Fast movers: October – December ’24

Introduction

Grips reports the fastest movers in the e-commerce space alerting you which sites are raking in sales so you can stay competitive. With Grips, e-commerce leaders can measure, in real-time, the success of their competitors’ promotional activities, empowering them to make data-driven decisions about how to respond (or not).

Be sure to follow Grips on LinkedIn to be the first to know when we share something new!

Update: November 21

When it comes to Christmas tree shopping, consumer preferences vary widely across the Atlantic and even between major retailers. In our latest analysis, we looked at sales of over 1,000 distinct Christmas tree SKU sales on Lowes.com, in Menards stores, and on JohnLewis.com, uncovering fascinating insights into regional preferences for tree types, shopping channels and decorative styles. Whether it’s the convenience of online shopping in the US or the curated elegance of John Lewis offerings in the UK, our data sheds light on how holiday traditions shape consumer behavior in different markets.

Online Lowes.com

On Lowes.com, Christmas trees drive a third of seasonal decor sales (33%), the largest single subcategory, with pre-lit trees making up a significant portion. In fact, pre-lit varieties account for an impressive 86% of total Christmas tree revenue, with shoppers particularly favoring larger sizes. In fact, 9-foot trees are the most popular on Lowes.com accounting for 27% of sales alone. Trees 10 feet and taller account for 13% of sales. That preference for height does not necessarily translate to girth, as 29% of trees sold on Lowes.com are described as “slim.”

Pine trees tower over other genera, contributing 43% of Christmas tree revenue. Fir trees come in second with 25% of sales. Frasier Hill Farm brand trees–Lowe’s in-house brand–account for 29% of tree sales followed by Nearly Natural (21%) and National Tree (16%).

In-store at Menards

Unlike on Lowes.com, tree sales account for just 23% of holiday decor sold at Menards brick-and-mortar stores. One factor driving lower tree revenue at Menards is shoppers’ preference for shorter (and cheaper) trees. In store, 7.5-foot varieties generate 46% of tree sales at an average price of $210. By comparison, trees 9 feet and taller account for just 21% of sales but have an average price of $324.

One thing is consistent between Lowes.com and Menards in-store, and that is the dominance of pre-lit trees which account for 83% of revenue. When it comes to tree varieties, trees specified as pine are also the most popular at Menards accounting for 30% of tree sales followed by fir trees with 23% of sales. Menards presents less of an opportunity for other Christmas decor brands as their in-house brand, Enchanted Forest, accounts for a whopping 97% of tree sales.

How UK Holiday Tree Trends at John Lewis Compare to U.S

When comparing U.S. retailers to John Lewis, it’s fascinating to observe the differences in holiday tree preferences between American and UK shoppers. Similar to the U.S., convenience is key, with pre-lit trees accounting for 77% of Christmas tree sales at JohnLewis.com. However, UK shoppers lean toward slightly shorter trees, with 7-foot options being the most popular choice. Potted trees are also more popular accounting for 19% of online sales.

In terms of tree varieties, most trees sold on JohnLewis.com don’t specify a genus. Among those that do, spruce trees take the top spot followed closely followed by pine. Like Menards, the John Lewis brand dominates trees sold by the retailer. Manufacturers seeking to break into John Lewis will almost certainly need to white label their designs, sacrificing their own brand recognition for that of the retailer.

Flocked or not?

With most of the US and UK still green, some shoppers are looking for trees with a bit of snow. Flocked trees are especially popular with Lowes.com shoppers where they represent 31% of sales. Meanwhile, on JohnLewis.com, flocked or snowy trees account for just 12% of revenue, and in Menards stores, such options make up just 8% of sales.

Stay tuned for details on other holiday decor categories and performance during the Black Friday/Cyber Monday rush.

Update: November 19

Advent Calendar Frenzy on JohnLewis.com: Beauty Top-Sellers Sell Out While Shoppers Shift Focus!

At John Lewis, Advent Calendars have taken center stage in holiday sales, initially claiming a massive 27% share of total holiday sales on JohnLewis.com. Demand has been so intense that 9 of the top 10 overall best-sellers are now out of stock, including 8 out of the top 10 beauty advent calendars.

Sold-Out Favorites Include:

- John Lewis Beauty Advent Calendar – Sold out as of 11 November, after generating a whopping $650,00 in revenue since Halloween

- Rituals Classic Advent Calendar – Sold out as of 13 November, with $127,100 in sales season-to-date

- Jo Malone London Advent Calendar – Sold out as of 11/16 generating nearly $100,000 in sales

Why This Matters for Competitors:

With John Lewis largely sold out of top beauty advent calendars, there’s a major window of opportunity for competitors who still have beauty calendars in stock. Now is the perfect time to promote your available inventory and attract eager customers still searching for the perfect holiday treat.

Changing Shopper Trends:

With the surge in out-of-stock items leaving virtual shelves virtually bare, advent calendars’ share of John Lewis’ holiday sales dropped to just 14% from November 16 through 18. Among those still in need of a unique advent calendar, shoppers are gravitating toward Food & Beverage calendars, particularly those with alcohol themes. Here are the top calendars that consumers snatched up last weekend:

- Fever-Tree The Ultimate Gin & Tonic Advent Calendar – Generating $12,500 in revenue over the weekend and $64,000 season-to-date

- Beer & Snacks Advent Calendar – With $11,960 in sales last weekend and $60,500 since Halloween, this savory option is gaining traction

- Hotel Chocolat The Advent Calendar For Two – $10,000 in sales over the weekend accounted for nearly a third of revenue season-to-date

How Grips Helps You Stay Ahead:

Grips gives our clients unparalleled visibility into their competitors’ daily sales trends. When competitors sell out, it’s your chance to swoop in and capture unmet demand. See what’s driving holiday purchases in real-time and adjust your marketing to maximize sales.

Want to capitalize on shifting holiday trends and out-of-stock competitors? Book a demo and gain a competitive edge.

Update: November 13

As retailers transition into new seasonal offerings, Grips dives into the latest performance trends among top retailers across the UK and US. This report highlights which holiday products are capturing customer interest and driving sales, offering a snapshot of what’s trending and where the market is headed.

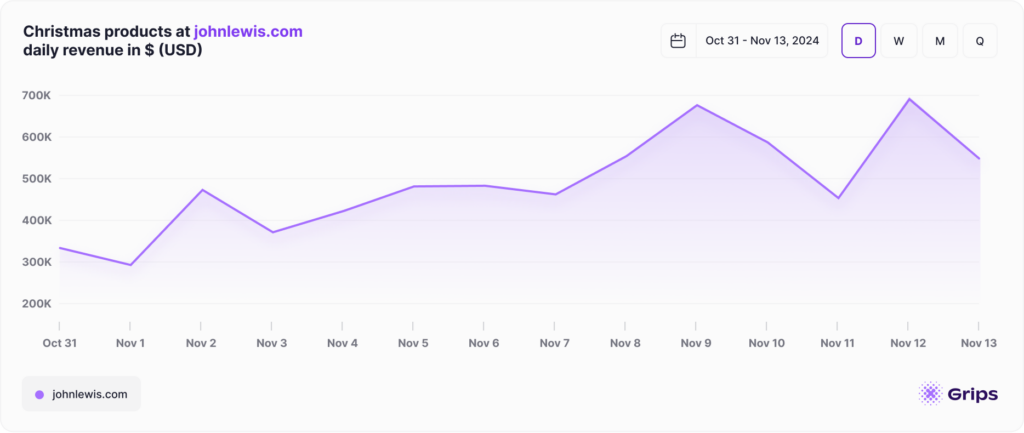

John Lewis: Beauty Calendars Spark a Festive Sales Surge

Beauty advent calendars are dominating the seasonal product landscape this year, with seven out of the ten best-selling products falling into this category. Leading the charge is the John Lewis Beauty Advent Calendar, which has achieved a staggering $644,000 in sales from November 1st to November 13th—over double the sales of the next highest seller, Charlotte’s Beauty Treasure Chest of Love 12-Door Advent Calendar.

While traditional holiday items like Christmas trees and decorations remain popular, advent calendar gifting (or self-gifting) is capturing customer attention and driving sales significantly higher.

This trend is also mirrored in JohnLewis.com’s overall seasonal product sales. With holiday sales totalling £5.6 million the first week of November, sales have climbed steadily, reaching £10.5 million the week ending November 13th. Advent calendars accounted for 38% of holiday sales last week, helping to give the category a boost even if shoppers are less reluctant to spend on decor.

King of Christmas: Best-Selling Trees Power Holiday Sales

King of Christmas’ top-selling products highlight a clear consumer trend toward larger, pre-lit artificial trees with snow-covered or flocked designs. Models like the King Noble Fir and Queen Flock® dominate, reflecting a preference for hassle-free, elegant holiday décor that fits larger spaces. While premium trees with more LED lights, such as the King Fraser Fir, perform well, many best-sellers fall within the $400-$800 range, showing demand for quality options at more affordable prices. Additionally, smaller models like the 6-foot King Noble Fir still generate strong sales, indicating a market for budget-friendly choices as well. These trends demonstrate that consumers value convenience, festive aesthetics, and size, with flocked designs growing in popularity.

Frontgate: High-Value Holiday Décor Fuels Revenue Growth

Frontgate’s top-selling products showcase a strong demand for high-quality, festive décor that combines traditional holiday symbols with modern features. Items like the Christmas Cheer Cordless Wreath with Red Bow and Christmas Cheer Cordless Garland are popular, indicating consumers’ preference for pre-lit, hassle-free holiday décor. Notably, large, statement pieces like the 9 ft. LED Giant Nutcracker also perform well, catering to customers seeking unique, show-stopping decorations. Additionally, smaller, affordable items like the Christmas Cheer Cordless Teardrop Swag with Bow and various garlands highlight a trend for versatile, budget-friendly décor that adds elegance to home settings. The mix of lower- and higher-priced items shows that consumers are investing in both larger, premium pieces and smaller, easy-to-use accents for holiday decorating.

Update: October 22

Apparel: Collaborations Offer a Path to Drive Sales

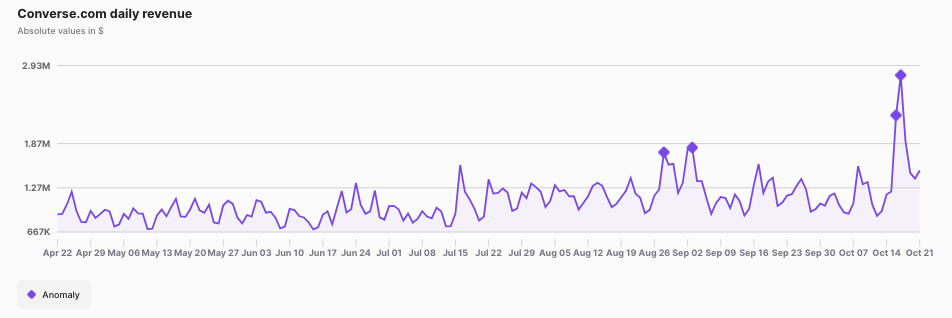

Converse, Jimmy Choo and Brunt Workwear have recently leveraged collaborations that allow their customers to feel a connection to their idols and admired figures—quite literally walking in their shoes.

Converse partnered with Billie Eilish, releasing a line on October 17th that drove daily revenue for Converse.com to $2.79 million, a significant leap from their typical $1.2 million average. This collaboration, featuring Eilish’s signature aesthetic, gives fans the opportunity to share a part of her unique style, appealing to both sneakerheads and music enthusiasts.

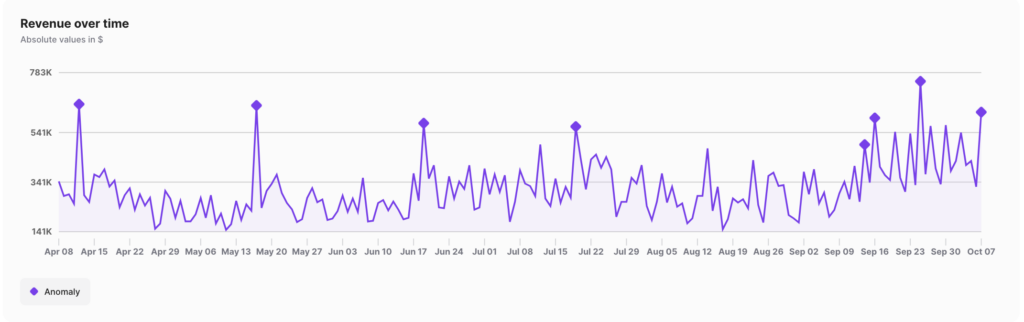

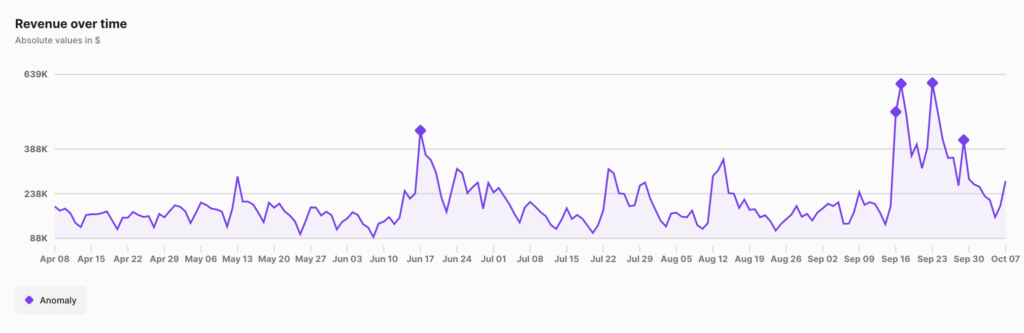

Daily e-commerce revenue on Converse.com

Jimmy Choo introduced the second instalment of its Pretty Guardian Sailor Moon collection on October 9th. This luxury line, which generated around $506,000 via JimmyChoo.com on launch day, invites fans to step into the world of an iconic anime series. The sale doubled their usual daily revenue of $186,000, proving that the nostalgia and allure of Sailor Moon resonate strongly with their high-end clientele.

Brunt Workwear launched the Vastbinder boot, inspired by rodeo star Eli Vastbinder, on October 17th, resulting in a revenue jump to $164,000 from an average of $90,000 on BruntWorkwear.com. This product offers Brunt’s audience of tradespeople and outdoor workers a chance to align with a figure they respect, while also offering the practical durability they need.

These collaborations demonstrate how aligning with admired figures can translate into sales success, offering fans a way to connect with their heroes and celebrities through products designed with that connection in mind.

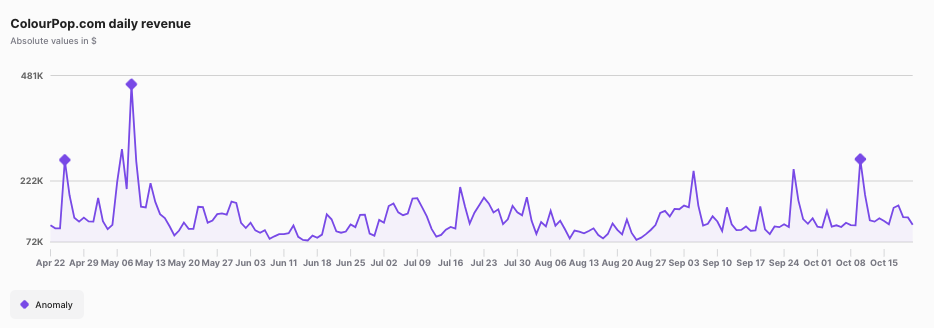

Beauty & Cosmetics: Product Drops and Collabs Make Sales Pop

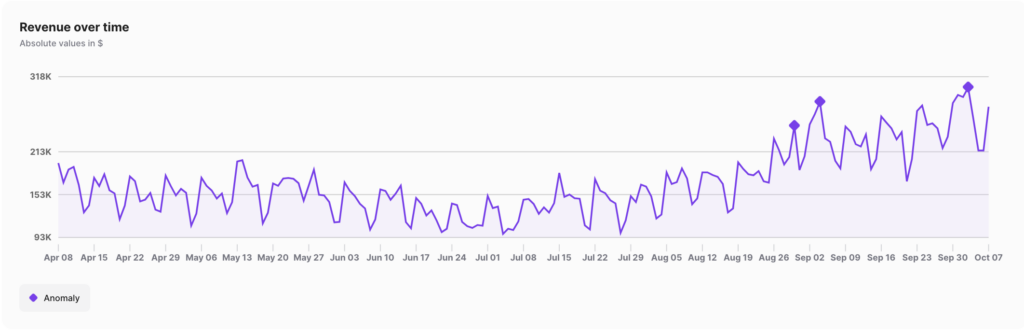

Recent trends among beauty brands like ColourPop, Tarte Cosmetics and Glossier highlight the power of strategic product launches and collaborations in driving significant sales spikes.

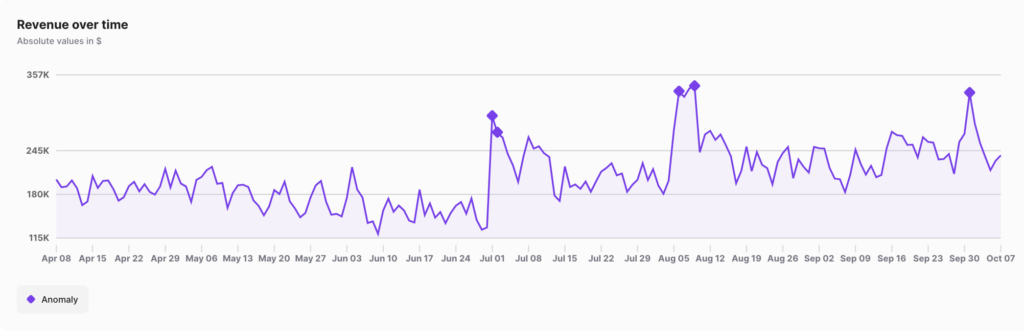

ColourPop recently saw a substantial spike in sales with its Bratz collaboration, launched on October 10th. The release, appealing to millennial nostalgia, drove daily sales for ColourPop.com to over $274,000. This followed other successful launches like the Stranger Things collaboration on September 26th, which generated $251,000, and the Pokémon collection on May 9th, which remains the brand’s biggest day this year with $458,000 in sales. For ColourPop, these partnerships have outperformed traditional sales events, making them key revenue drivers.

Products from the Bratz collaboration accounted for nearly three-quarters of all sales on ColourPop.com even two days after launch. The top-sellers include: Bratz x ColourPop Full Collection, Girls Night Out shadow palette and Yasmin lippie kit. The Raspberry Mojito lux lip oil is the top-selling non-Bratz product.

Daily e-commerce revenue for ColourPop.com

Tarte Cosmetics experienced a different kind of success with its 40% off Cyber Monday sale, held from October 15-20. This promotion, open to all customers, brought in an estimated $1.62 million in additional revenue on TarteCosmetics.com, with peak sales days reaching over $468,000. This event significantly outperformed Tarte’s earlier, more exclusive September promotion, which focused on loyal customers and added about $870,000 in extra revenue. The wider availability and tie-in with a major shopping event like Cyber Monday allowed Tarte to capture a larger audience.

Glossier also tapped into the power of limited-edition releases with the launch of their holiday-flavored lip balms on October 15th, adding an estimated $197,000 in additional sales between October 15th and October 21st. New flavors like Cookie Butter, Biscotti and Espresso were positioned as limited-time offers with messaging designed to create urgency. Despite this, the products have remained in stock, suggesting that Glossier’s inventory planning was prepared to meet heightened demand.

These examples show how beauty brands are using targeted product drops—whether through exclusive collaborations or limited-time releases—to drive short-term revenue surges. By aligning with cultural touchpoints or seasonal excitement, these brands can engage new customers and keep their core audiences returning for more.

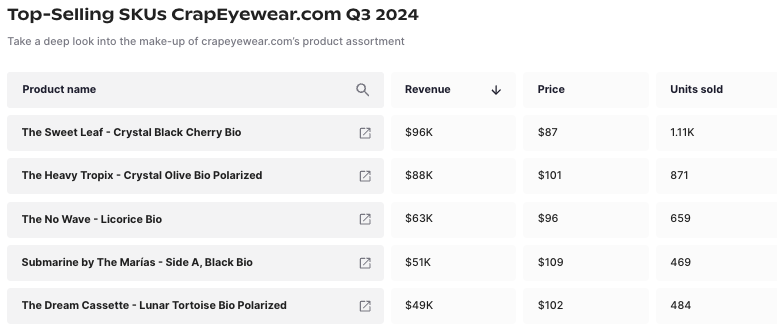

Eyewear: Discounts Lead to a Bright Month for Sales

Crap Eyewear’s “Buy One Get One Free” (BOGO) promotion, running from October 16 to October 20, drove a significant revenue surge. Before the sale, from September 16 to October 15, the average daily revenue on CrapEyewear.com was approximately $15,000. However, during the BOGO event, daily revenues spiked, reaching around $38,000 on October 17 and maintaining elevated levels through October 20. This represented a more than 150% increase compared to the prior period’s daily averages.

Crap Eyewear’s top-performing SKUs, such as “The Sweet Leaf – Crystal Black Cherry Bio,” which generated $96,000 in sales during Q3, were instrumental in driving this uplift, showcasing the value of Grips’ real-time SKU-level data. This precise data allows for tracking product-level performance, enabling brands to effectively adjust their strategies in response to rapidly changing consumer demand.

Top-selling products CrapEyewear.com Q3 2024

Krewe’s sales promotion, offering discounts of up to 70%, took place from October 15 to October 21. In the four weeks before the sale (September 15 to October 14), average daily revenue on Krewe.com hovered around $12,000. During the promotional period however, daily revenues soared, peaking at $28,000 on October 19 and maintaining elevated figures through October 21. This surge marked an over 130% increase compared to the pre-sale period.

Both companies’ success highlights how targeted promotions, combined with strategic discounting, can drive substantial revenue growth, even as consumer behaviors fluctuate in the competitive eyewear market.

Update: October 4

Brands that stay ahead are constantly adjusting their strategies. At Grips, we’ve been keeping a close eye on trends across the fashion and apparel industry, and we’re seeing several standout brands making impressive gains. Whether through product releases, targeted sales events, or exploring new categories, these brands are finding ways to capture consumer attention and boost revenue. Let’s dive into how some of the fastest movers are executing their strategies.

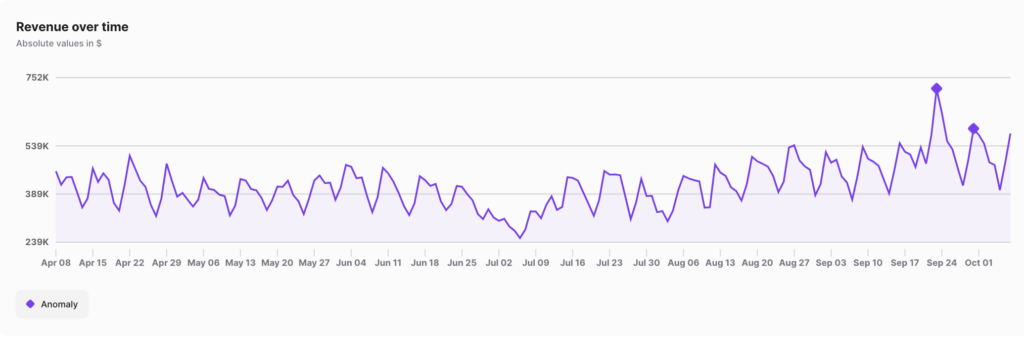

Camper: Rethinking Discount Strategies with Product Releases?

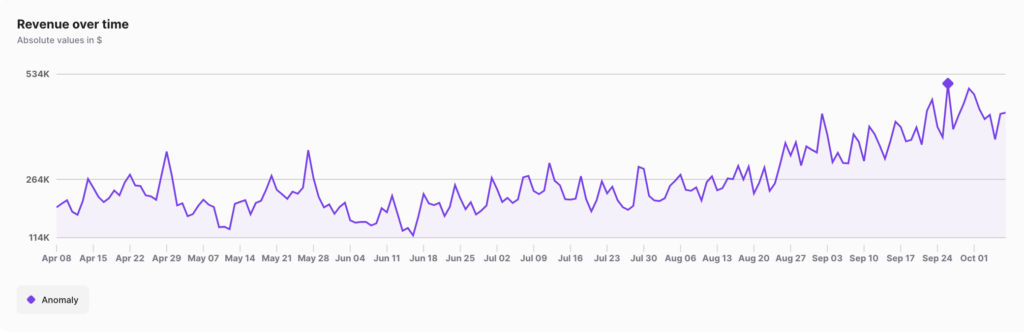

Camper, the Spanish footwear brand known for its unique designs and comfort, has traditionally leaned on mid-month discount events to drive sales. These promotions, held like clockwork, have reliably resulted in a brief doubling of daily sales on Camper.com versus the pre-sale average. However, recent data from Grips shows that in September, Camper started to experiment with a new approach—shifting away from discounts and focusing on product releases.

Instead of a sharp, temporary spike tied to sales, Camper saw a more gradual and sustained increase in revenue throughout the month driven by new product releases. Sales were up 40% month-over-month in September and doubled compared to the same period last year. This shift indicates that Camper is testing a new strategy to drive demand without sacrificing margin through heavy discounting. Given the competitive nature of the footwear market, maintaining brand value and appeal while growing revenue is a delicate balance, but Camper’s success in September may point to a new winning formula for the brand.

Camper.com daily sales

Taylor Stitch: Consistent Growth Driven by Best-Selling Basics

Taylor Stitch, a San Francisco-based direct-to-consumer (DTC) brand, has been steadily growing over the past year. Known for its high-quality men’s apparel, Taylor Stitch’s dedication to craftsmanship and sustainable fabrics has resonated with consumers looking for long-lasting wardrobe essentials.

According to Grips data, online sales for TaylorStitch.com in September were double what they were the previous year. October has already gotten off to a strong start as well, with the brand setting record sales, excluding the Black Friday/Cyber Monday period. The Après Pants, retailing for $118, and the Jack button-down shirt at $125, continue to be the best-sellers. With an average order value of $226, customers are frequently purchasing a complete outfit in a single transaction, helping the brand maintain steady growth.

TaylorStitch.com daily sales

Taylor Stitch has leveraged its commitment to ethical production and timeless designs, setting itself apart in a crowded market of fast fashion and fleeting trends. By continuing to focus on well-made, versatile staples, Taylor Stitch is successfully positioning itself as a brand for the long haul.

Vinted: Expanding Categories to Reach New Audiences

Vinted, a second-hand marketplace, has been riding the wave of the resale boom. As consumers increasingly seek sustainable shopping options, Vinted’s platform has grown rapidly, particularly in 2024. Grips data reveals that Vinted.com sales reached $15 million in September, a 150% increase compared to last year. This growth may be due in part to the introduction of a new Electronics category, which is opening the door to a broader audience.

Historically, Vinted has been more popular with female shoppers, with men accounting for only a quarter of the site’s transactions. However, the addition of electronics could be a strategic play to attract more male consumers, diversifying their customer base. As resale continues to gain traction and the sustainability movement shows no signs of slowing down, Vinted is well-positioned to continue growing by expanding its category offerings and customer reach.

Vinted.com daily sales

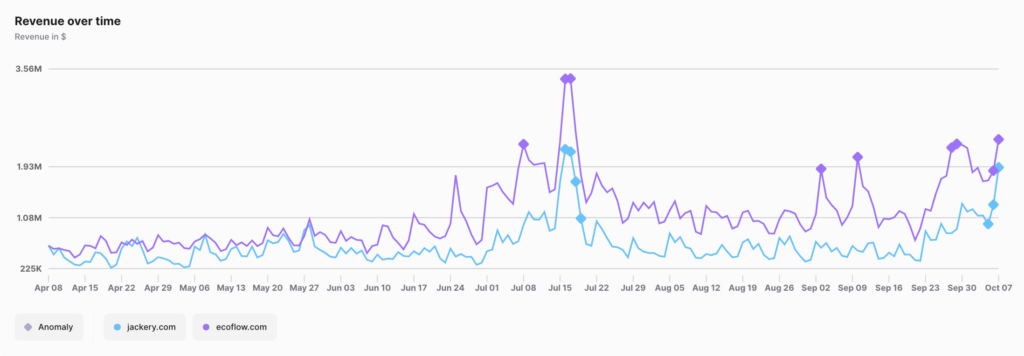

Jackery & EcoFlow: Powering Growth Through Natural Disasters

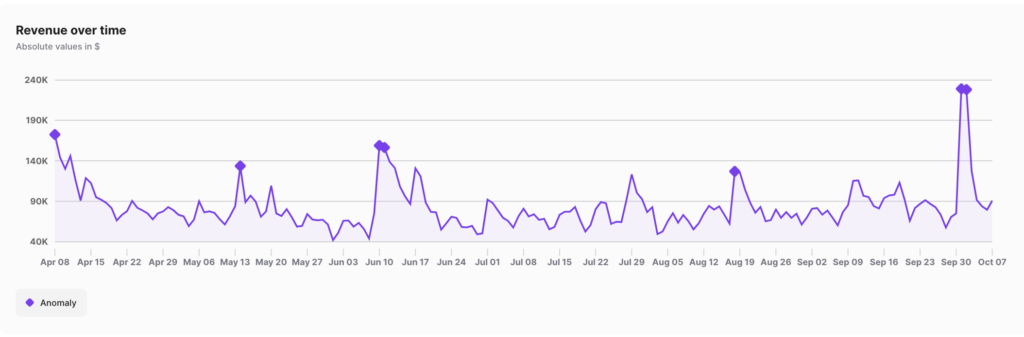

Jackery and EcoFlow, leaders in portable power solutions, saw a massive spike in sales following the landfall of Hurricane Helene and is seeing it again with Milton on final approach to Florida’s West coast. Natural disasters often create immediate demand for products like portable generators, and both brands were well-positioned to meet that need. Grips data shows that online sales for Jackery.com and EcoFlow.com jumped by 88% in the week following the hurricane.

Combined, the two brands have generated $436 million in online sales so far in 2024, reflecting a 70% year-over-year increase. As more consumers become concerned with emergency preparedness, demand for portable power solutions is on the rise, and these two companies are at the forefront of meeting that need. By positioning their products as essential tools in times of crisis, Jackery and EcoFlow have established themselves as trusted brands in the growing energy storage market.

Jackery.com and EcoFlow.com daily sales

Sweaty Betty: Maximizing Sale Momentum with Smart Discounting

Sweaty Betty, the UK-based activewear brand, saw a major sales surge in September, thanks to a well-executed sale strategy. Grips data shows that from September 16th to the 22nd, SweatyBetty.com sales spiked to $3 million, a 155% increase compared to the previous four-week average. Initially offering discounts of up to 60%, the brand smartly increased the offer to 70% off when sales began to slow, resulting in an additional 19% boost in revenue the following week.

Sweaty Betty has consistently been a favorite in the premium activewear space, competing with brands like Lululemon. Its loyal customer base is often drawn to the brand’s stylish, functional apparel, but strategic discounting has helped Sweaty Betty drive sales beyond its peak periods, like New Year’s resolutions or Black Friday/Cyber Monday. By using smart promotions to sustain momentum, the brand has set a new record for September sales, surpassing even the busy holiday shopping period last year.

SweatyBetty.com daily sales

Dolce & Gabbana: Blurring the Lines Between Fashion and Function

Luxury fashion brand Dolce & Gabbana is no stranger to high-profile collaborations, and its recent partnership with Stabilo, known for its premium writing instruments, is no exception. The limited-edition collection featured signature Dolce & Gabbana patterns on Stabilo highlighters, blending the worlds of fashion and function in a way that appealed to both loyal fans and new customers.

According to Grips data, this collaboration led to a 32% surge in revenues on dolcegabbana.com, with the collection selling out quickly and driving demand across the brand’s other product lines. Dolce & Gabbana’s ability to leverage collaborations that tap into new markets while maintaining their luxury positioning is a key driver of their continued success.

dolcegabbana.com daily sales

NARS Cosmetics: A Golden Launch Boosts Sales

NARS Cosmetics struck gold with the launch of its limited-edition 24 Karat collection. Grips data shows that sales for NARScosmetics.com spiked by 135% in the first three days after the collection dropped, totaling nearly $600K. This launch marked one of the brand’s best sales periods of the year, surpassed only by Black Friday.

The 24 Karat collection’s success showcases NARS’ ability to tap into the luxury beauty segment while staying true to its bold, edgy identity. Limited-edition collections have long been a cornerstone of NARS’ strategy, creating urgency and driving demand among beauty enthusiasts who want exclusive products. This recent launch proves that NARS continues to master the art of creating hype around high-end beauty releases.

NARScosmetics.com daily sales

Grandin Road: Capturing Seasonal Sales with Décor Promotions

Grandin Road, known for its high-quality seasonal décor, has been seeing impressive growth as consumers prepare for Halloween and Christmas. The brand began its Halloween promotions as early as June, and Grips data reveals that online sales on GrandinRoad.com steadily climbed from $5.4 million in June to an estimated $11.5 million in September, driven largely by heavy discounting on Halloween and fall décor.

The success of Grandin Road’s September sales, which were double the revenue from June, demonstrates the power of timely and targeted promotions. Offering up to 60% off Halloween items sparked consumer interest, and as Halloween approaches, these figures are expected to remain strong. By planning promotions well in advance of the holidays and using discounts to drive urgency, Grandin Road has been able to capture a significant share of the seasonal home décor market.

GrandinRoad.com daily sales

Conclusion: Strategic Shifts Are Paying Off for Fashion Brands

From experimenting with new product release strategies to expanding into untapped categories, these fashion and apparel brands are demonstrating the power of innovation in today’s competitive market. By carefully monitoring industry trends and sales data, Grips Intelligence helps businesses stay ahead of the curve, providing real-time insights into the moves that are driving growth across the industry.

Interested in seeing how your competitors are performing? Book a demo with Grips to learn more.

See the performance of thousands of sites

Grips reports on the daily, weekly and monthly e-commerce sales for tens of thousands of domains. Book a demo today and we’ll give you a sneak peak into your comp set.

Archives

See fast-movers from: