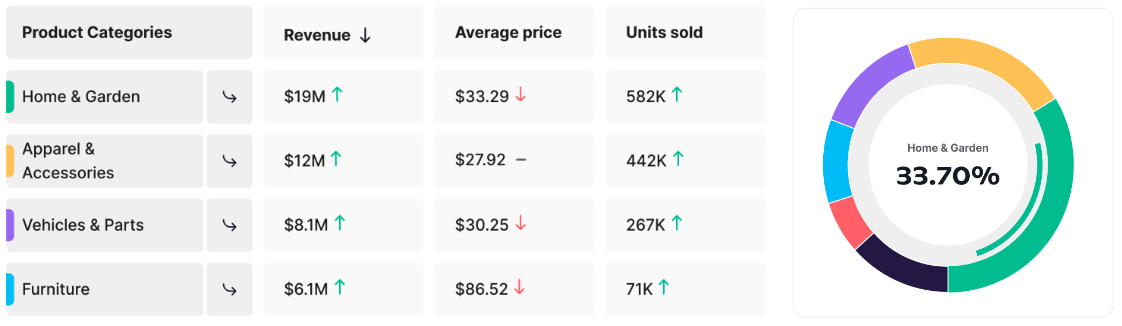

Top Home & Garden sites to watch

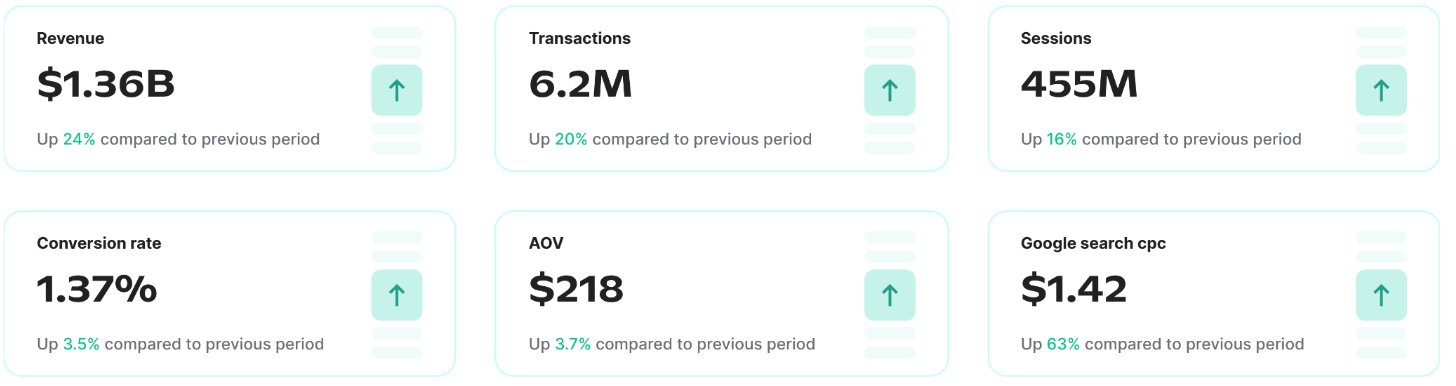

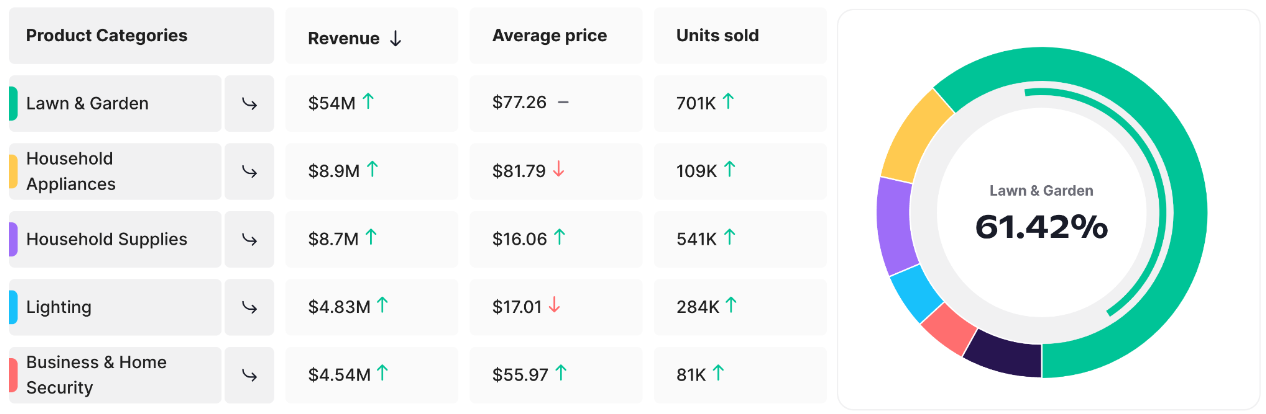

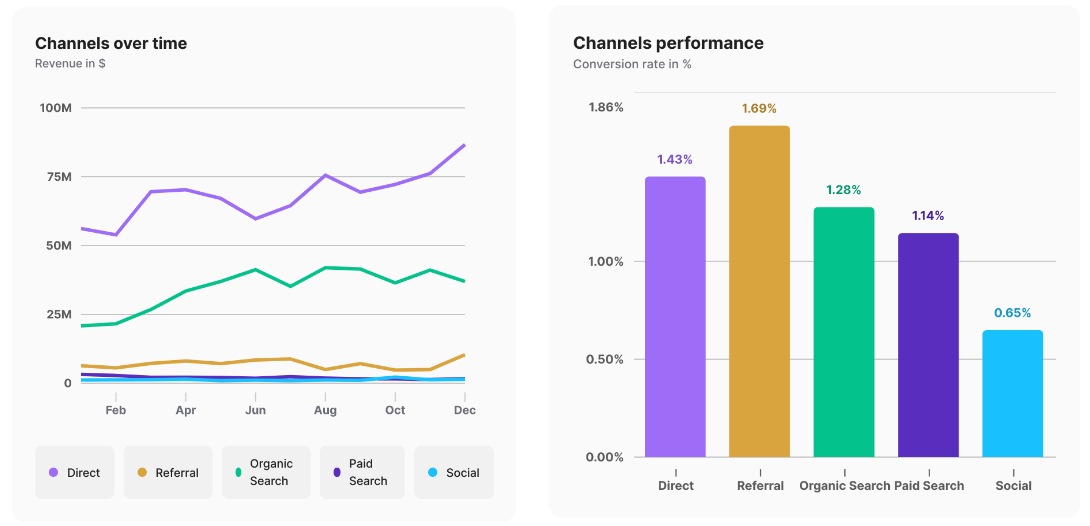

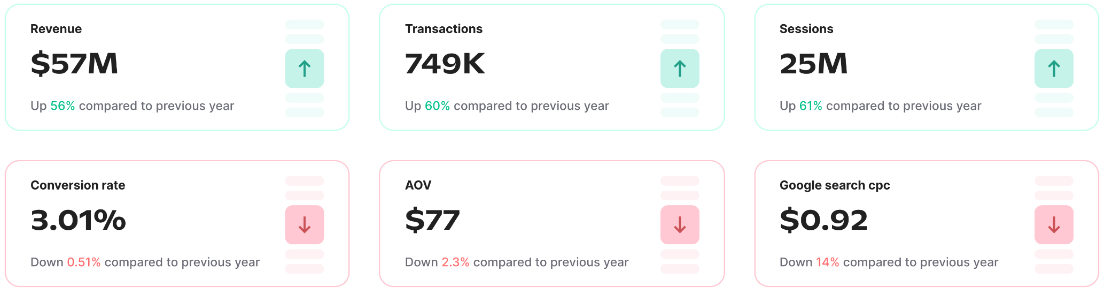

In the fast-evolving landscape of the $60 billion home and garden e-commerce category, certain digital companies are setting the pace, reshaping how consumers enhance their living spaces. Our latest report delves into this dynamic sector, spotlighting the top digital companies to watch in the U.S. By analyzing critical metrics like e-commerce revenue, best-selling categories and the top performing marketing channels, we offer an unparalleled glimpse into the market’s current leaders and emerging trends.

From innovative product offerings to strategic marketing approaches, these companies are not just riding the wave of digital transformation; they are creating it. Whether it’s through groundbreaking product introductions or savvy digital marketing campaigns, the insights provided reflect a sector that’s not just growing, but thriving in its ability to meet and exceed consumer expectations. For industry professionals and enthusiasts alike, this report is a compass pointing towards the future of home and garden e-commerce.

You can also download a PDF of the report here.

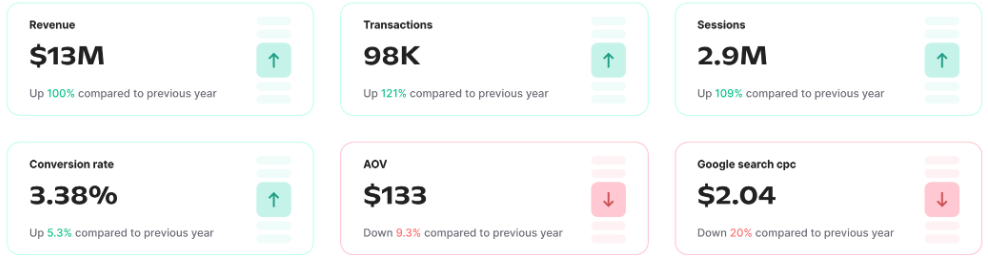

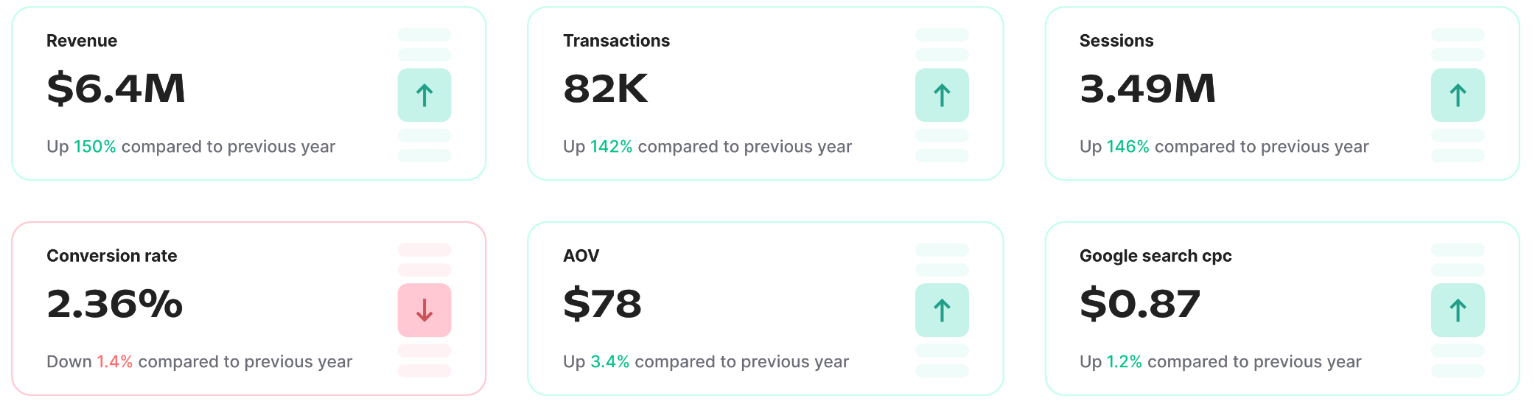

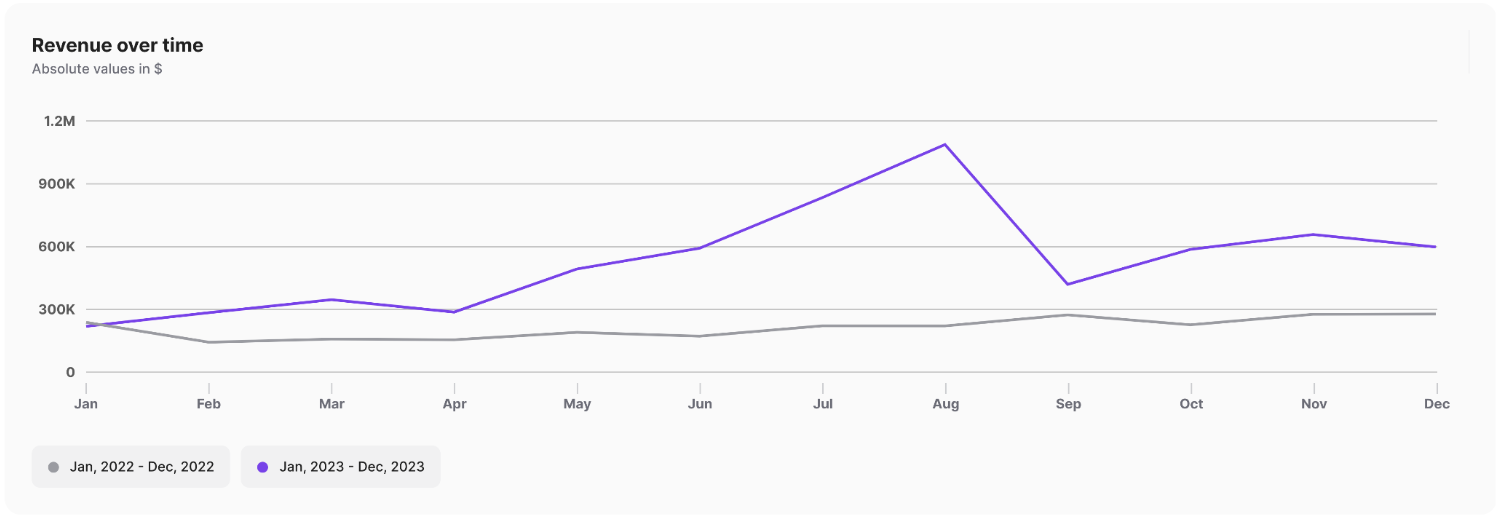

Grips reports that DTC sales on AeroPress.com reached $6.4 million in 2023 in the United States with revenues percolating up remarkable 150% over 2022 levels.

Grips reports that DTC sales on AeroPress.com reached $6.4 million in 2023 in the United States with revenues percolating up remarkable 150% over 2022 levels.

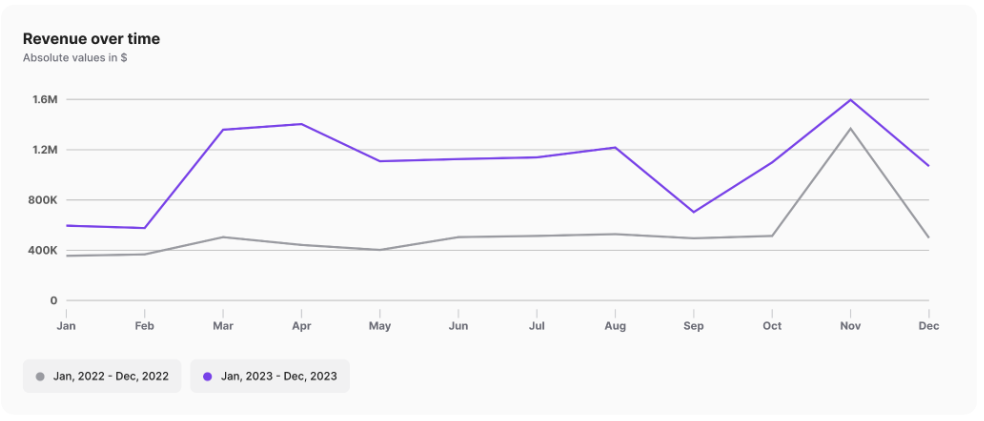

Revenue on

Revenue on

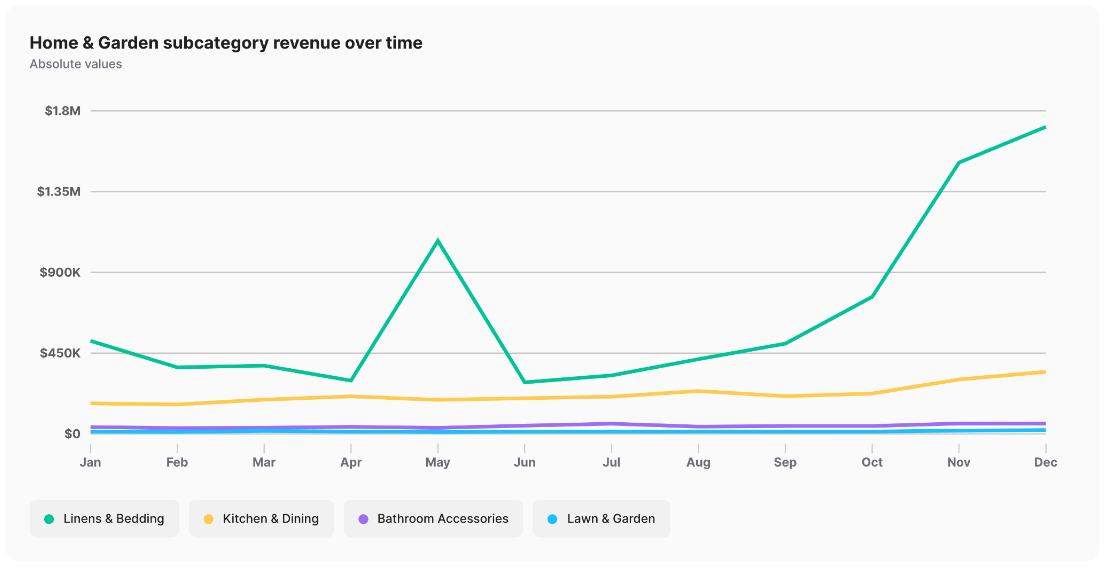

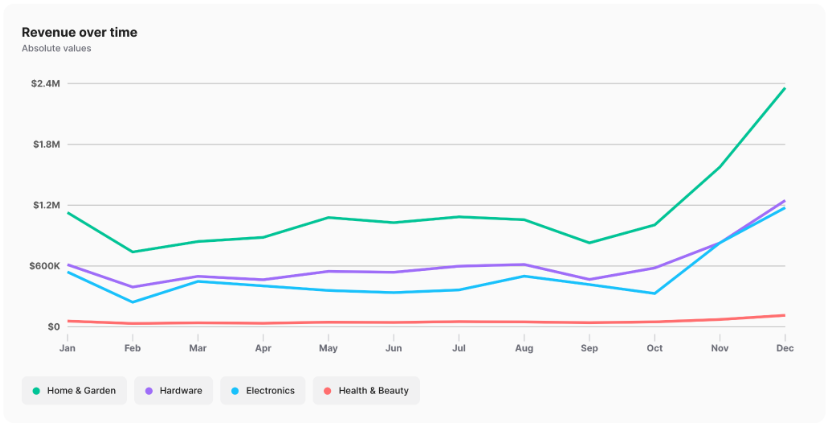

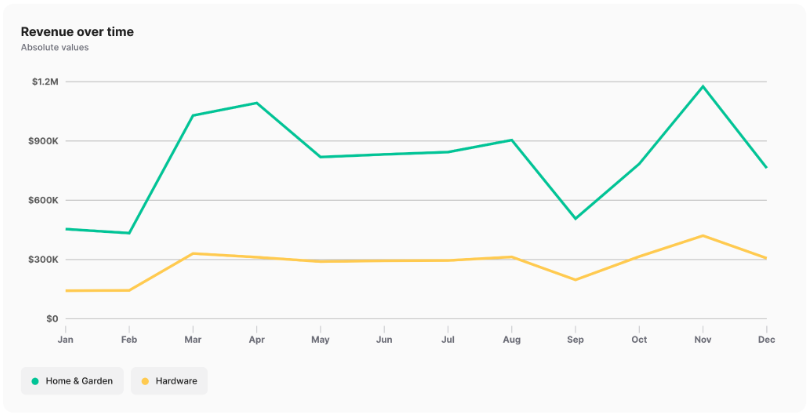

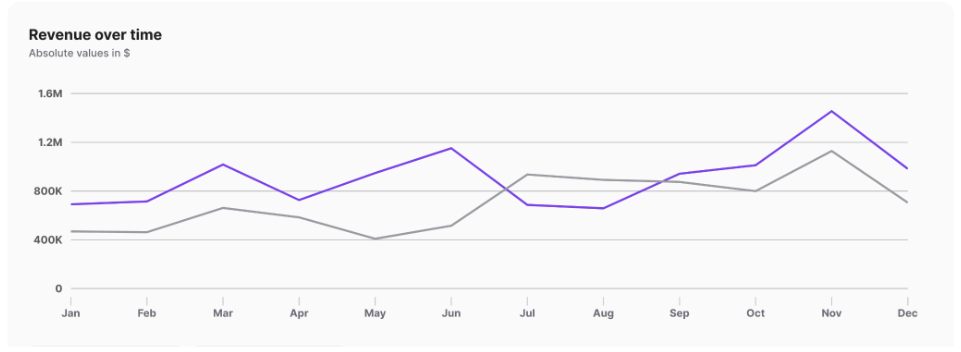

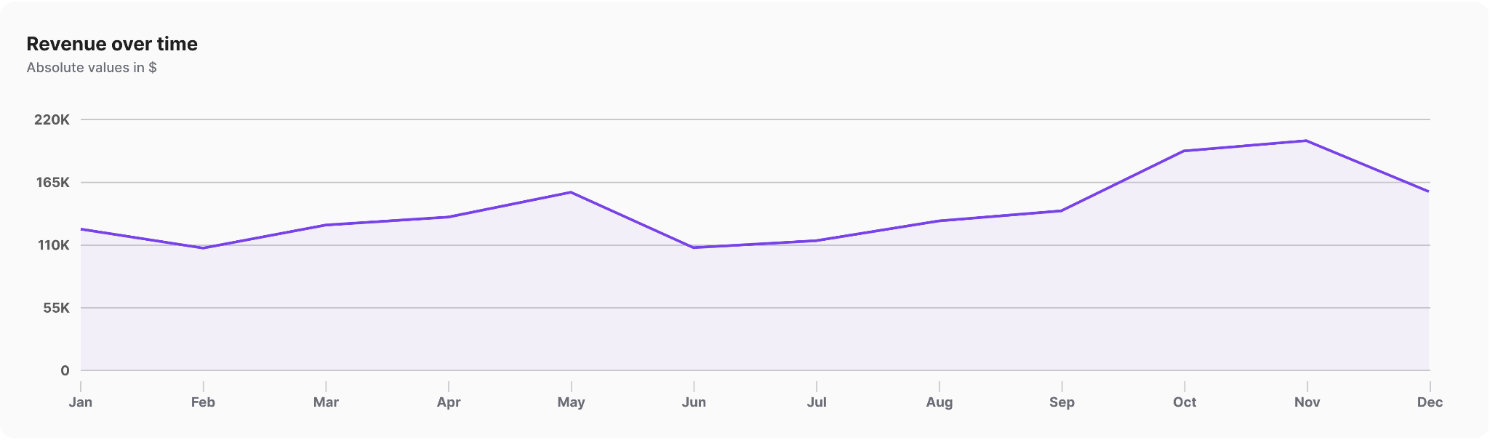

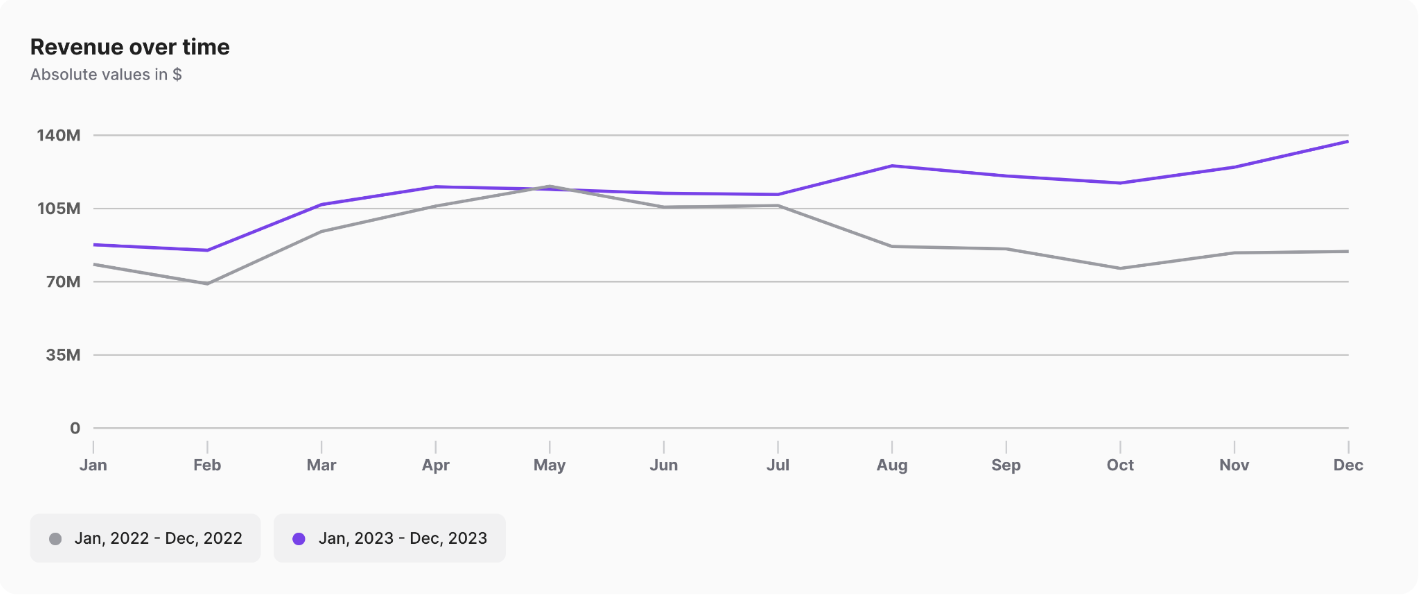

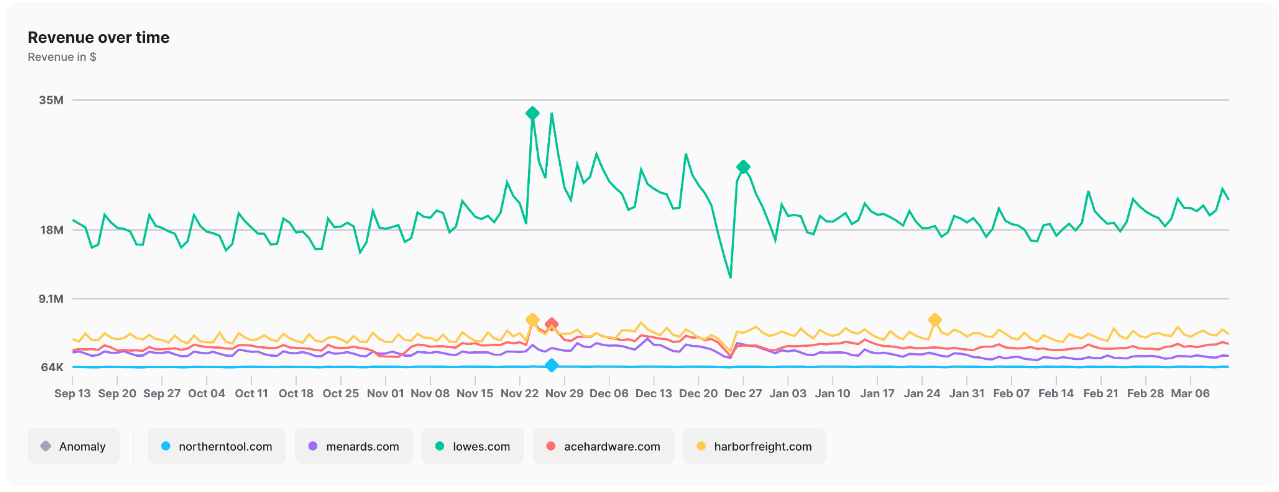

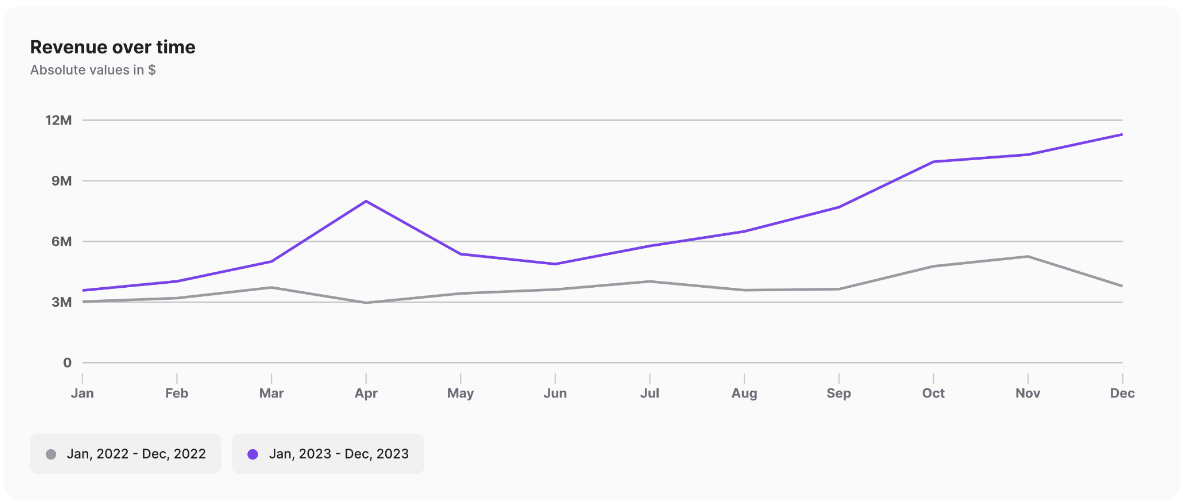

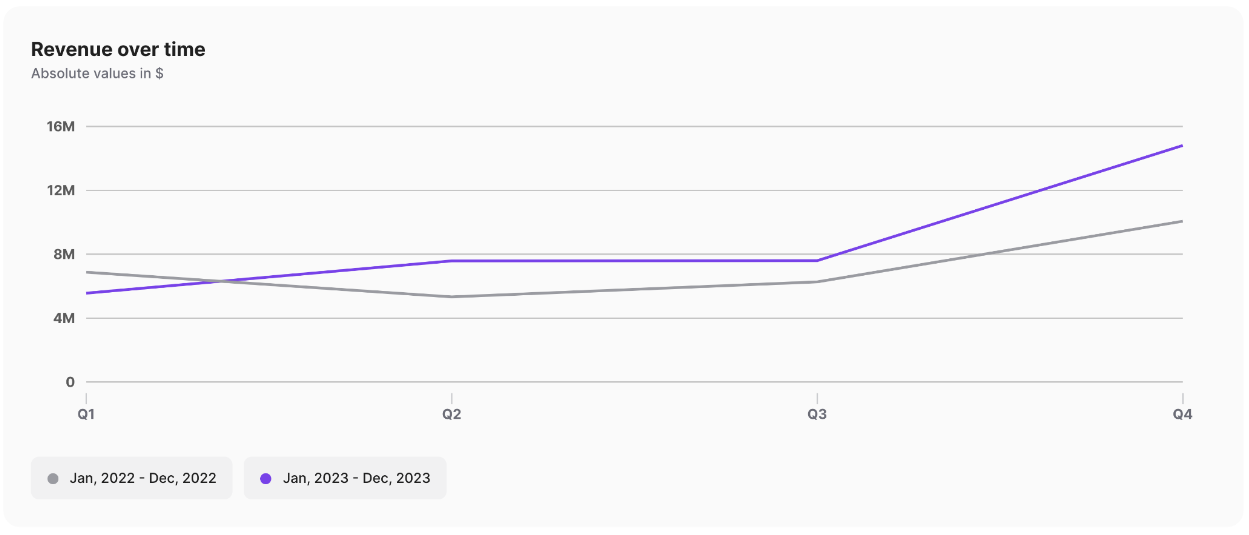

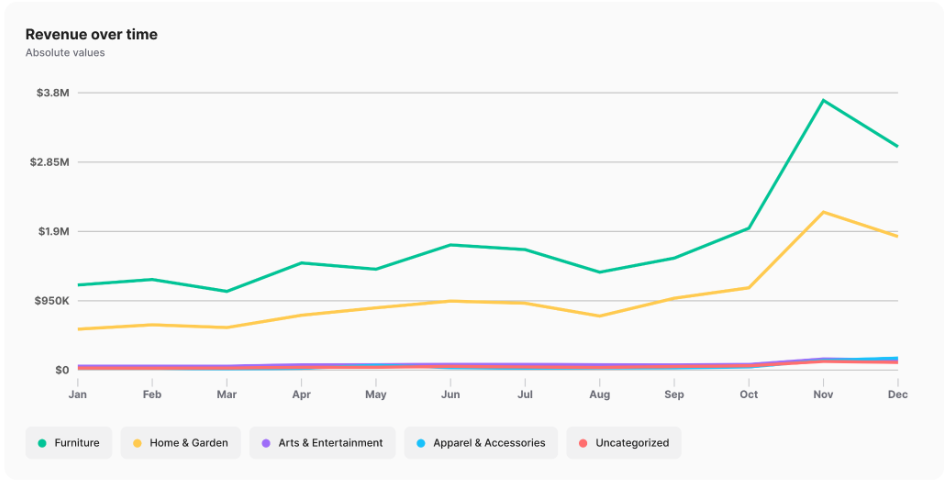

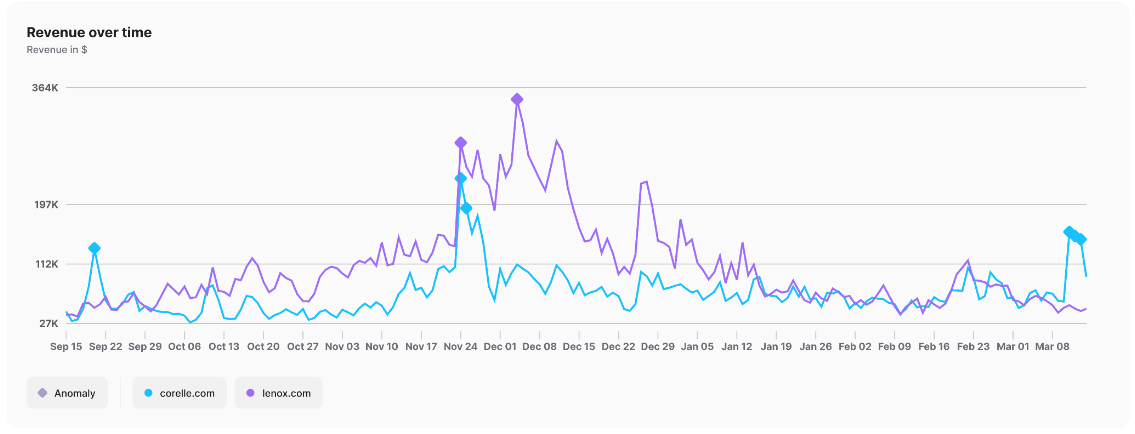

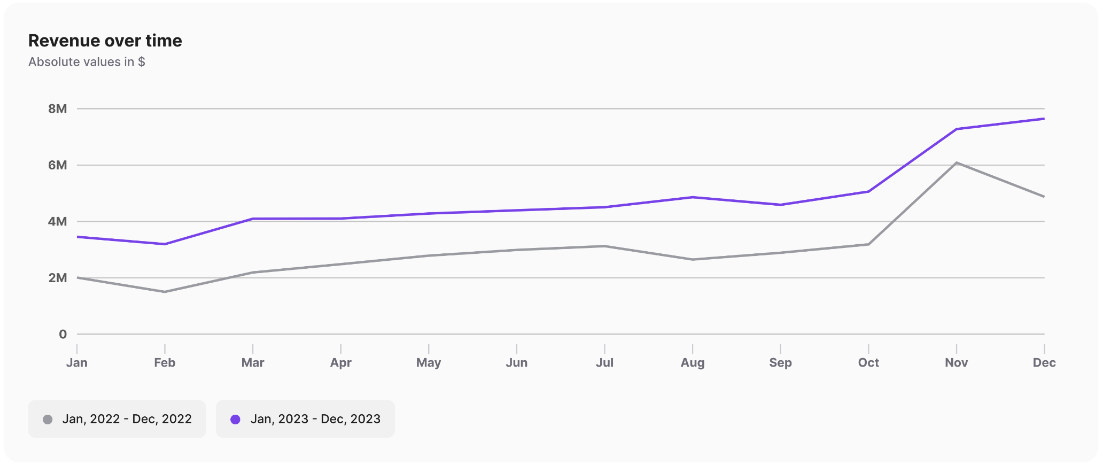

Natural Life started out 2023 with a strong lift in sales over 2022 with Q1 revenues up 89% YoY, the result of a surge in sales which began in H2 2022. This momentum slowed slightly, but sales were consistently up by 41% or more each quarter. Even during the holiday period, the company maintained impressive growth, recording a 57% increase in sales in December compared to 2022. Coincidentally, this is when Home & Garden sales surged.

Natural Life started out 2023 with a strong lift in sales over 2022 with Q1 revenues up 89% YoY, the result of a surge in sales which began in H2 2022. This momentum slowed slightly, but sales were consistently up by 41% or more each quarter. Even during the holiday period, the company maintained impressive growth, recording a 57% increase in sales in December compared to 2022. Coincidentally, this is when Home & Garden sales surged.