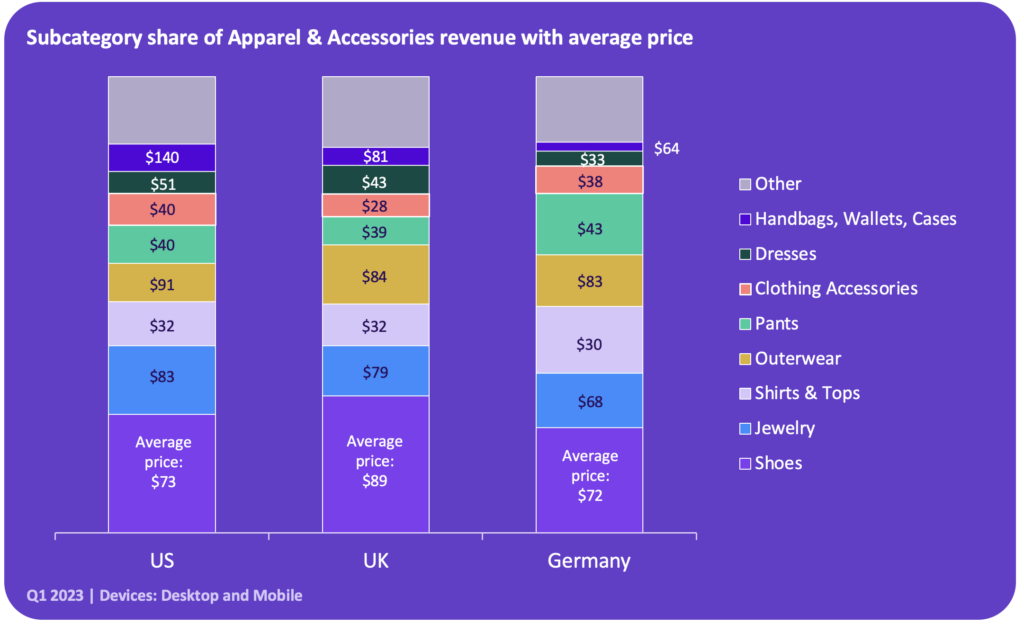

Shoes are the industry’s top-selling subcategory

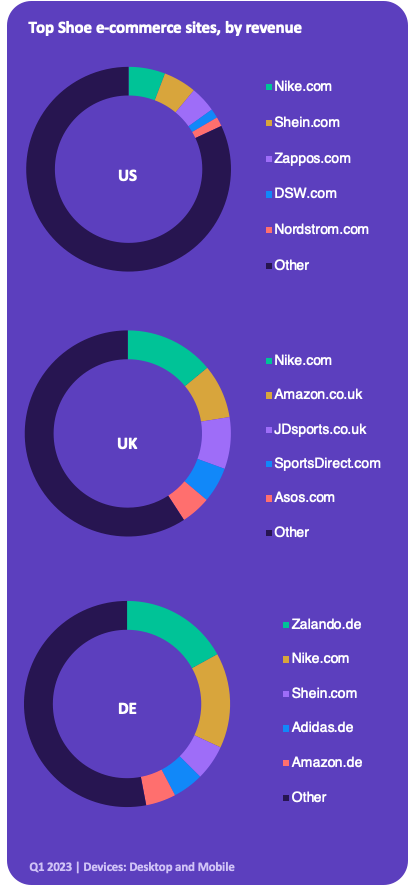

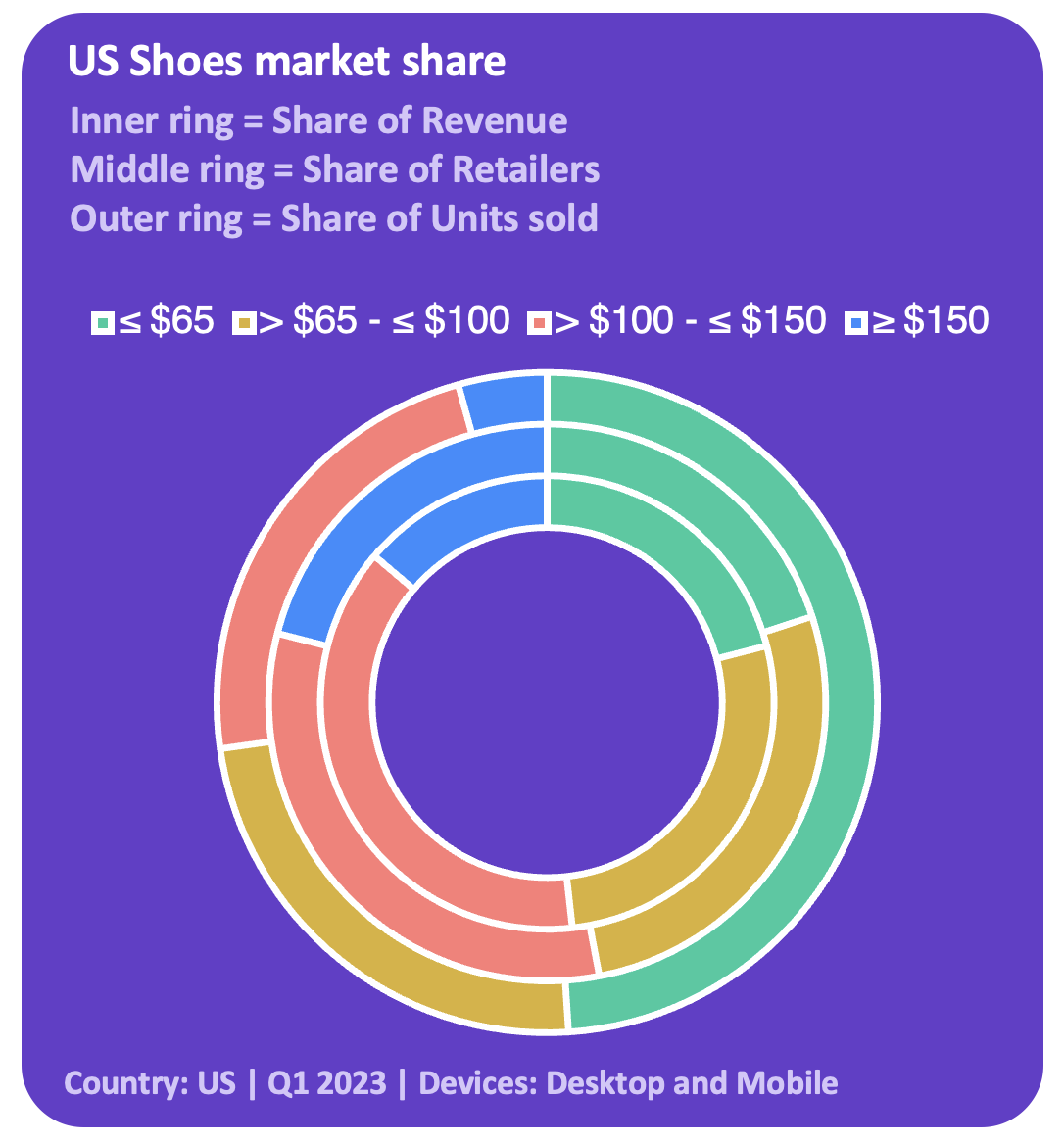

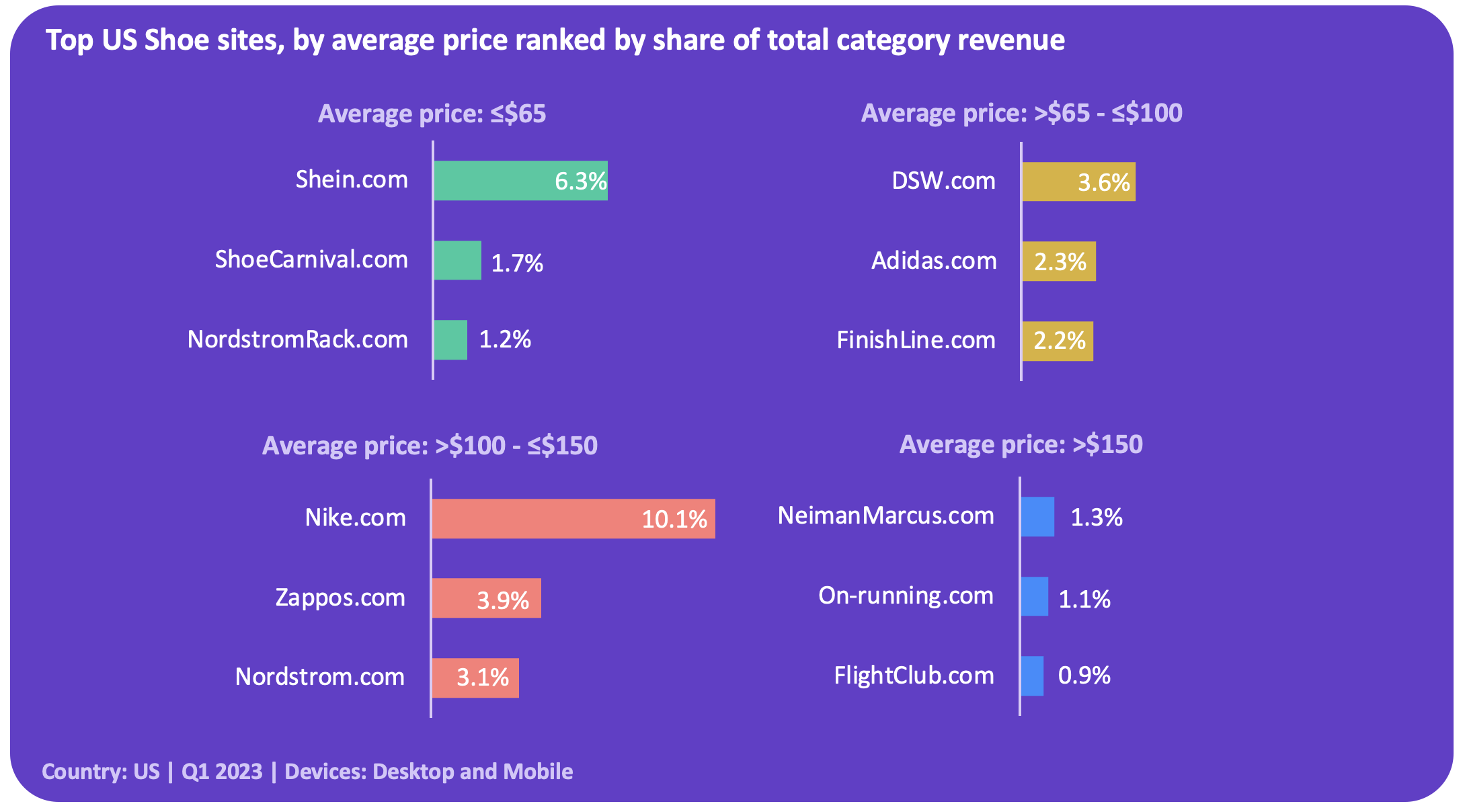

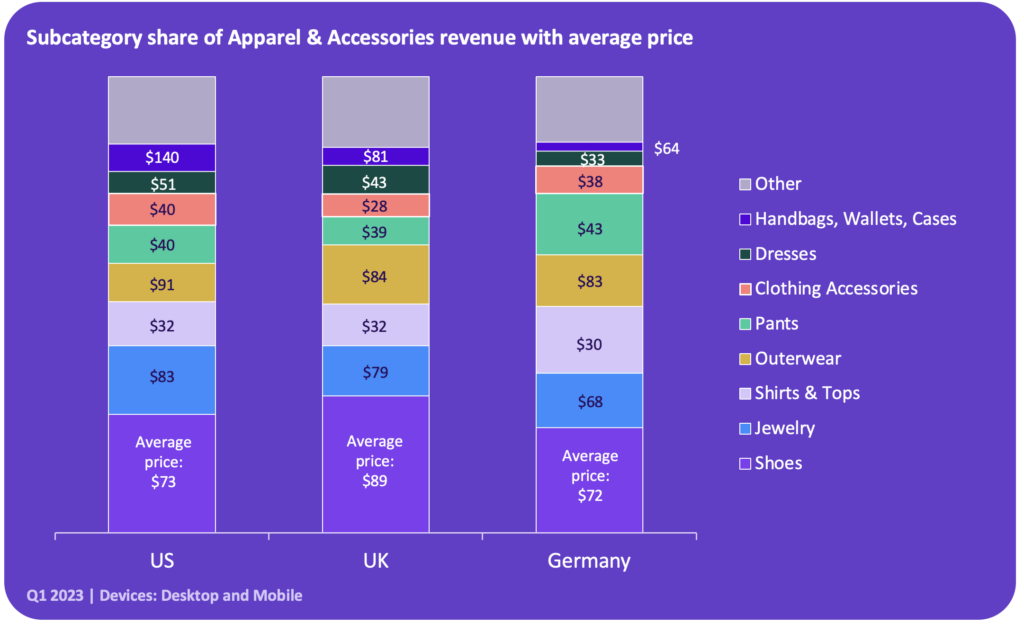

According to Grips, Shoes account for the largest share of e-commerce revenue for Apparel & Accessories products in the US, UK and Germany, representing between 23 percent and 30 percent of online Apparel & Accessories sales. The average price for Shoes in the UK, was the highest at $89 while in the US and Germany prices were in the low- to mid-seventies range.

In the US, Jewelry accounted for the second greatest share of revenue. Colder average climates pushed other categories up in the UK and Germany. For instance, Outerwear was the second highest grossing subcategory in the UK while Shirts & Tops was runner-up in Germany. Germany also saw a disproportionately high share of revenue to Pants. Of the top major categories, Handbags, Wallets and Cases came in last in the UK and in Germany. Americans, meanwhile, Handbags’ share of wallet in the US was at least 50 percent higher beating out Dresses.

Seasonally speaking, Outwear accounted for a greater share during colder months while Swimwear, Sunglasses, et al accounted for a greater share during warmer/sunnier months. However, there were some interesting trends when breaking the data down further. For instance, Coats & Jackets saw share of wallet peak in November while winter accessories like scarves, gloves, etc. peaked in January indicating consumers had more forethought to buy coats ahead of colder weather but still had a need to supplement or even replace accessories as winter wore on.

Likewise, Swimwear accounted for the lowest share of wallet in November but saw share grow immediately after the holidays as consumers began planning Spring travel. Shorts saw a similar trend, but didn’t see sales start to increase again until March suggesting that consumers anticipated needing a new bathing suit earlier than they realized they also needed shorts.

Understanding regional and seasonal differences in sales like these will help brands better plan promotions and assortment to maximize sales.