Q1 Furniture sales online hit $12.1 billion

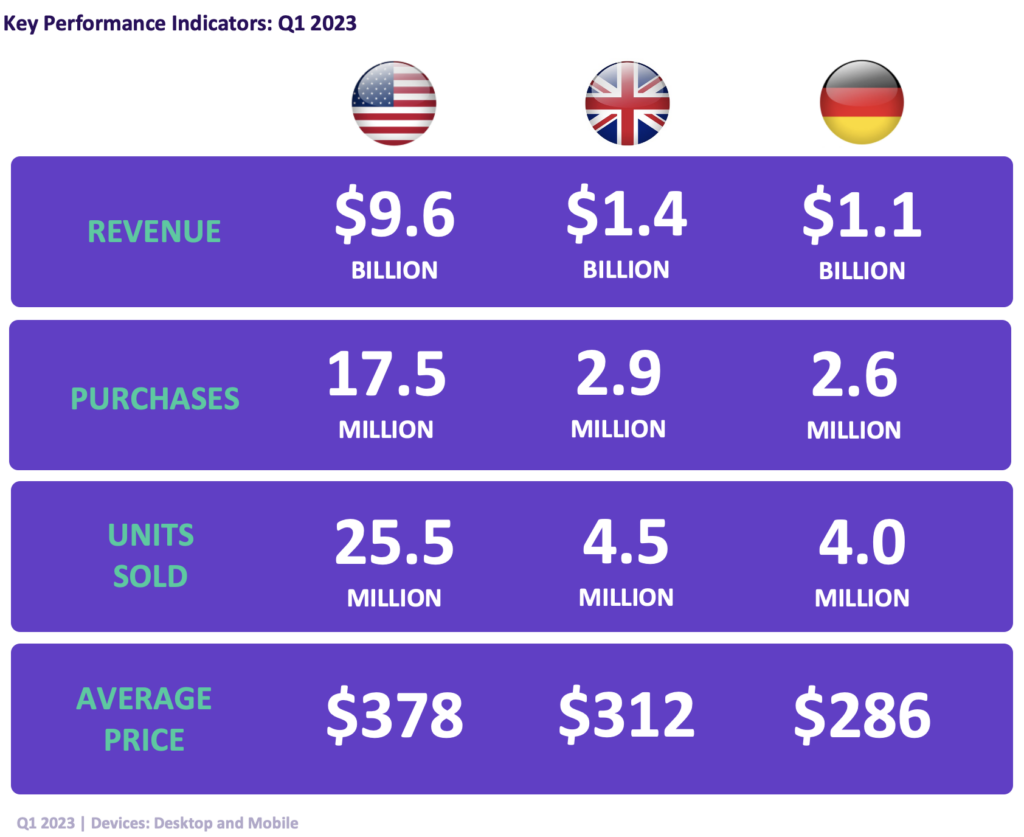

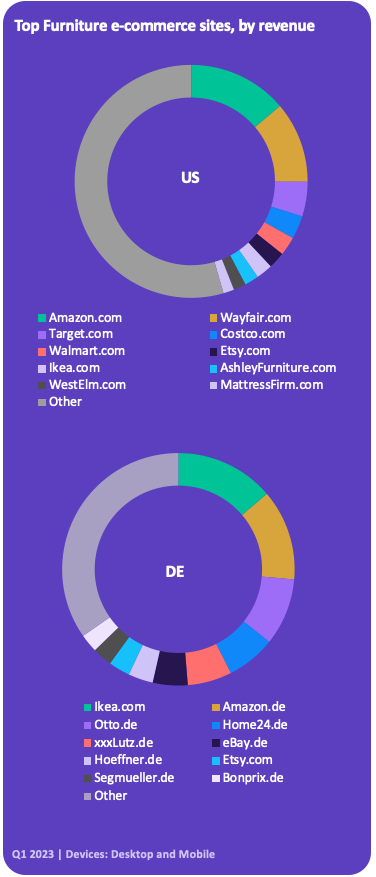

Grips reports that mobile and desktop e-commerce sales of Furniture in the US, UK and Germany during Q1 2023 surpassed $12.1 billion from over 20 million distinct transactions or purchase events. The US accounted for more than three quarters of both revenue and purchases.

The average price of a piece of furniture sold online in the United States was the highest of the three countries covered in this report with each item averaging $378. In the UK, consumers spent $312 on a piece of furniture online and in Germany, the price was a virtual bargain at just $286.

These findings come from Grips’ Competitive Intelligence platform, which reveals key e-commerce metrics, including purchases, units sold, revenue, top sites and more for thousands of unique product categories across tens of thousands of retailers. The findings in this report represent sales of over six million tracked Furniture items sold across more than a thousand domains.