In a surprising move, Tractor Supply Company (TSC) recently announced significant changes to its diversity initiatives and climate goals, sparking widespread controversy and affecting its bottom line. Grips Intelligence, a leader in e-commerce analytics, has provided exclusive data revealing the immediate sales impact following the announcement.

How Tractor Supply Company Announcement Impacted Sales

Introduction

Sales Impact Analysis

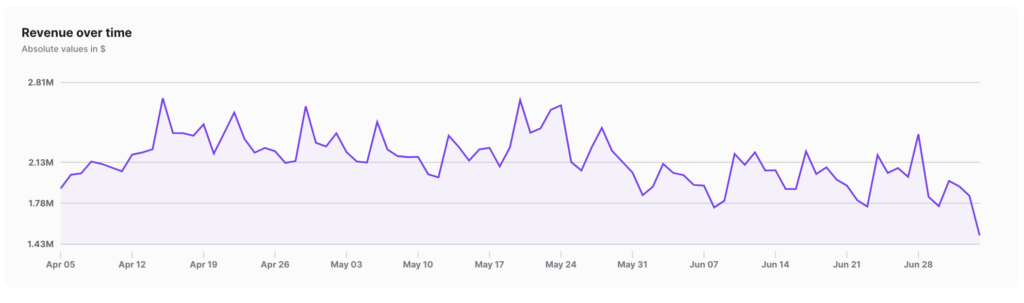

Grips Intelligence reported a notable spike in sales on tractorsupply.com immediately after the announcement. On July 28th, sales surged to $2.37 million, marking a remarkable 23% increase week-over-week—the highest single sales day in a month for the retailer. However, subsequent days showed varied results:

- July 29th: Sales increased by only 2% week-over-week.

- July 30th: Sales remained unchanged compared to the previous week.

- July 1st: Sales experienced a decline of 10% week-over-week.

- July 2nd: Sales were down 5% week-over-week.

- July 3rd: Sales were down 11% week-over-week.

- July 4th: Sales were down 25% week-over-week.

TractorSupply.com daily revenue

Knowing that the Independence Day holiday likely was a factor in the performance on July 4th, we looked at other home improvement stores, including Lowes.com, Menards.com, and AceHardware.com. All three also saw a drop in sales week-over-week, but none as much as Tractor Supply. Specifically, Ace saw sales drop 20%, Lowes dropped 11%, and Menard’s dropped 24%.

When considering the total week-over-week change in sales for the six days following the announcement (excluding the July 4th numbers to avoid bias), sales were actually down 1% compared to the previous week. This indicates that the initial spike was short-lived and suggests a potential shift in consumer sentiment and purchasing behavior following TSC’s decision. We will continue to monitor these trends to see how they develop in the coming weeks.

Long-term growth and risks

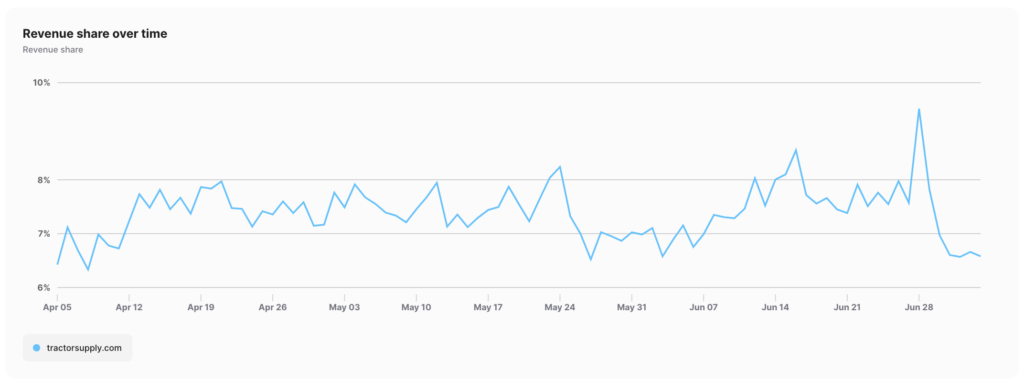

Despite this recent volatility, Tractor Supply Co has seen solid growth in the past year in terms of online sales. In 2023, sales on tractorsupply.com grew 26% year-over-year, and in the first five months of 2024, sales were up 7%. This raises questions about whether this polarizing move may jeopardize the company’s online sales growth. While their physical retail stores are located in or near rural communities, their online sales are likely to attract customers outside of this core zone, where shoppers may not ascribe to the beliefs on which right-wing groups were criticizing the company. This could be a significant factor that will be reflected in the future performance of tractorsupply.com.

Conclusion

While it’s too early to determine the long-term impact, TSC’s decision seems to have polarized customers. The initial surge in sales was strong but brief, followed by an unremarkable weekend when sales are typically at their lowest of the week. Meanwhile, the notable drop in sales on Monday, the day sales normally take a big jump, suggests that the move has more progressive customers re-thinking their support of the company. The fluctuations in sales figures indicate that the controversial announcement likely had an impact on consumer trust and loyalty. But for how long, we don’t yet know.

Grips continues to monitor these trends closely and will provide updates into the evolving dynamics of retail and consumer behavior.

Stay informed and stay ahead with Grips

Discover how Grips Intelligence delivers real-time insights into your competitors’ business, including consumer reactions to events such as new product launches, promotions, and even public announcements. Stay ahead of the competition with actionable data that empowers your strategic decisions. Schedule a demo today to see how Grips can transform your competitive intelligence strategy.