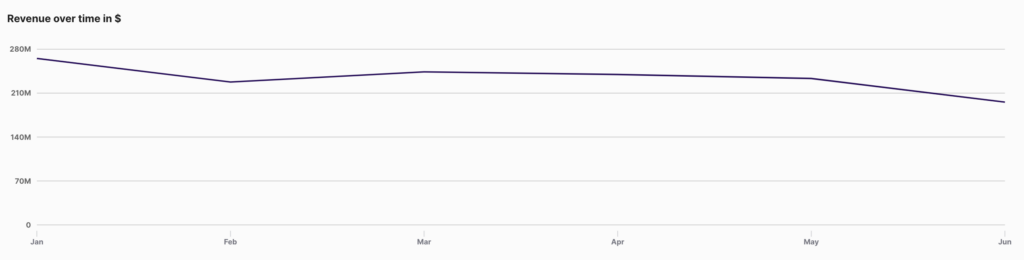

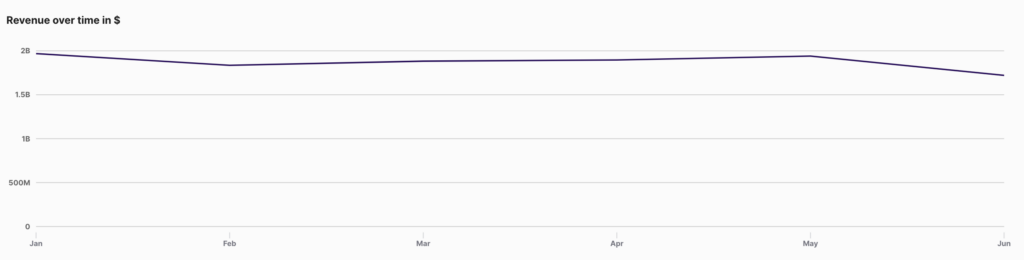

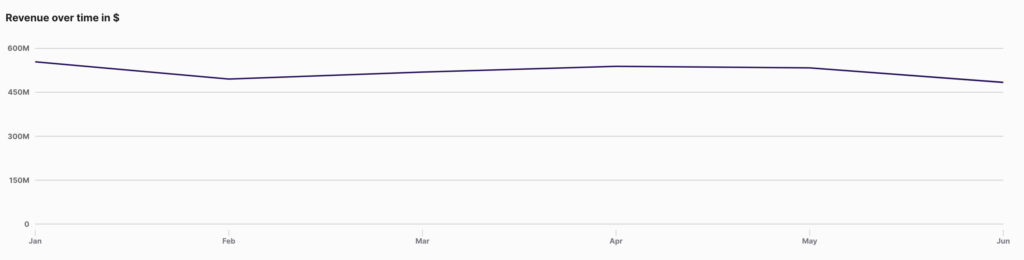

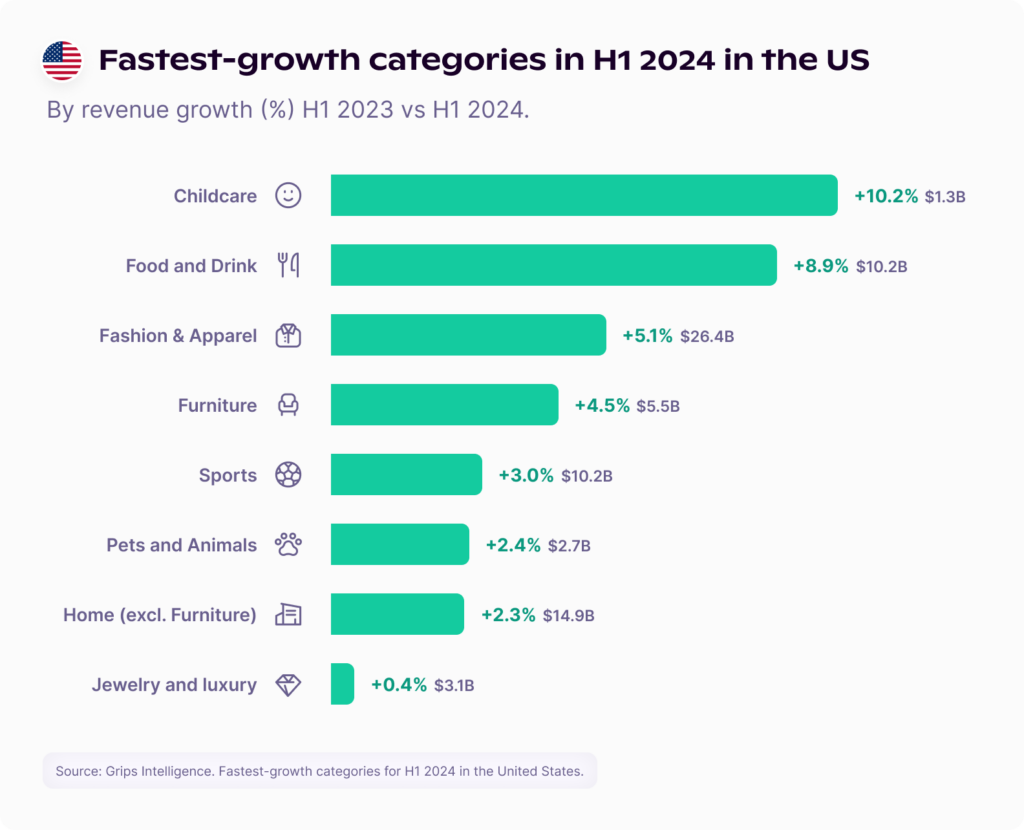

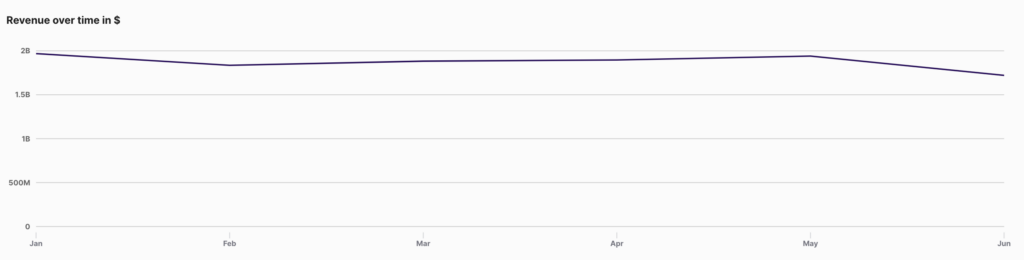

Fashion and Apparel

Fashion and Apparel experienced a modest growth of 5.13%, with revenues rising from $25.1 billion in H1 2023 to $26.4 billion in H1 2024. This steady growth suggests that consumer interest in fashion remains strong, driven by seasonal trends and the continued appeal of online shopping for clothing and accessories. E-commerce managers in this space should focus on maintaining brand loyalty through personalized shopping experiences and capitalizing on emerging fashion trends to sustain growth.

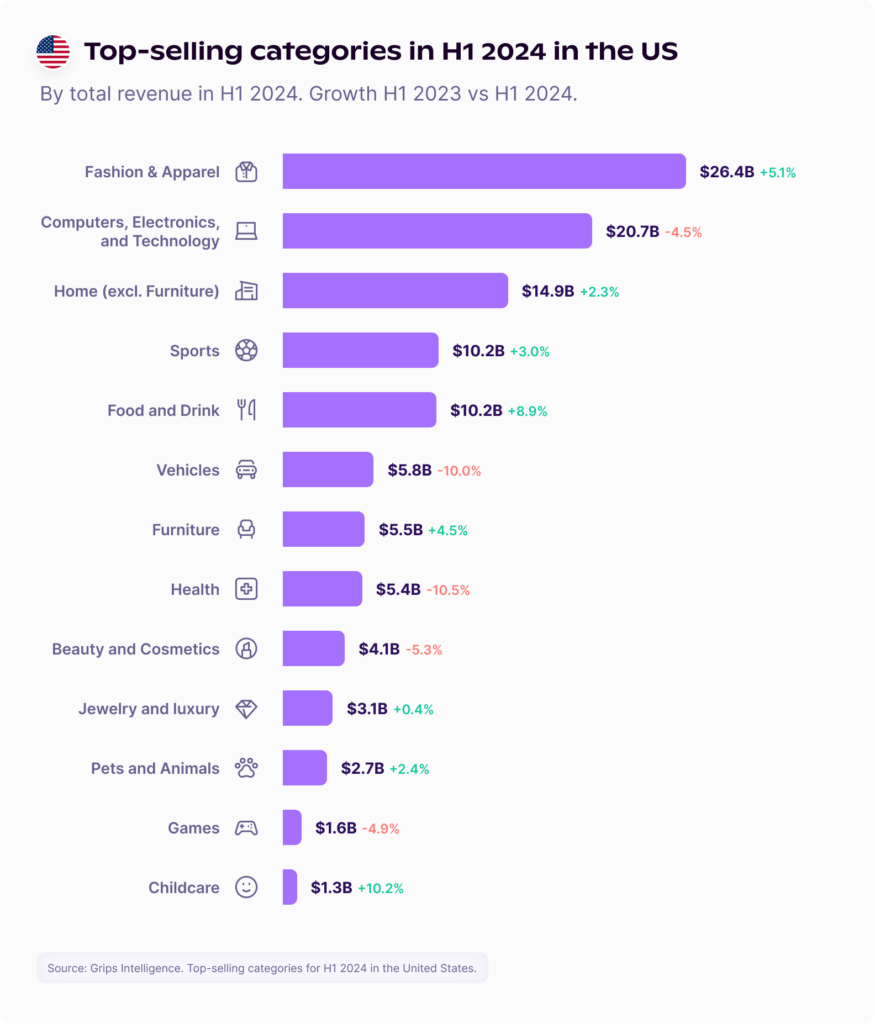

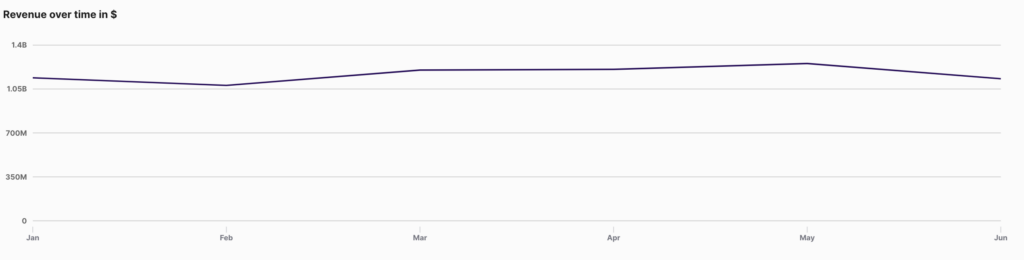

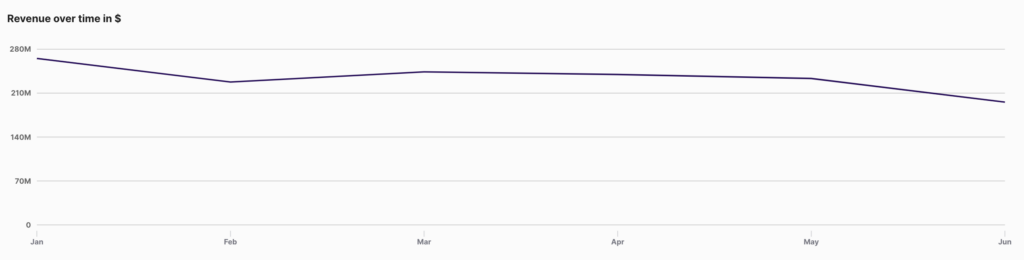

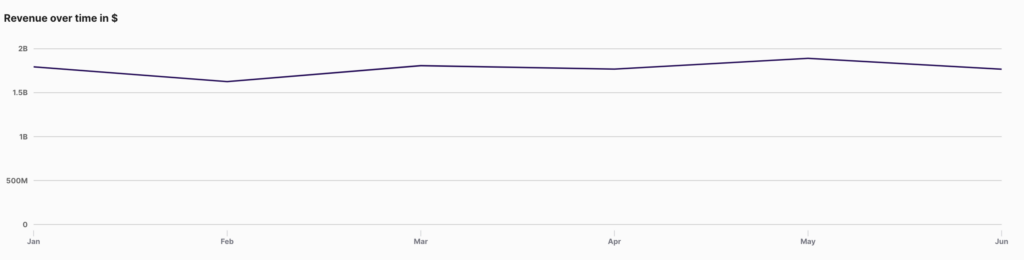

Computers, Electronics, and Technology

Revenue in the Computers, Electronics, and Technology category declined by 4.54%, dropping from $21.7 billion in H1 2023 to $20.7 billion in H1 2024. This dip may be attributed to market saturation or reduced consumer spending on high-ticket tech items. To counteract this trend, e-commerce leaders should consider enhancing customer retention strategies.

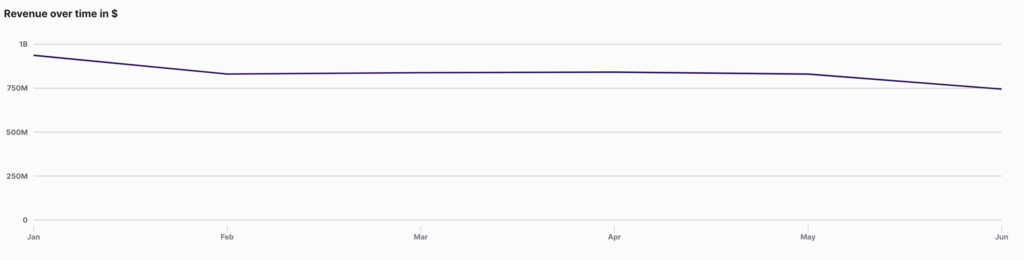

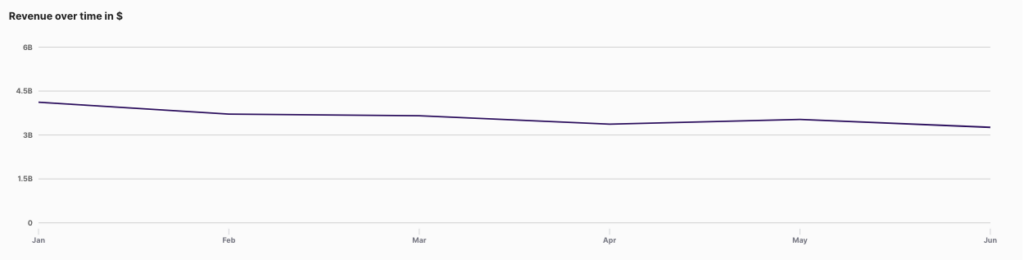

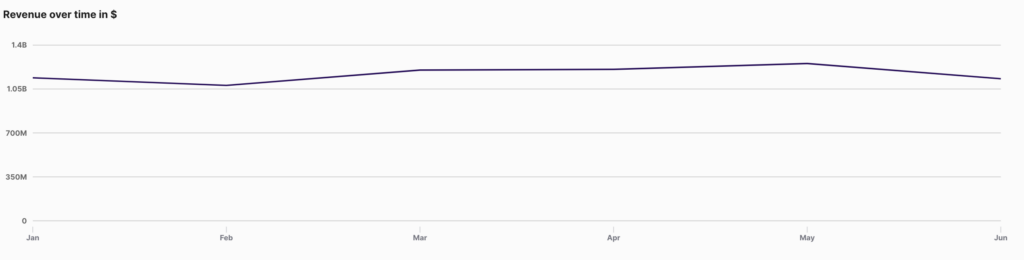

Home (excluding Furniture)

Home and Garden (minus Furniture) saw a slight growth of 2.30%, with revenues increasing from $14.6 billion to $14.9 billion. The category’s stability reflects a continued consumer interest in home improvement and gardening products. Retailers can leverage this by expanding product lines to include eco-friendly and DIY solutions, as well as offering targeted promotions that align with seasonal trends and consumer preferences for sustainable living.

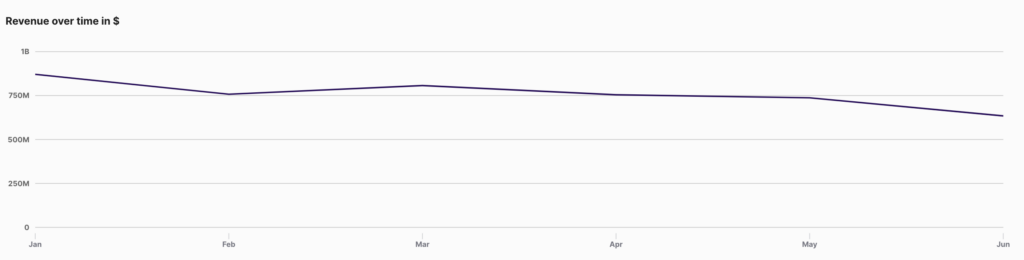

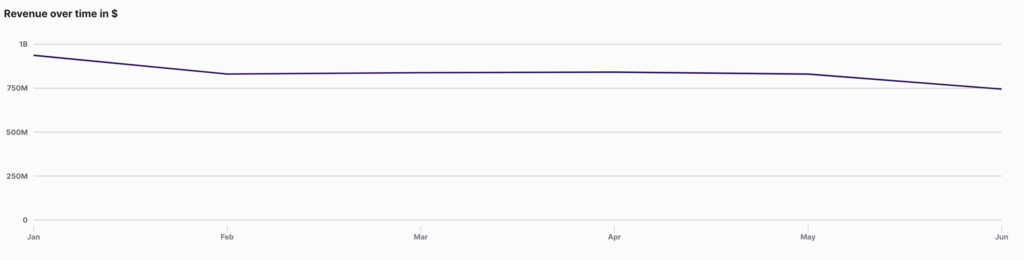

Sports

The Sports category grew by 3.02%, with revenues rising from $9.9 billion in H1 2023 to $10.2 billion in H1 2024. This growth indicates a sustained interest in fitness and outdoor activities. E-commerce businesses should capitalize on this trend by offering exclusive sports equipment, enhancing direct-to-consumer sales channels, and engaging customers through community-building initiatives, such as virtual fitness classes or sports-related content.

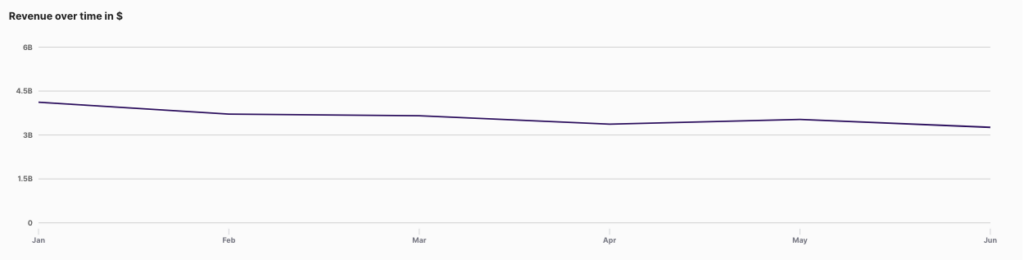

Food and Drink

Food and Drink experienced a notable growth of 8.87%, increasing from $9.3 billion in H1 2023 to $10.2 billion in H1 2024. This growth highlights the ongoing shift towards online grocery shopping and the demand for convenient food delivery options. Retailers in this space should focus on expanding their product offerings to include niche and specialty items, as well as improving logistics for faster and more efficient delivery services.

Vehicles

The Vehicles category saw a significant decline of 10.03%, with revenues dropping from $6.4 billion in H1 2023 to $5.8 billion in H1 2024. This decline likely reflects the impact of rising living costs and reduced consumer spending on big-ticket items. E-commerce businesses in this sector should explore offering flexible financing options and expanding into more affordable product assortment.

Furniture

Furniture revenue grew by 4.48%, from $5.3 billion in H1 2023 to $5.5 billion in H1 2024. This growth indicates a continued consumer focus on home comfort and personalization. Retailers should capitalize on this trend by offering customizable furniture options, promoting sustainable materials, and curating collections that resonate with current interior design trends.

Health

The Health category experienced a decline of 10.51%, dropping from $6.1 billion in H1 2023 to $5.4 billion in H1 2024. This decrease may be due to the stabilization of pandemic-driven demand or market saturation. To reignite growth, e-commerce leaders should consider diversifying their product offerings to include wellness and mental health products, as well as focusing on niche markets within the health sector.

Beauty and Cosmetics

Beauty and Cosmetics saw a decline of 5.30%, with revenues decreasing from $4.3 billion in H1 2023 to $4.1 billion in H1 2024. This dip may reflect changing consumer preferences or economic pressures. To boost sales, businesses in this category should focus on sustainable beauty products, personalized skincare solutions, and leveraging influencer marketing to reach new audiences.

Luxury

The Jewellery and Luxury Products category experienced marginal growth of 0.36%, with revenues reaching $3.1 billion in H1 2024. Despite the modest increase, this category remains resilient, indicating a steady demand for luxury goods. E-commerce leaders should emphasize the exclusivity and craftsmanship of their products while exploring new ways to personalize the luxury shopping experience, such as virtual consultations or bespoke services.

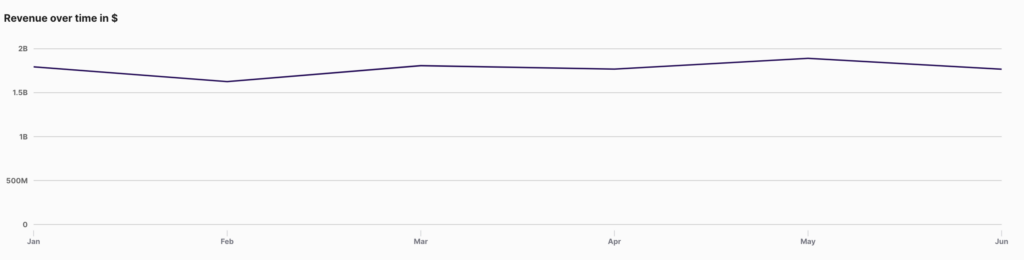

Pets and Animals

Pets and Animals saw a modest growth of 2.36%, with revenues increasing to $2.7 billion in H1 2024. The growth reflects ongoing consumer investment in pet care. Retailers can drive further growth by expanding their offerings to include premium pet products, health-focused items, and sustainable pet care solutions.

Games

The Games category experienced a decline of 4.94%, with revenues dropping from $1.7 billion in H1 2023 to $1.6 billion in H1 2024. This decline may be due to market saturation or shifts in consumer entertainment preferences. To counter this, e-commerce businesses should explore emerging trends in gaming, such as immersive gaming.

Childcare

The Childcare category grew by an impressive 10.19%, with revenues increasing from $1.2 billion in H1 2023 to $1.3 billion in H1 2024. This growth highlights the increasing reliance on online shopping for childcare essentials. E-commerce retailers should focus on expanding their product range to include innovative and eco-friendly childcare products, as well as offering subscription services for recurring purchases like diapers and formula.