Summer Fridays caters to skincare needs by providing a range of vegan and cruelty-free products. Their selection includes cleansers, moisturizers, masks and more, formulated for a luxurious at-home spa experience.

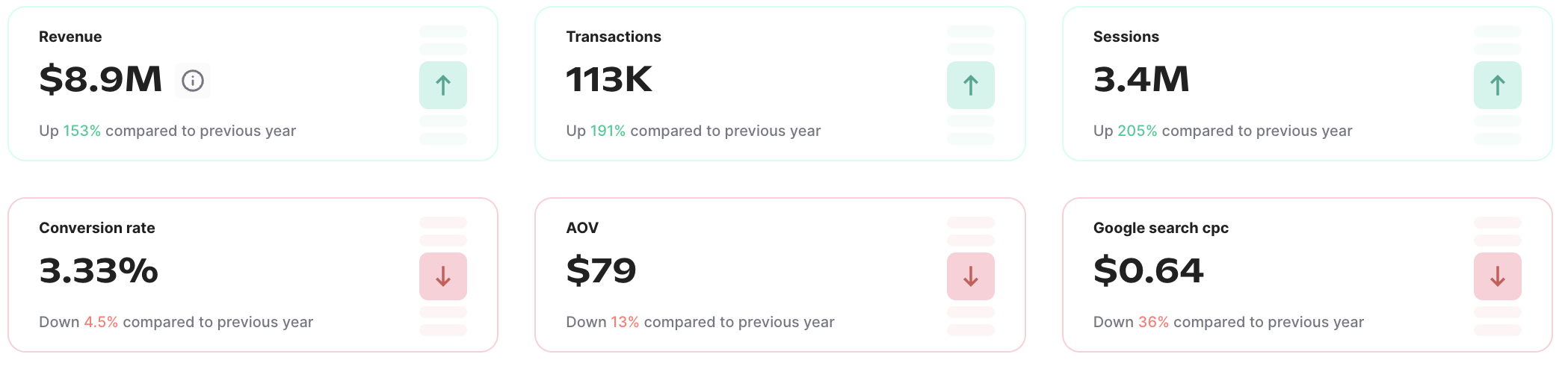

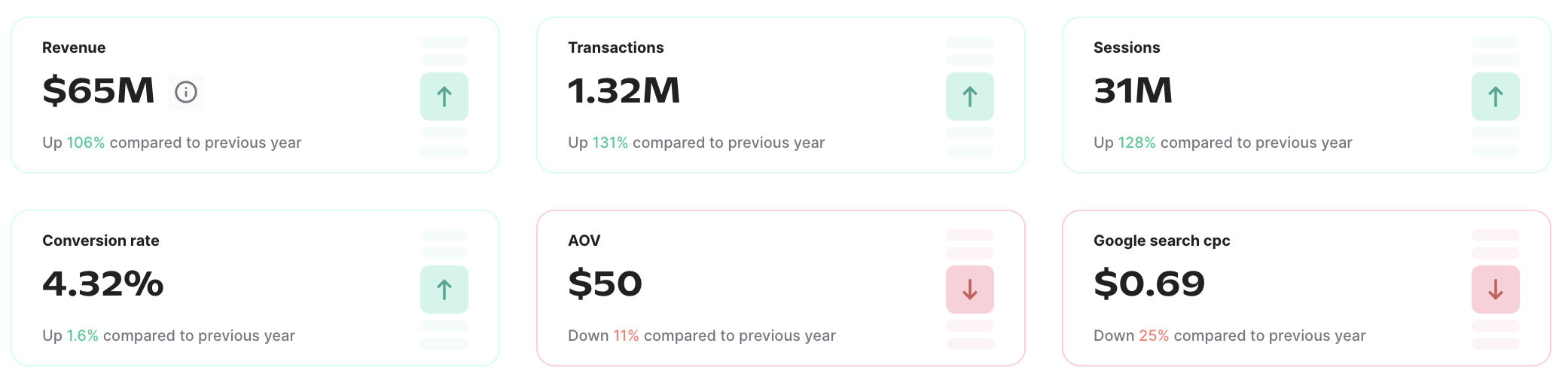

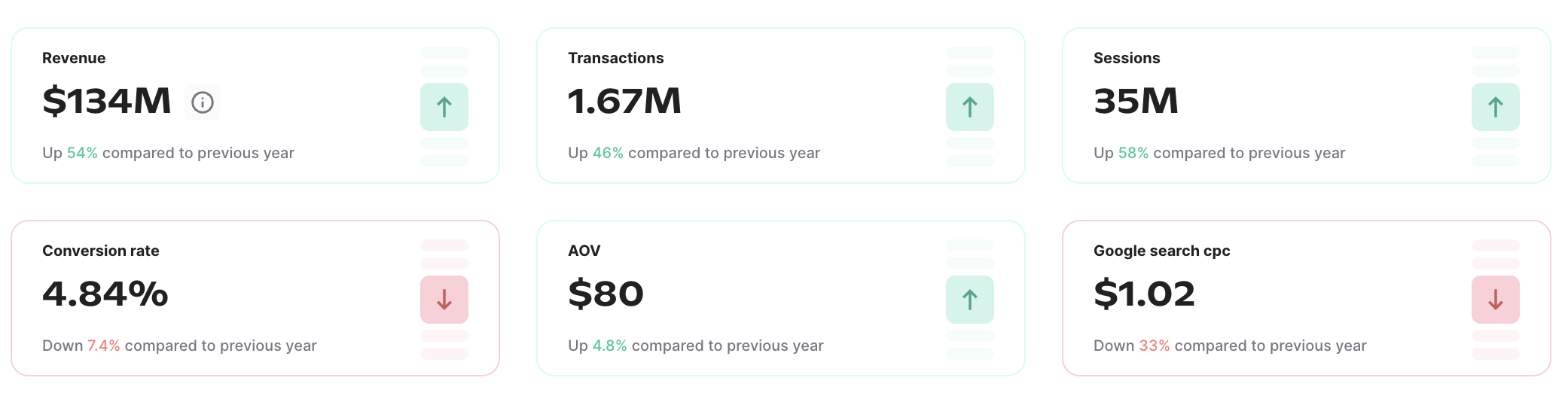

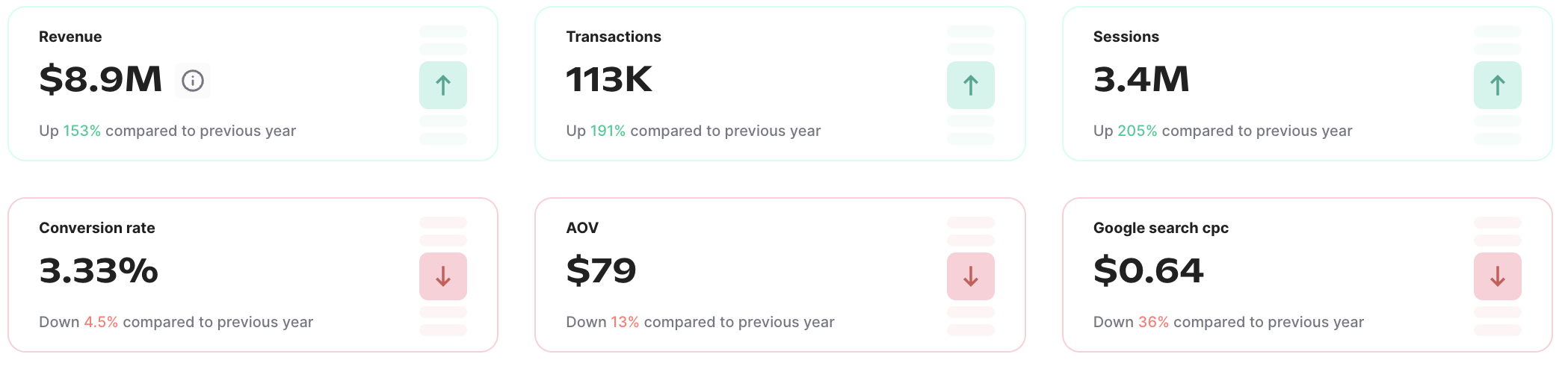

KPIs

March, 2023 – February, 2024 US vs year prior

Grips data reveals impressive growth for SummerFridays.com in the US in 2023 and into the start of 2024. Revenue surged 153% to $8.9 million, fuelled by a doubling of website sessions.

However, Grips’ data showed a slight dip in some customer acquisition metrics. For instance, conversion rate dipped to 3.3% from 3.5%, and the average order value (AOV) fell to $79 from $91.

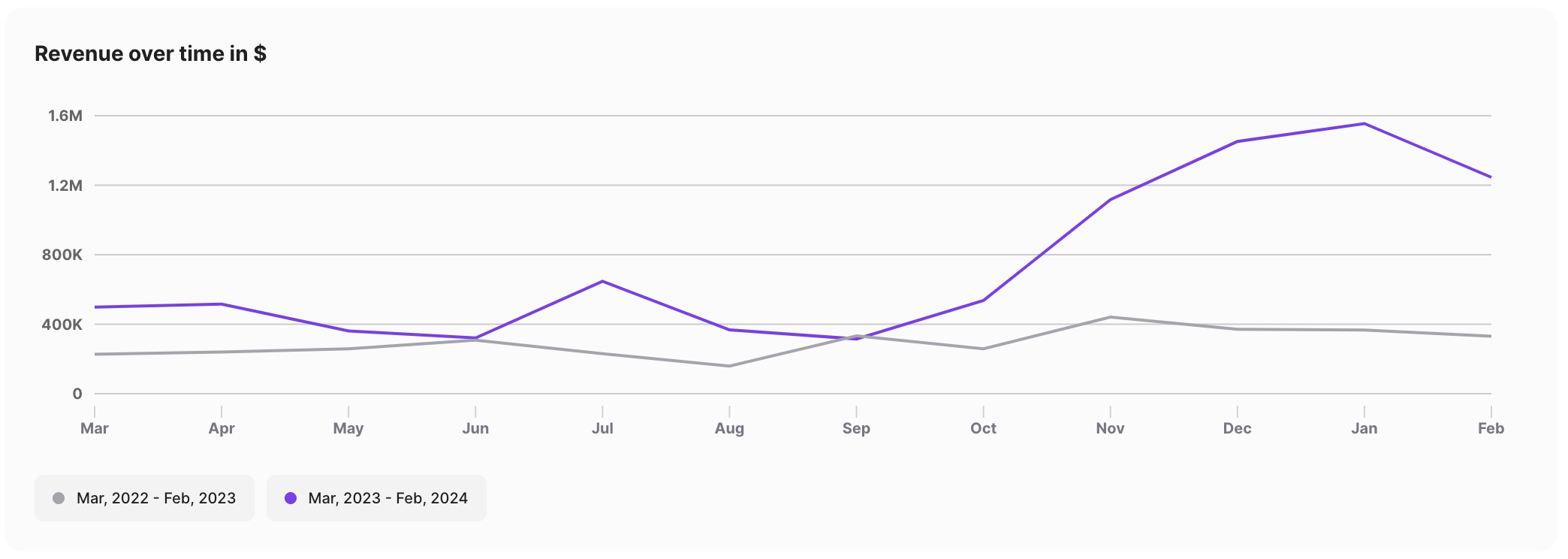

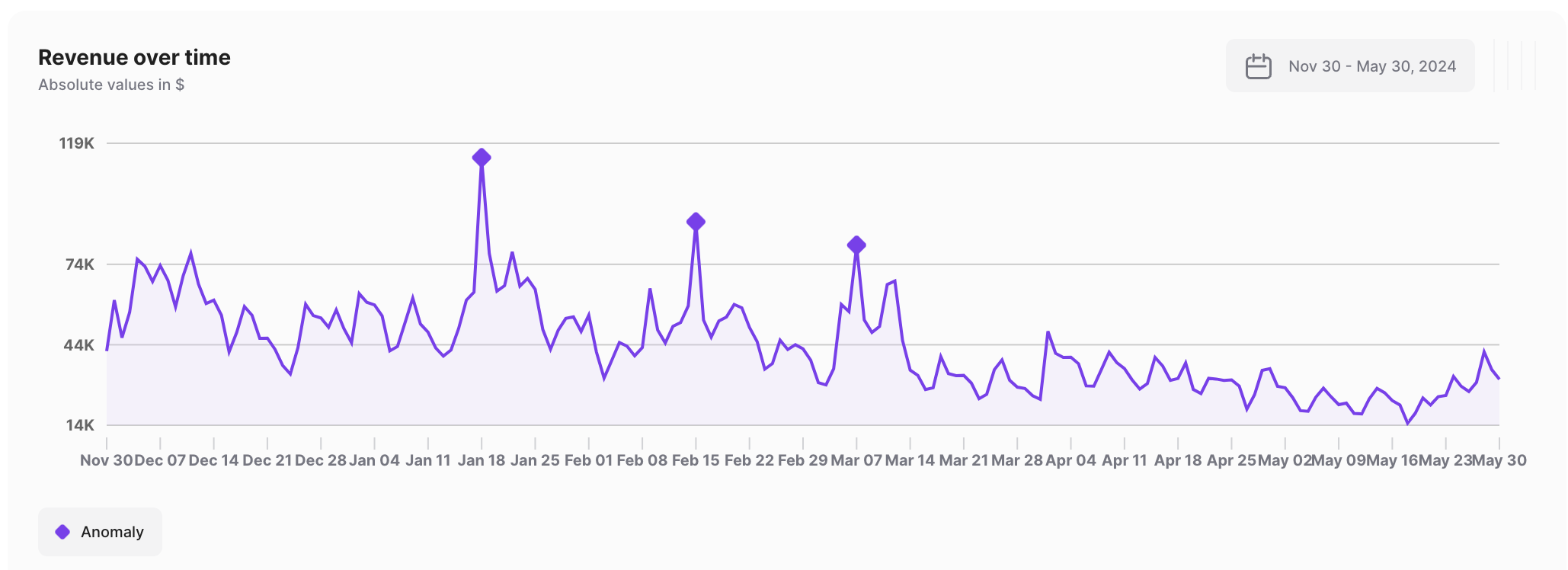

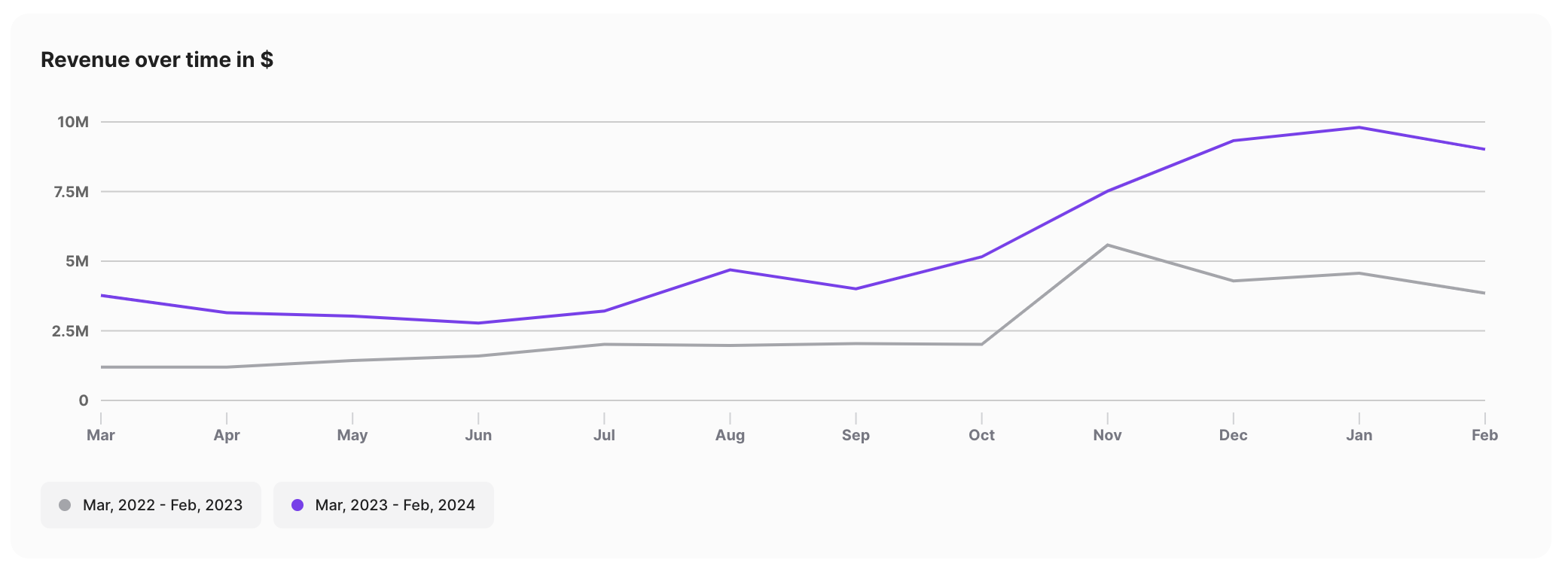

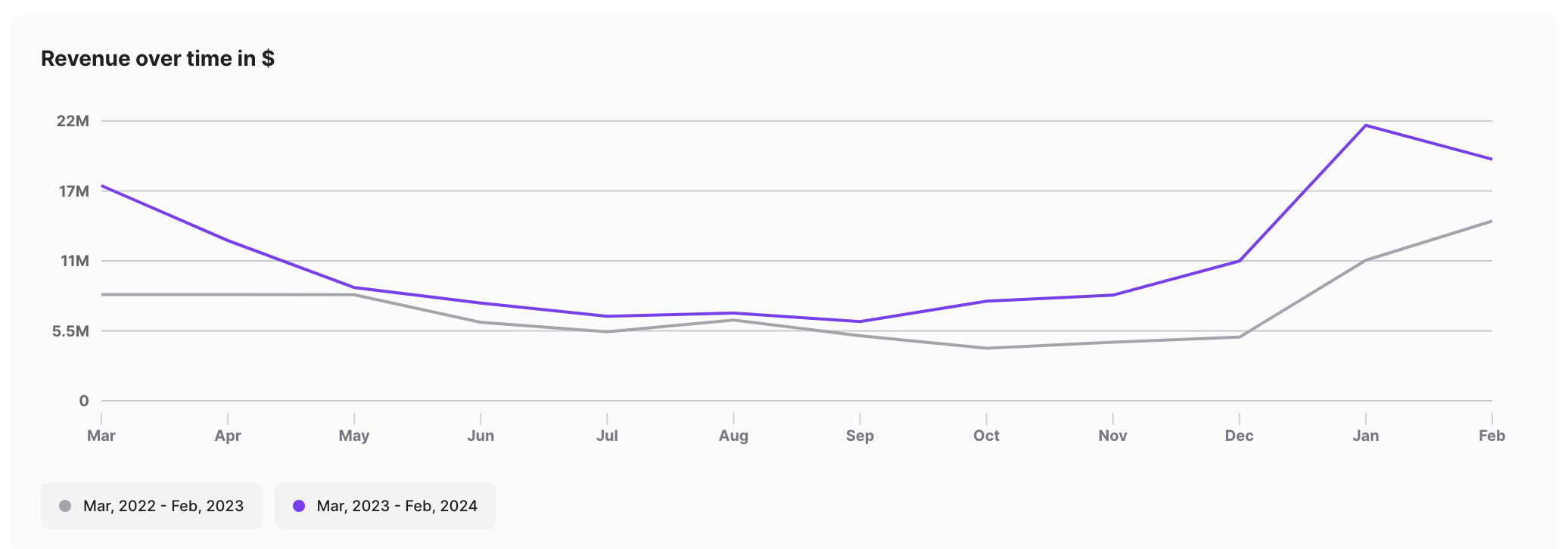

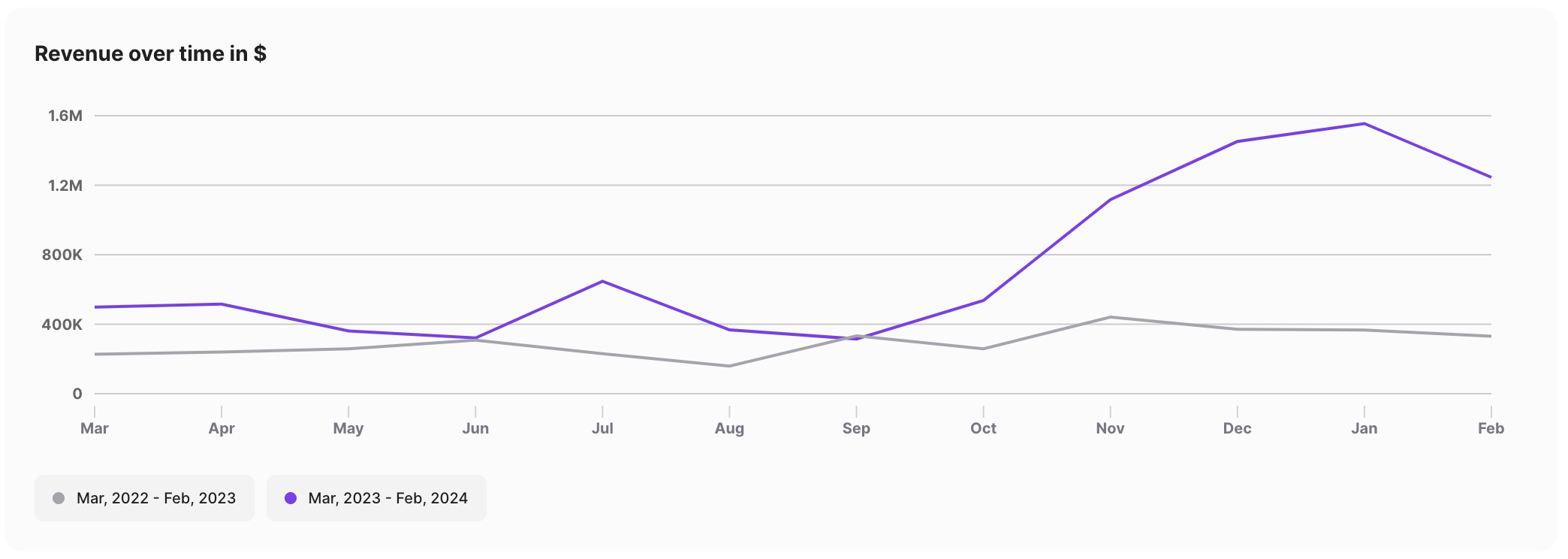

Monthly Revenue

March, 2023 – February, 2024 US vs year prior

Grips data reveals a strong revenue surge for SummerFridays.com starting in October 2023. But sales really took off in December right about the time that their lip balm went viral. The lip balm, which comes in a range of colors and flavors, including birthday cake and iced coffee, generated millions of views on TikTok.

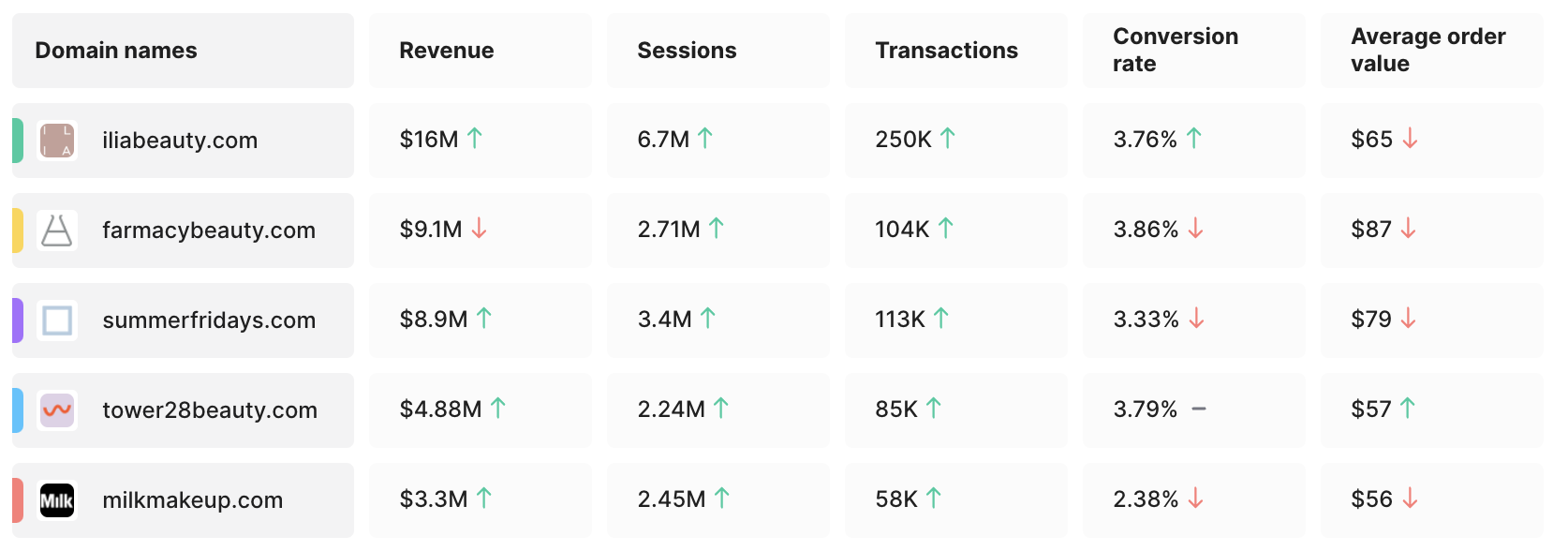

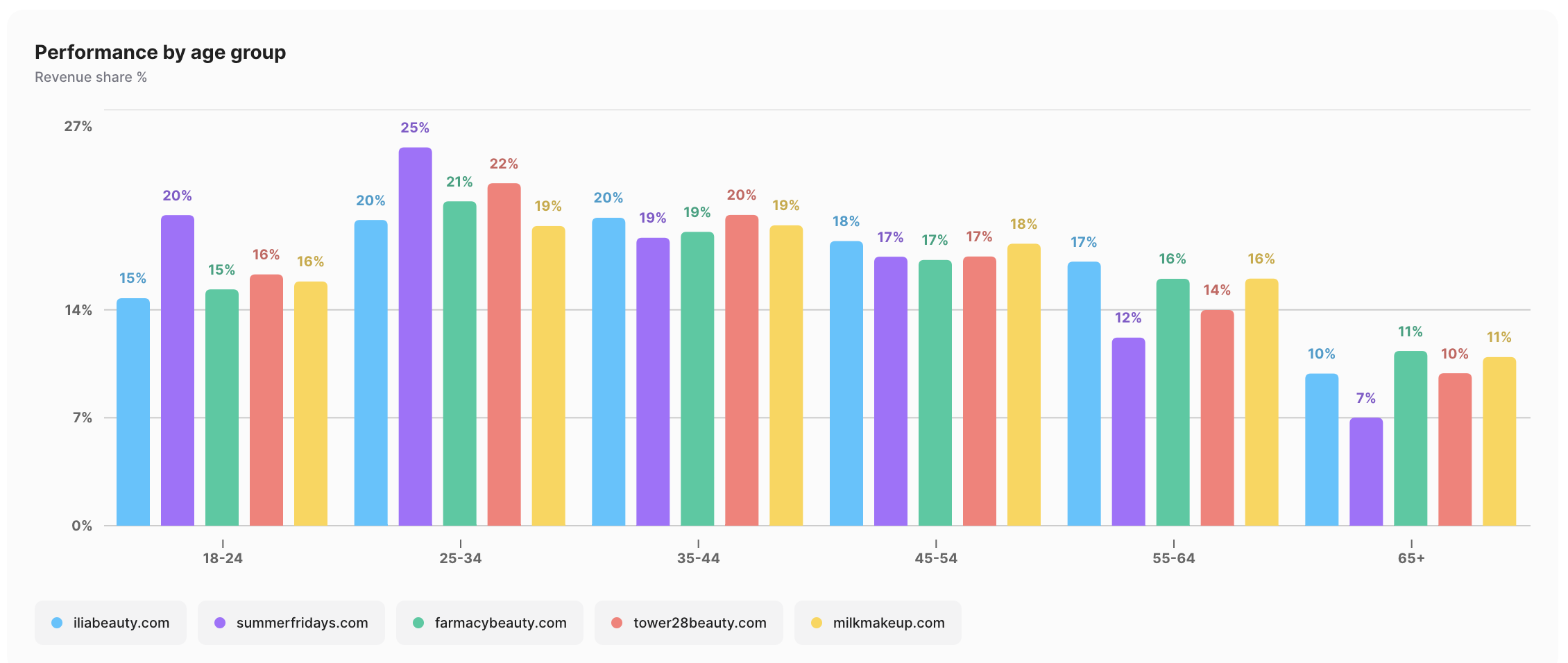

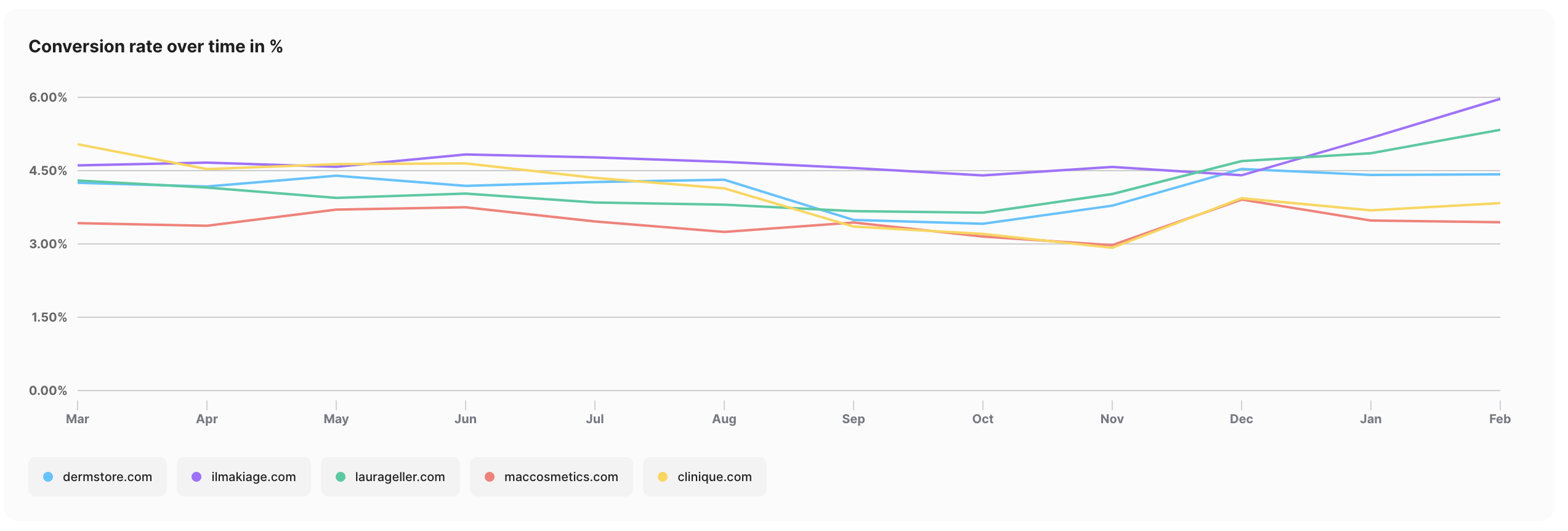

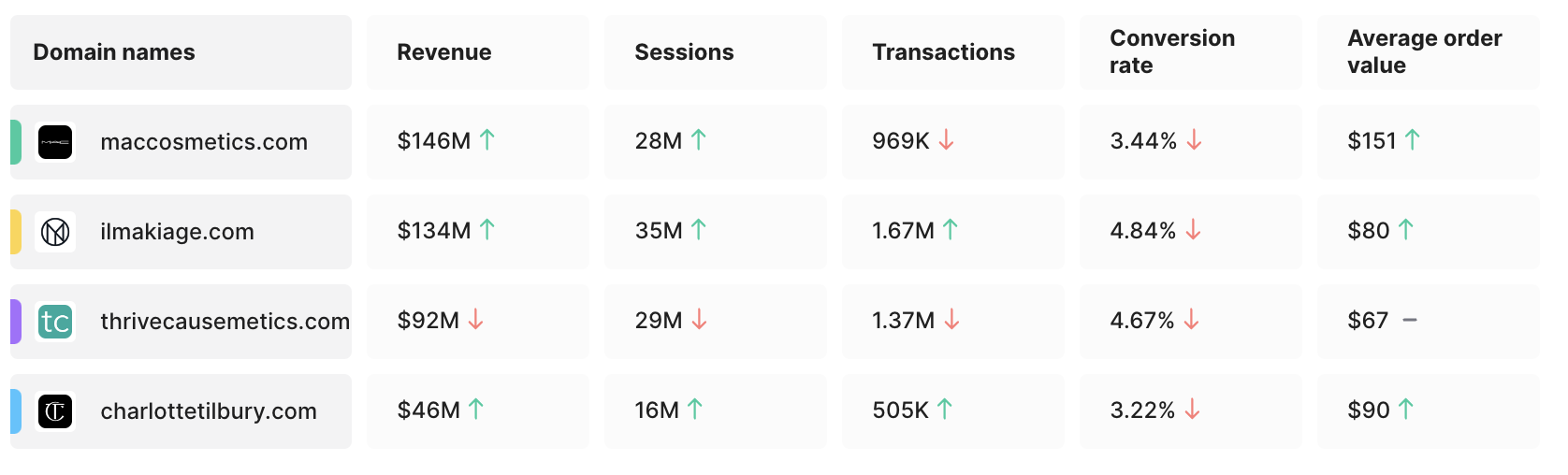

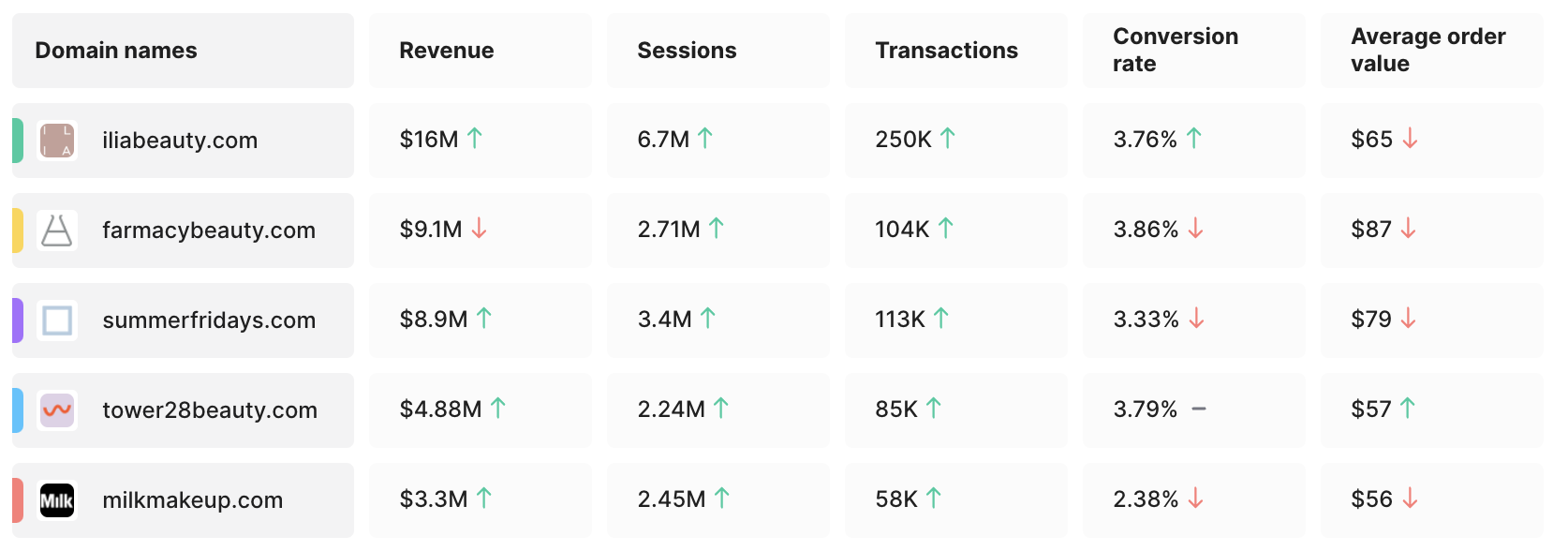

Competitor Comparison

March, 2023 – February, 2024 US

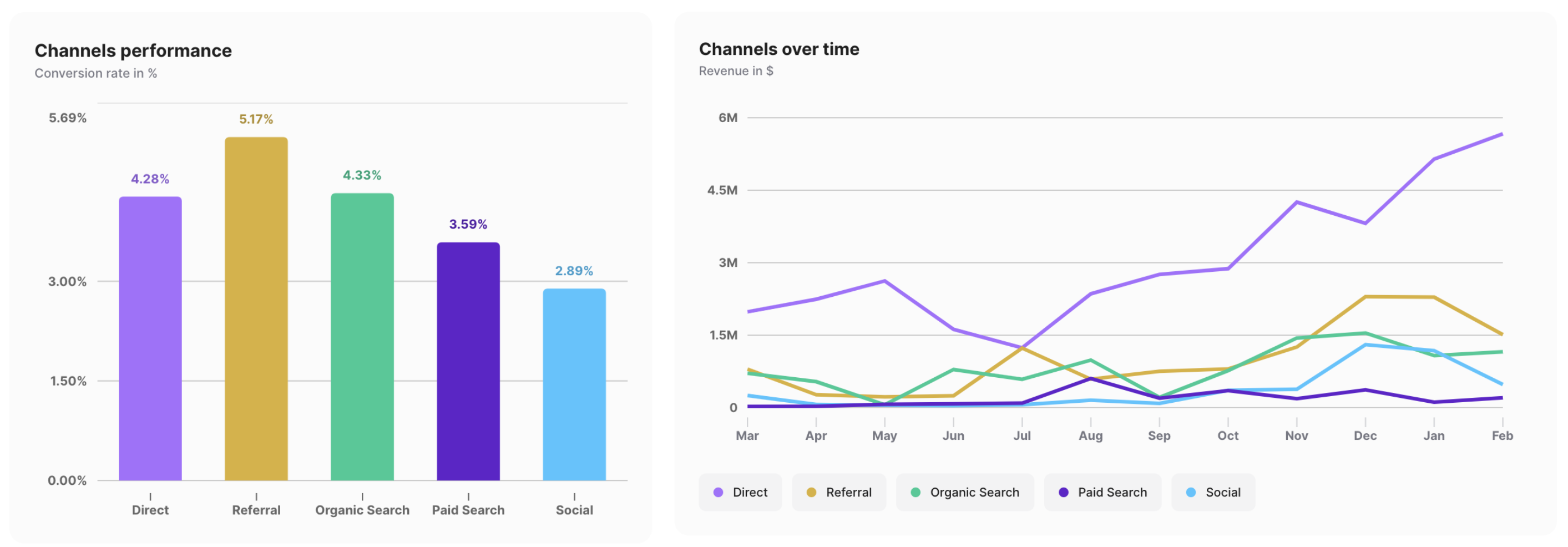

Summer Fridays navigates a tight competitive landscape with other vegan beauty & cosmetics brands. The site boasts a higher AOV compared to competitors, but their conversion rate is lower. While there is generally an inverse correlation between AOV and CVR, Summer Friday may also be seeing a lower conversion rate from the surge in attention from social media which typically convert at lower rates.

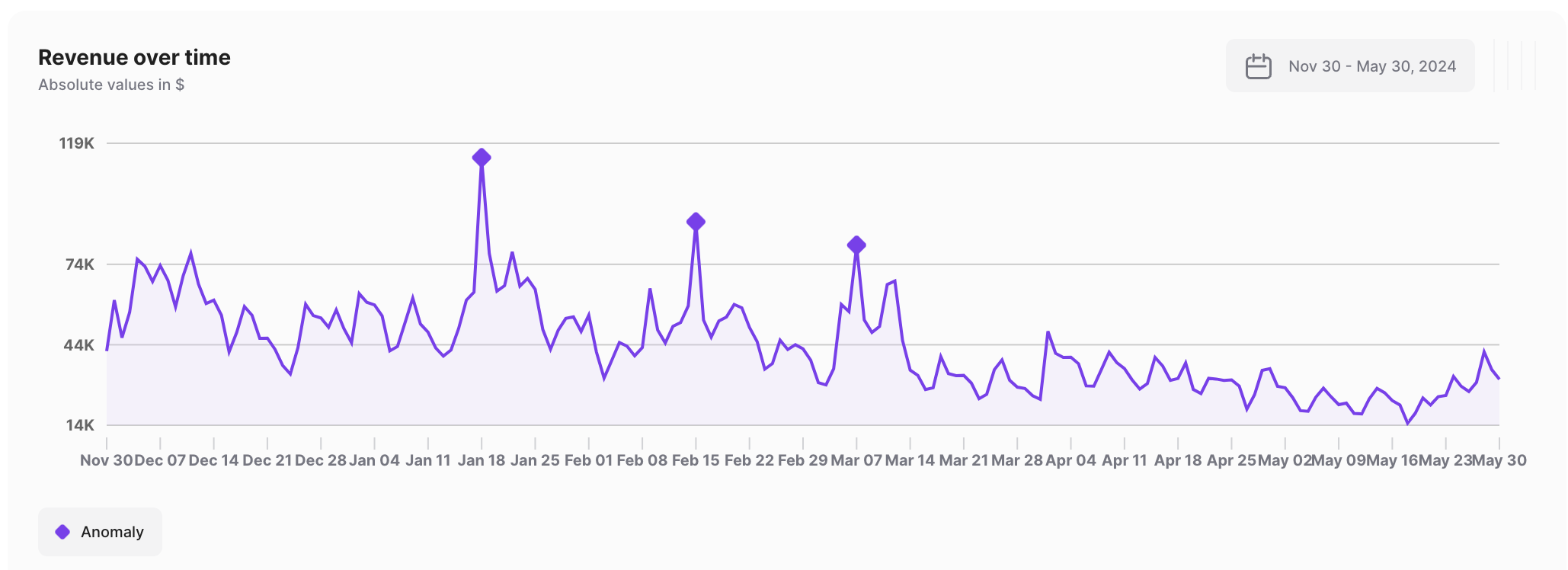

Promotions

November 30, 2023 – May 30, 2024

SummerFridays.com daily revenue exceeded Grips expectations three separate times in the past six months. One key date was January 18th when Summer Friday released new Lip Oils generating $116,000 in a single day, more than they generated on Cyber Monday. The spike on February 15th coincided with the release of their birthday cake lip balm and March 7th was their 6th anniversary event.

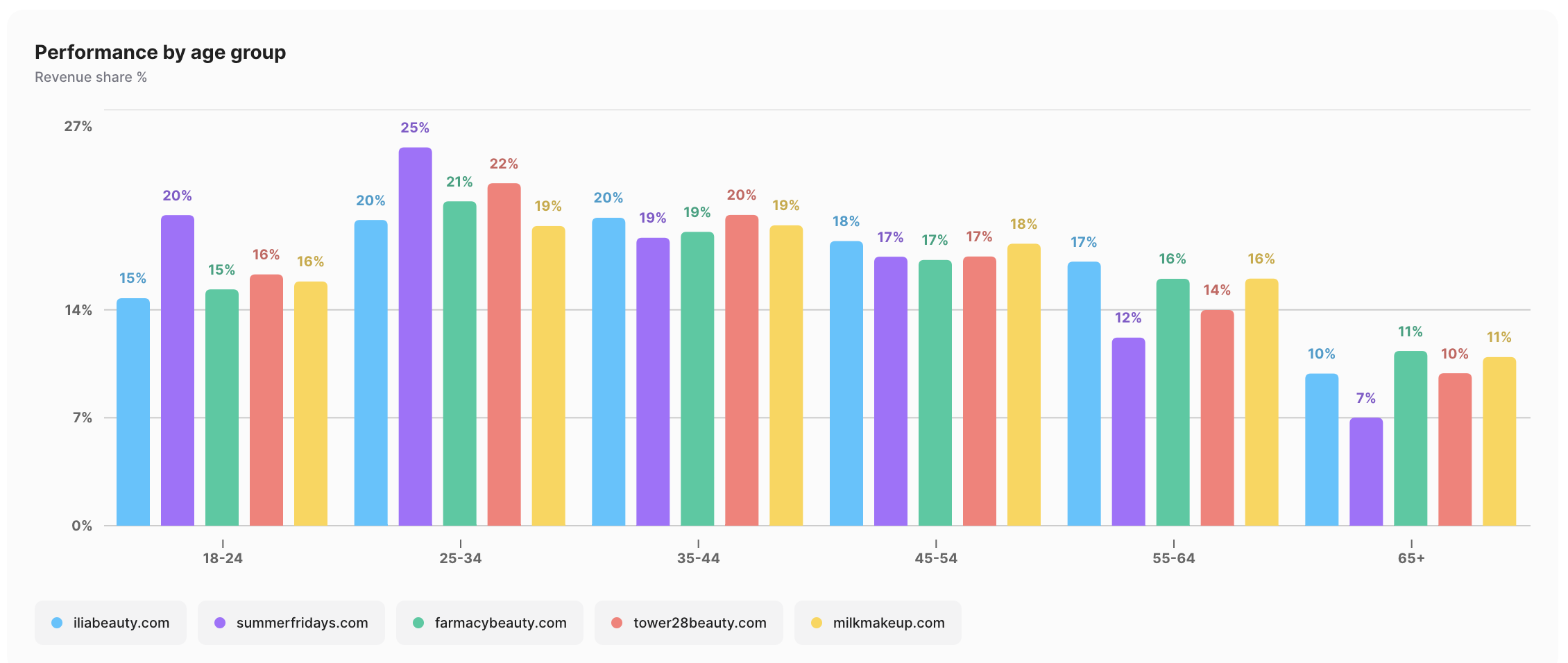

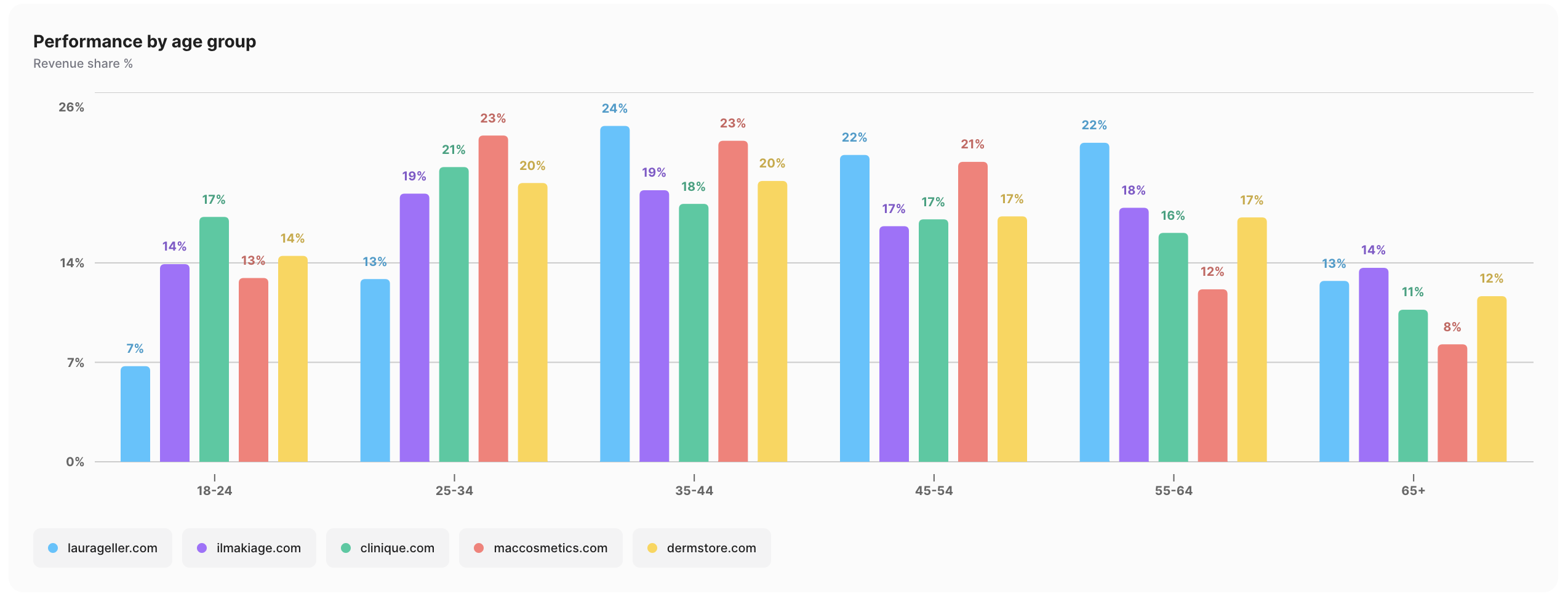

Audience strength

March 2023 – February 2024

Summer Fridays gets 45% of their revenue from consumers between 18 and 34 years of age, the highest share among the vegan beauty comp set. The youthful skew of their audience no doubt helps the brand attract other young clientele and gives them an opportunity to grow with these young consumers and provide them with an evolving set of products.