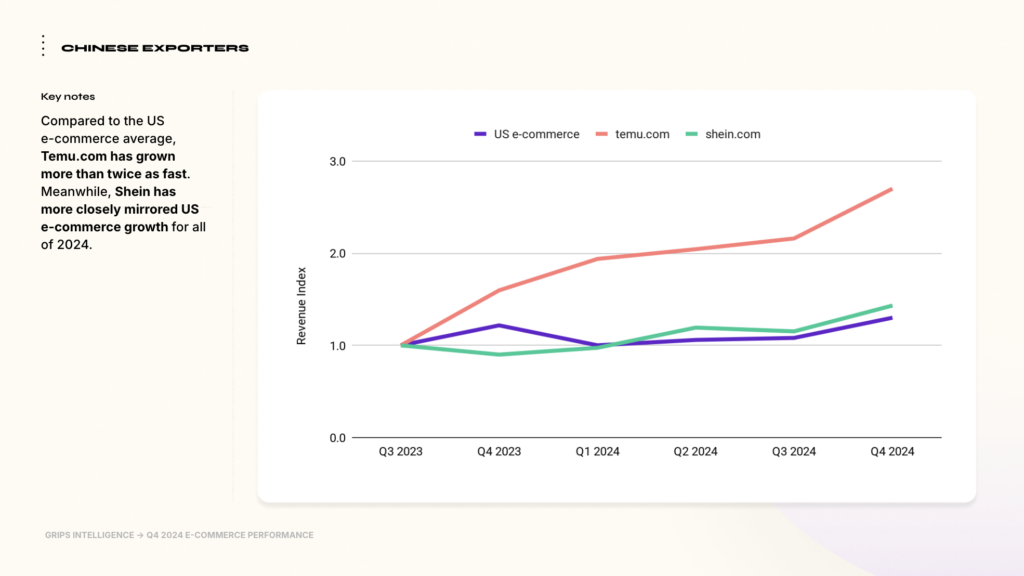

Emerging Players: TEMU and Shein

Asian e-commerce platforms continued to disrupt the U.S. market:

- TEMU.com: Outpaced overall U.S. e-commerce growth by more than 2x, driven by aggressive pricing and a broad product assortment.

- Shein.com: Mirrored U.S. growth rates but faces potential challenges from proposed tariffs that could impact its price competitiveness. The planned 10% tariff on all Chinese imports will likely affect both Shein and TEMU, as their business models heavily rely on sourcing from China.

Tariff and Economic Considerations

Looking ahead, proposed tariffs could lead to a 20% increase in prices for some imported goods. President Donald Trump, who assumed office again on January 20, has announced plans to implement a 10% tariff on all Chinese imports starting February 1, which could disproportionately impact Chinese importers like Shein and TEMU, as well as Amazon, which is increasingly reliant on Chinese imports. Similarly, tariffs on Canadian imports or Mexican imports could affect different sectors, such as lumber from Canada and produce from Mexico. Retailers reliant on global supply chains may face challenges, while those with domestic production capabilities could benefit. Key strategies to mitigate risks include:

- Diversifying supply chains.

- Investing in localized inventory.

- Adjusting pricing strategies to account for consumer elasticity.

Recommendations for E-Commerce Managers

To capitalize on these insights, e-commerce managers should:

- Leverage real-time competitive intelligence to optimize pricing and promotions.

- Invest in Google’s Performance Max campaigns to enhance advertising ROI during peak shopping periods.

- Monitor the impact of macroeconomic factors, such as tariffs, down to the SKU-level to proactively adapt strategies.

- Focus on category-specific growth opportunities, such as Beauty and Luxury goods, which continue to thrive despite broader economic concerns.

Conclusion

The U.S. e-commerce sector demonstrated robust performance in Q4 2024, with seasonal trends, category-specific growth, and advancements in digital advertising driving success. E-commerce managers who stay informed and agile will be well-positioned to navigate the evolving retail landscape and capture opportunities in 2025.

Book your free demo with a Grips Intelligence analyst to learn how Grips can help you stay on top of category trends and your top competitors on a daily basis down to the SKU level.