In today’s competitive landscape, understanding consumer trends is paramount for businesses in the Pets & Animals category to maintain their market share and drive growth. By staying attuned to the evolving needs and preferences of pet owners, companies can adapt their strategies to meet the demands of this dynamic industry. In this post, we will explore five prominent consumer trends to watch in 2023, highlighting specific retailers that embody these trends and explaining their significance in shaping the future of the market.

Data shown is taken directly from the Grips Competitive Intelligence platform. When you’re ready to gain similar insights into the e-commerce performance of the competitors of your choice (and Grips reports on nearly 500 Pets & Animals sites in the United States alone), request a free demo so you can start gaining market share.

Personalized Pet Products

The growing trend of personalization in the pet industry is driven by consumers who view their pets as valued family members, deserving of the same level of attention and customization that they would offer to other members of their household. And it’s one reason why we think our data points to retailers like Cuddle Clones (cuddleclones.com) and Wild One (wildone.com) performing so well, generating $19.6 and $24.4 million in mobile and desktop revenue in 2022, respectively.

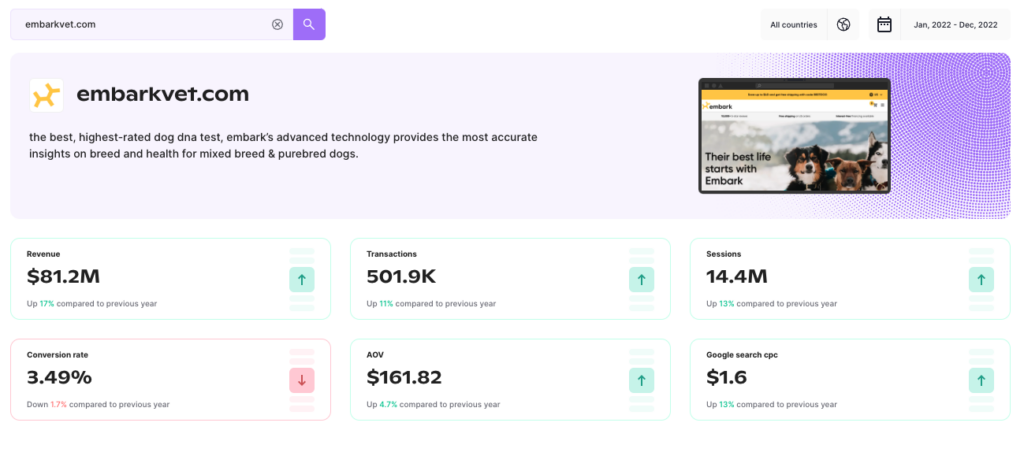

What better way to show your off your pet’s uniqueness than by sequencing her DNA? Embark (embarkvet.com) is one of the leading dog DNA providers with Grips reporting the site generated $81.2 million in revenue in 2022, up 11 percent year-over-year. But with the rise of competitors like Wisdom Panel, sales were flat year-over-year in Q1 of this year making it more important than ever to have insights into the competitive landscape.

Sustainable and Eco-Friendly Products

Consumers are increasingly concerned about the environmental impact of owning a pet. And Grips has found a growing demand for more sustainable products with locally-sourced ingredients or with eco-friendly packaging. The trend is so popular now that highlighting the sustainability of your pet product has become table stakes for the category at-large. Specialty retailers like The Honest Kitchen (thehonestkitchen.com) and Earth Rated (earthrated.com) are leading the way in offering sustainable pet products.

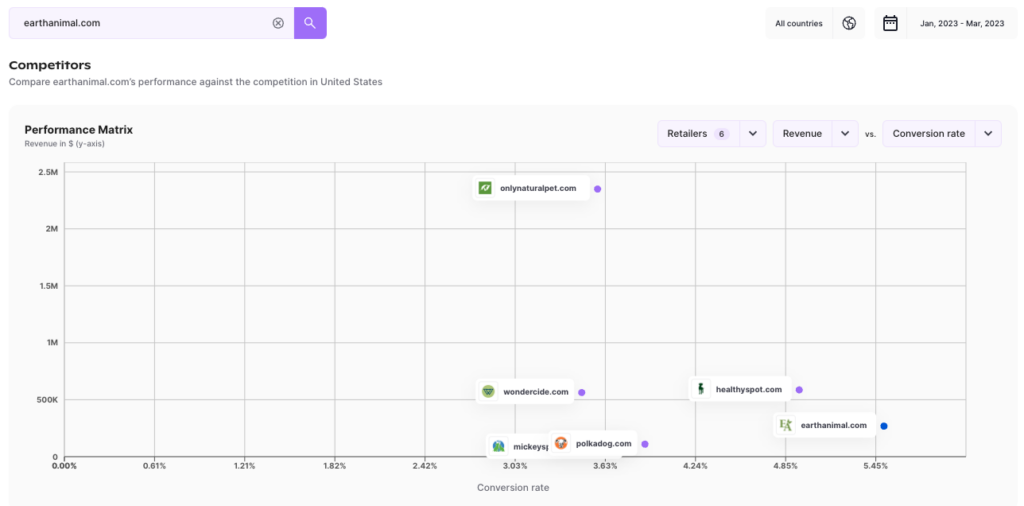

Another company that is putting sustainability front and center is Earth Animal (earthanimal.com) which makes all-natural pet foods, treats, remedies and supplements. The company, while a niche player with just $300,000 in e-commerce revenue during Q1 2023, converts 5.5 percent of visits into sales, higher than the category average and higher than their core comp set, which you can see in the chart from the Grips Competitive Intelligence tool below. Scoring a win like this is an indicator that the company is resonating with consumers and should be on the radar of companies who want to remain competitive.

Tech-Enabled Pet Care

Not since the release of Tamagotchi have pets been more tech-savvy. The integration of technology into traditionally low-tech products like collars and litter boxes is becoming increasingly common. Likewise, technology has added entirely new markets to the pet space, such as pet cams and even fitness trackers.

Companies like Litter Robot (litter-robot.com), which makes an automatic litter box, and PetSafe (petsafe.net), which specialized in customizable safety products, are two retailers offering a range of tech-enabled products that are designed to make pet care more efficient.

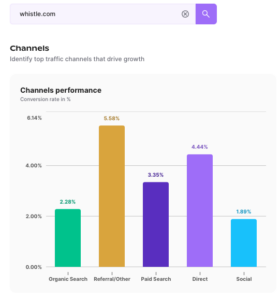

Whistle (whistle.com) is another tech-driven company that saw revenue increase by 49 percent year-over-year in Q1 2023 and by 34 percent in Q4 2022. The company manufactures smart collars to track the health and location of man’s best friend which retail between $69 and $149 and also require an annual subscription. The site performs best among visitors coming in via referral links. According to Grips, Referral traffic to whistle.com in the United States converts at 5.6 percent, on average, while less than 2 percent of traffic from Social results in a sale. Having a data-informed acquisition strategy that learns from the successes and mistakes of competitors will improve your chances of future success.

Subscription-Based Services

In recent years, the US Pets & Animals e-commerce market has seen a shift towards new business models and, in particular, the rise of subscription services. Subscription services have become increasingly popular, with a growing number of companies offering pet owners the convenience of regular deliveries of often-bulky food and supplies, eliminating the need for regular trips to offline stores. Subscription models have the added benefit of keeping pet owners within the retailer’s ecosystem where they can purchase everything from toys to food to grooming and even veterinary services.

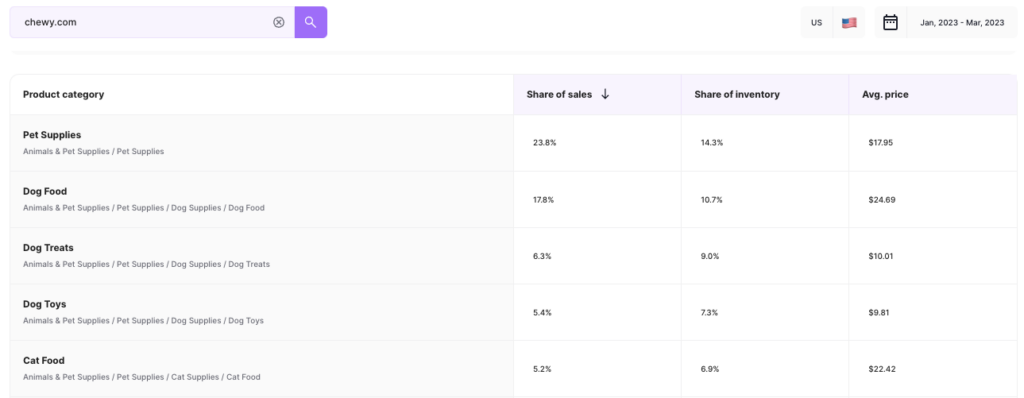

The alpha dog of the pet category, Chewy (chewy.com), recently reported that auto-ship sales represented over 70 percent of the pet retailer’s total net sales in Q4 2022. Grips data sheds further light on exactly what brings customers to Chewy in the first place. In Q1 2023, for example, nearly a quarter of Chewy.com’s revenue came from sales of Pet Supplies. Dog Food and Dog Treats accounted for the second and third greatest source of revenue with Cat Food ranking fifth. Among the top selling categories, Dog Food had the highest average price of nearly $25 pointing to its importance as a key revenue driver.

Source: Grips Intelligence | US | Q1 2023 | Devices: Mobile and Desktop

Health & Wellness Focus

One of the prevailing consumer trends in the US Pets & Animals category is the increasing emphasis on pet health and wellness. With many pet owners returning to the office and adjusting to post-pandemic routines, there is a growing awareness of the importance of maintaining their pets’ physical and mental well-being.

Many pet owners are experiencing concerns about their pets’ anxiety and overall happiness during their absence. As a result, they are seeking products and services that not only address the essential aspects of pet health but also provide solutions for anxiety relief and mental stimulation.

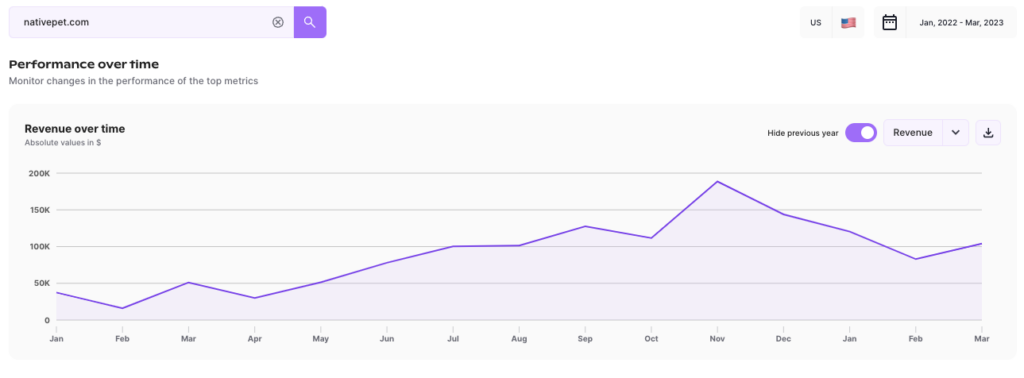

One such company catering to this growing consumer need is Native Pet (nativepet.com), which offers natural pet health supplements and remedies addressing issues from stress to bladder function. In the last year, Grips estimates that Native Pet increased e-commerce revenue in the United States by more than 500 percent. In doing so, it made our list of fastest movers in the Pets & Animals space. The fact that Native Pet serves the needs of pet owners from puppy to senior stage means bodes well for the continued success of this emerging brand.

Want to learn more about the Pets & Animals category in the United States, the best way is to register book a free demo. But you can also download our recent Pets & Animals benchmarking report which provides insights into the overall category performance in the United States, top brands, fast movers and the role that mobile plays in their e-commerce performance.