Your Customer Lifetime Value (CLV)—also known as client lifetime value or consumer lifetime value—is a core indicator of long-term profitability. Paired with Customer Acquisition Cost (CAC), this KPI gives you insight into whether you’re acquiring customers at a sustainable rate. Calculating CLV helps determine the value each customer brings over their lifetime, and CAC measures how much you spend to acquire them. Ideally, your CLV should be several times higher than your CAC for profitability.

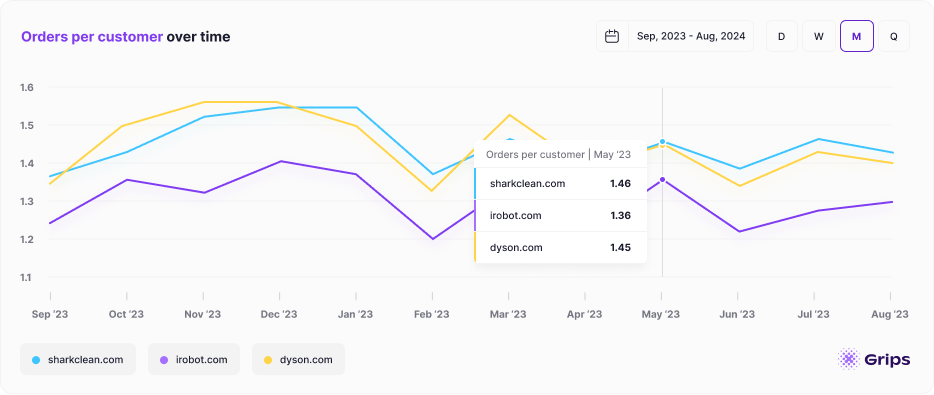

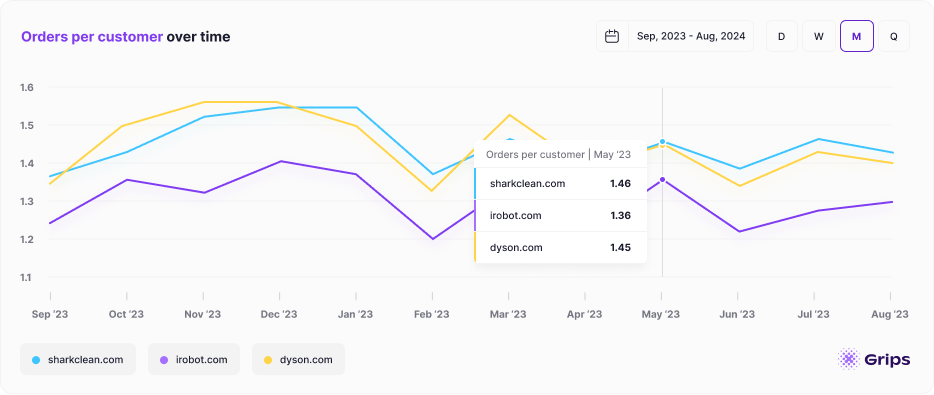

Another way to measure Customer Lifetime Value (CLV) is by tracking Repeat Purchases per Customer. This metric helps businesses assess customer loyalty by revealing how often customers return to make additional purchases. By analyzing this data, Grips clients can gain insights into customer retention patterns. For example, a higher Repeat Purchases value suggests stronger loyalty, giving you a competitive edge. Comparing this metric against competitors can reveal where their customers demonstrate higher engagement and loyalty, offering a valuable opportunity to refine retention strategies.

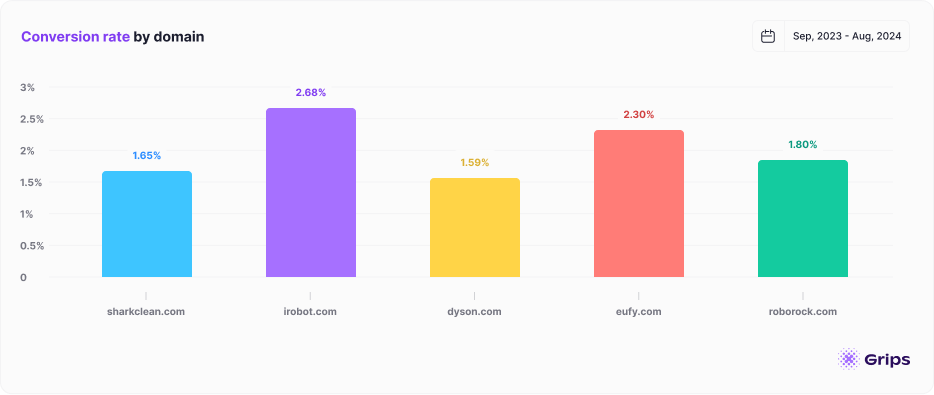

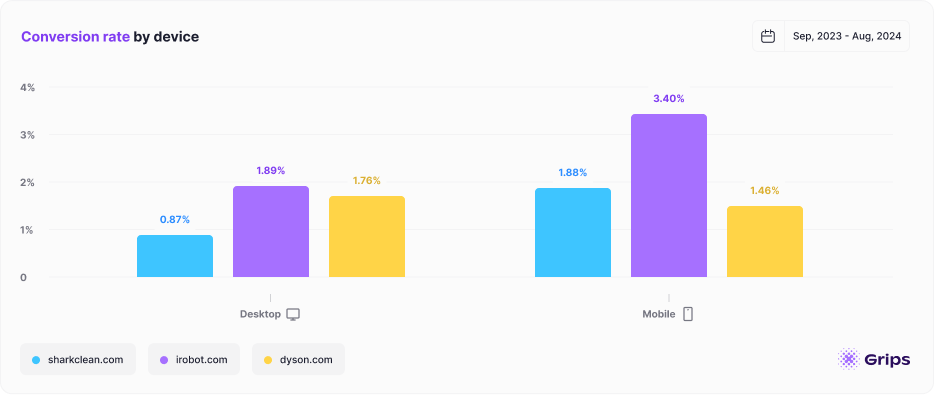

Tracking these KPIs together provides clarity on the cost-effectiveness of your acquisition strategies. Competitive benchmarking, especially around lifetime value (LTV) marketing efforts, reveals how your CAC compares to the industry standard. If competitors are spending less and gaining more, you may need to adjust your marketing efforts.