Unveiling the Significance of DTC Revenue

The digital realm continues to reshape the way consumers engage with brands giving them a unique opportunity to embrace Direct-to-Consumer (DTC) strategies and unlock new avenues of growth. In order to thrive, brands must dissect the dynamics of their competitors’ DTC sales versus those through partnerships.

“Successful competition starts with knowing not just how much your competitors make, but how they make it.”

In this report Grips, a leading provider of transactional e-commerce intelligence, dives into the realm of revenue generation and illuminates the importance of understanding DTC influence.

Peering into the Revenue Landscape

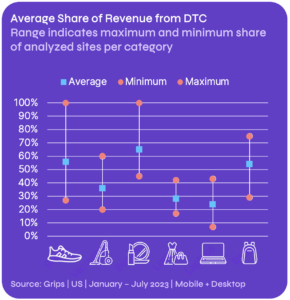

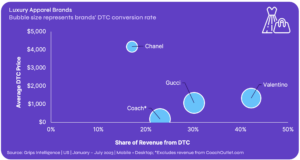

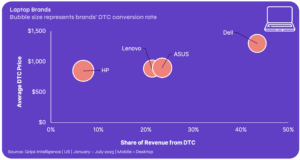

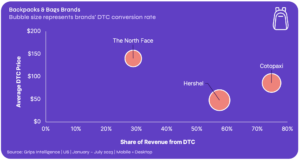

This comprehensive analysis meticulously scrutinizes the share of revenue derived from the DTC operations of 40 leading brands across six prominent product categories.

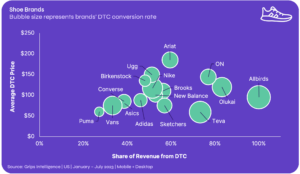

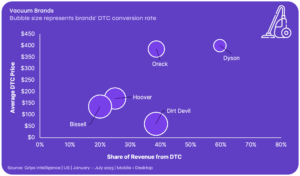

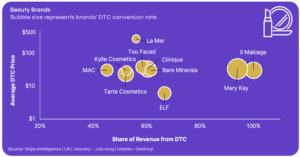

One of the most compelling findings is the wide variation in the share of revenue derived from DTC among different verticals. For instance, the average laptop brand analyzed in this report receives just 24 percent of revenue from DTC while DTC drives over half of the revenue for the average shoe brand. There are also significant differences in the way that individual brands within a given category approach their online sales strategies. Understanding these nuances provides valuable insights that will fuel your successful growth in today’s dynamic market.

Your E-commerce Mission Has a Guide

Successful competition starts with knowing not just how much your competitors make, but how they make it.

With our game-changing intelligence tracking over 65,000 brands across 45,000 domains, you’ll be empowered to make informed strategic decisions that lead your brand to sustainable success. From identifying potential market gaps to capitalizing on untapped revenue streams, Grips will serve as your guide in navigating the intricate e-commerce landscape.