Residents in these cities exhibited steady increases in spending from Sunday through Tuesday. This group appears to take a more measured approach, spreading out purchases over several days. Monday or Tuesday was often the day of highest spending, as consumers finished their preparations.

This pattern reflects a more cautious approach, where people ensured they had time to gather all necessary supplies without feeling rushed. These cities were prepared but not in a panic. Coastal and inland cities alike are in this group, which points to a more general preparedness mindset rather than a location-specific trend.

Top Cities:

- Miami

- Jacksonville

- Boynton Beach

- Gainesville

- Brandon

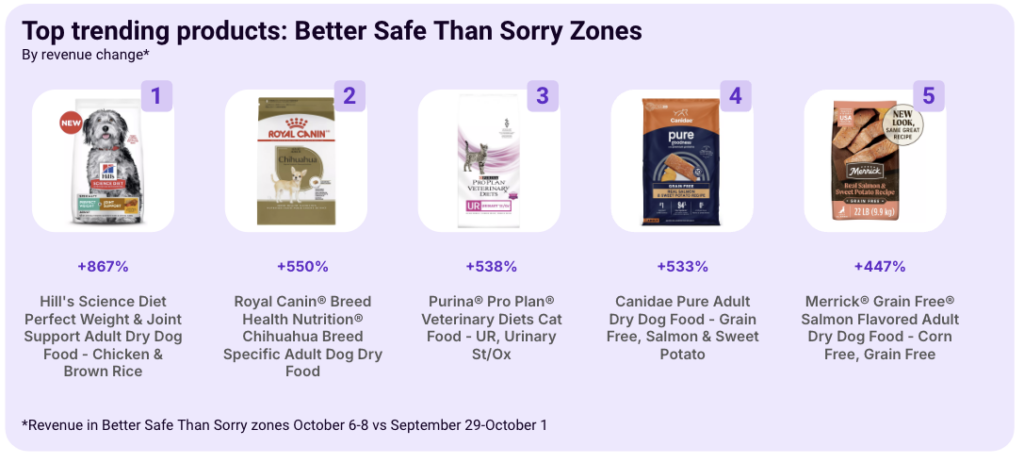

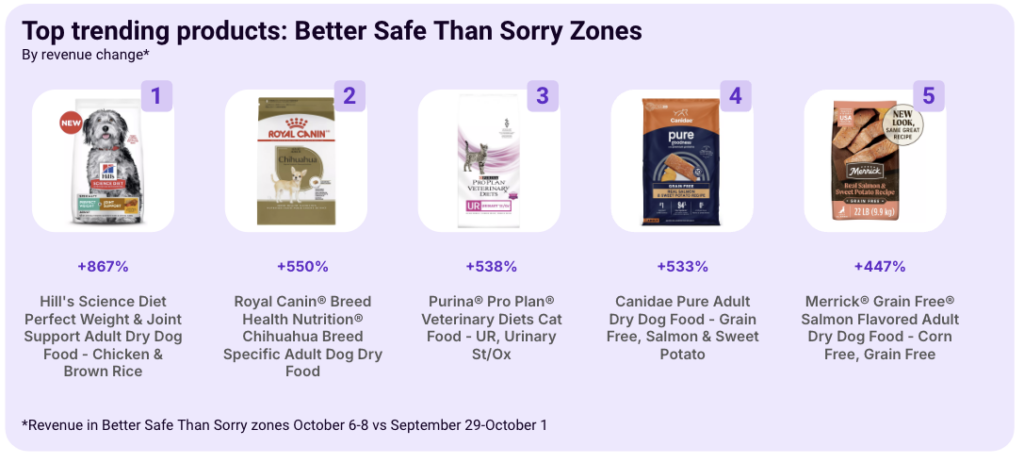

In the Better Safe Than Sorry zones, pet owners focused heavily on maintaining the well-being of their animals with a strong emphasis on specialized food and diet management. The top-trending product, Hill’s Science Diet Perfect Weight & Joint Support Adult Dry Dog Food, saw a staggering 867% increase in revenue. Other products like Royal Canin Breed Health Nutrition Chihuahua Breed Specific Adult Dog Food (+550%) and Purina Pro Plan Veterinary Diets Cat Food – UR, Urinary St/Ox (+538%) show that breed-specific and veterinary-recommended diets were also highly prioritized.

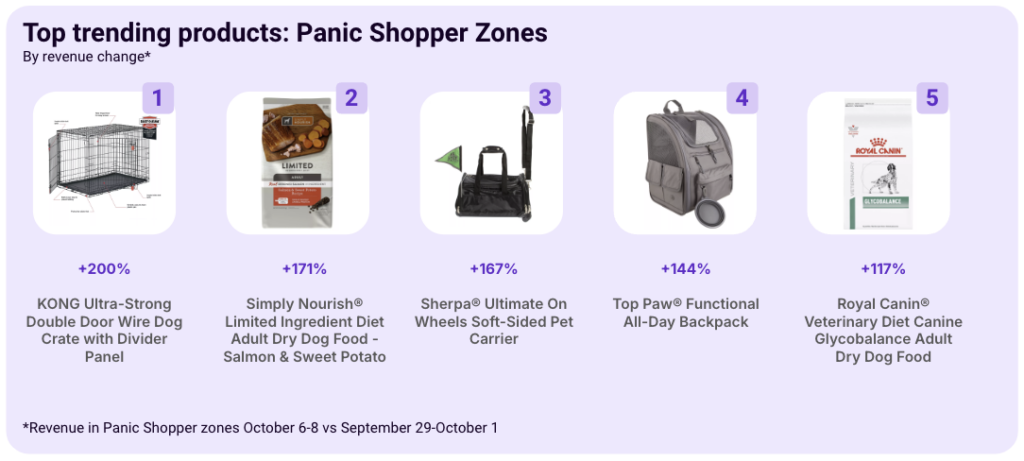

This focus on health-conscious and specialized pet food highlights a trend among residents in these zones to prepare thoroughly, ensuring that pets’ unique dietary needs were met even in emergency situations. Unlike the Panic Shopper and Beat the Rush zones, where mobility products were more prominent, these areas showed a stronger preference for long-term well-being, emphasizing proactive care over reactive measures.