Beverage containers are more than just a must-have accessory to stay hydrated. These often colorful and distinct vessels have become a highly-recognizable status symbol with many consumers going all-in on one brand.

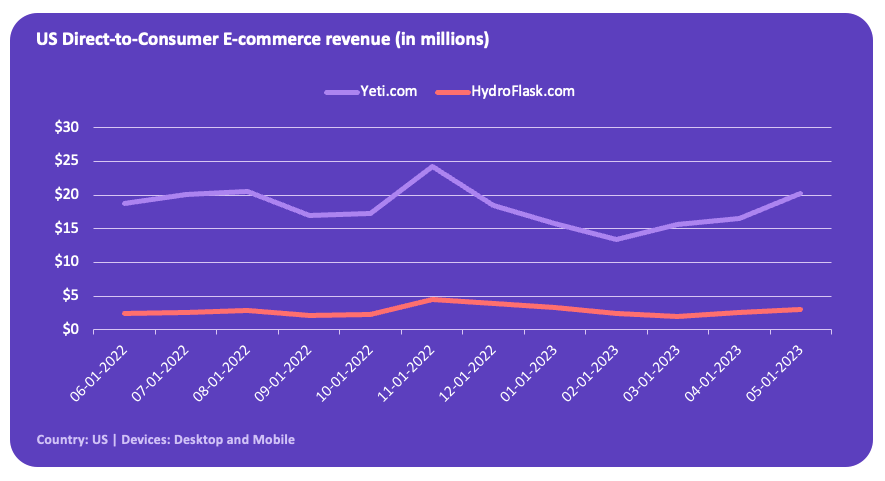

According to the latest research from Grips, Yeti (YETI), the maker of insulated containers ranging from coolers to water bottles to tumblers, generated an estimated $95.1 million in e-commerce revenue in the United States during the first five months of 2023, making it the nation’s leading brand in the Food & Beverage Carrier category. By comparison, Hydro Flask (HELE), another recognizable brand, generated $23.6 million online during the same period.