The invasion of Ukraine, which began on 24 February 2022 has changed millions of people’s lives for generations, and decimated the country’s economy overnight.

With an estimated 5 million people fleeing the country to other countries throughout Europe, the humanitarian cost is huge, and will continue having far-reaching impacts socially and economically, both in Ukraine and beyond its borders.

As the conflict continues, the economic cost to Ukraine is also substantial. The World Bank has predicted that the Ukrainian economy will shrink by an estimated 45.1% this year, as the war and displacement crisis restricts imports and exports and investment into the country.

But, the full extent of economic damage will depend on the length of the war. Even when the conflict is over, poverty and the displacement of citizens will continue to have lasting economic and social consequences, making a full economic recovery many years away.

The war has already caused half of Ukrainian businesses to shut down completely, while the other half are forced to operate well below capacity. As a result of supply chains disappearing overnight, millions fleeing the country and the continued uncertainty that war brings, household spending has seen a sharp downturn in the country, particularly in e-commerce.

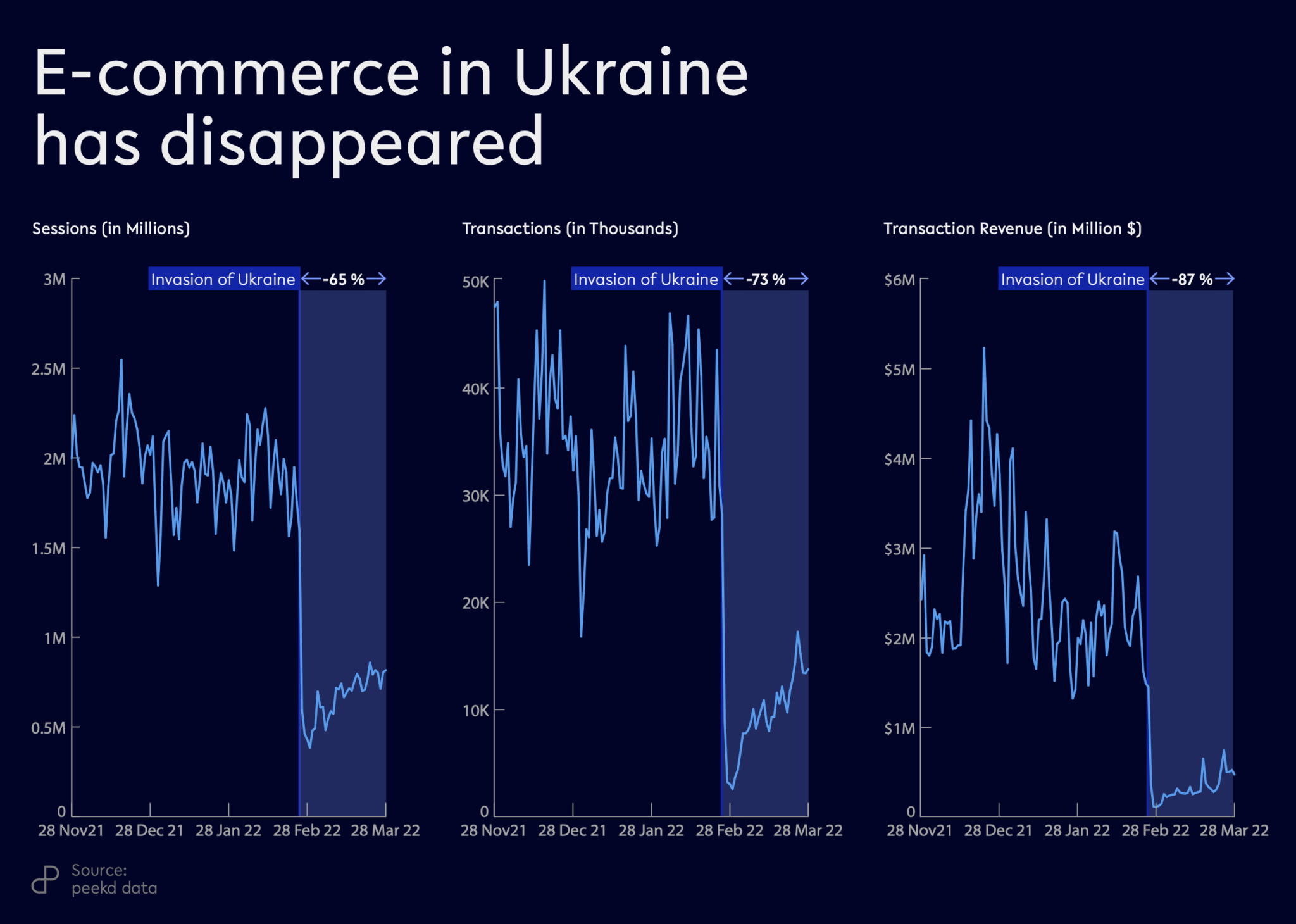

Our data shows that e-commerce in Ukraine has almost entirely disappeared. We monitored 3.5 million transactions in Ukraine over a 90-day period pre-invasion and one month post-invasion. We saw a decrease in e-commerce Sessions of 65%, Transactions falling by 73% and Revenues generated from digital sales collapsing by 87% across all categories.

Whilst there has been a slight increase in e-commerce Sessions, and some stability in certain industries. These are predominately for non-tangible digital services, such as entertainment, such as sports and streaming platforms, as buying tangible goods online is still extremely difficult or impossible, due to the collapse of supply chains.

In the immediate aftermath of the invasion, the Ukrainian economy went from one of relative prosperity, growing 3.8% in 2021 to a war economy. Overnight, demand for non-essential items almost ceased

to exist, with the citizens remaining in Ukraine focusing on visiting physical stores to buy essentials, such as food, gas and medicines, before potential shortages.

The shift to a war economy explains the collapse of e-commerce in Ukraine, coupled with internet

outages and the breakdown of supply chains, the tangible side of e-commerce will only recover once certainty has been restored.

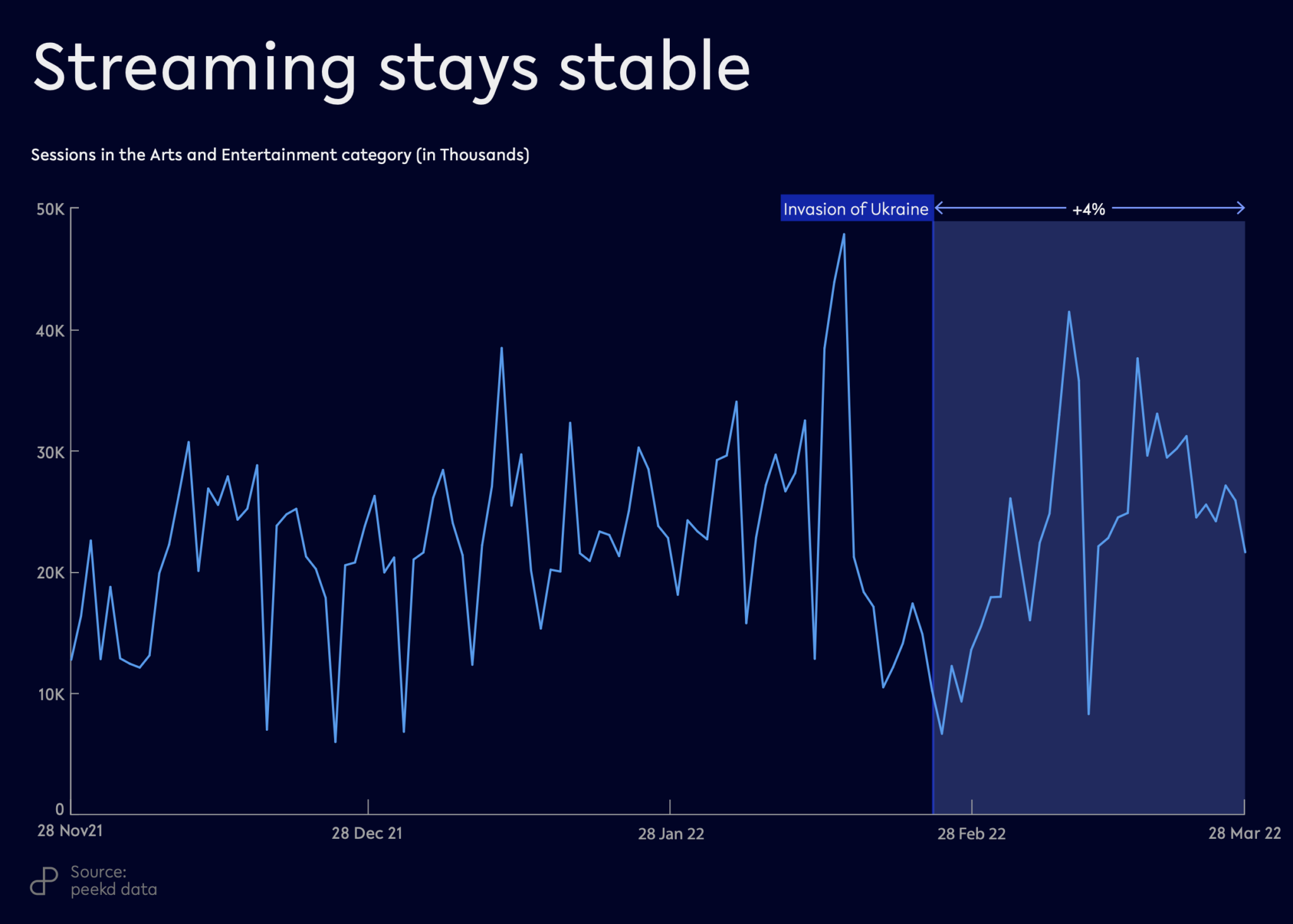

With e-commerce metrics dropping in nearly every industry during the time that we monitored transactions in Ukraine, there was one industry, where sessions actually grew (Arts & Entertainment), and a few categories where the drops in demand were less substantial than others.

Across our Sessions metric in Ukraine during the period that we monitored, we have seen a sustained or slightly less than average drop in demand for entertainment services.

In the Arts & Entertainment category, which includes TV, Movies and Streaming and Music, we saw the only increase in demand during the period of any e-commerce category in Ukraine, with Sessions growing by 4%.

After an initial drop in Sessions, we also saw some stabilization in demand in two other categories, which might be classified by some as entertainment – the Adult category, which includes adult-orientated content and the Sports category, which can include products with a more practical use, such as flashlights, backpacks and helmets.

Sessions for the Adult category saw a small decrease, but was ultimately the third highest industry in terms of Sessions that we monitored during this time. The Sports category saw an initial 56% drop in Sessions, but we saw demand stabilize after the initial drop, as the period we monitored continued.

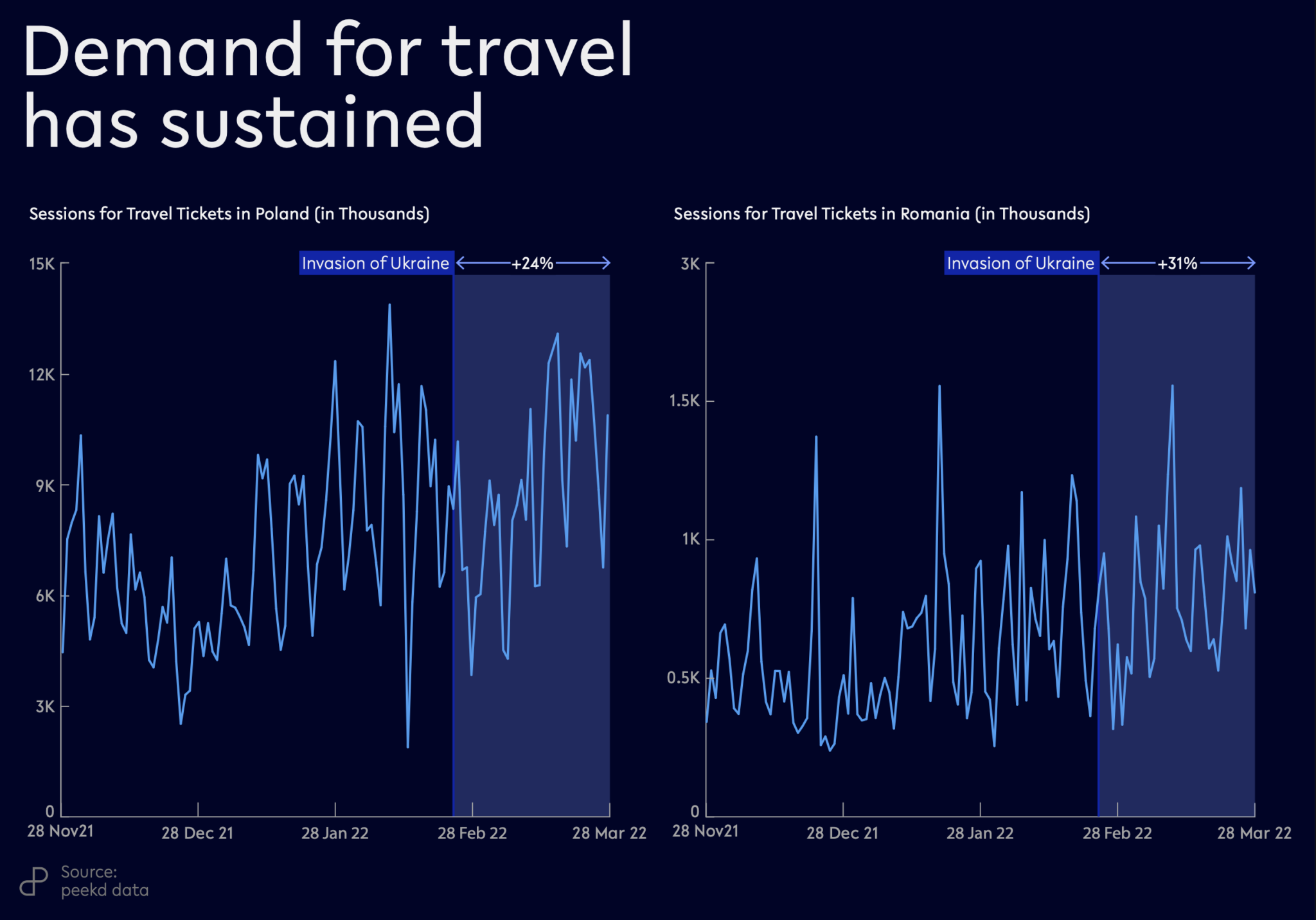

On the day that Russia began military action in Ukraine on the 24th of February, Ukraine closed its airspace to civilian flights. Despite this, Air Travel and Tickets have been two of the top three categories for the Transaction Revenue metric during the time period that we measured.

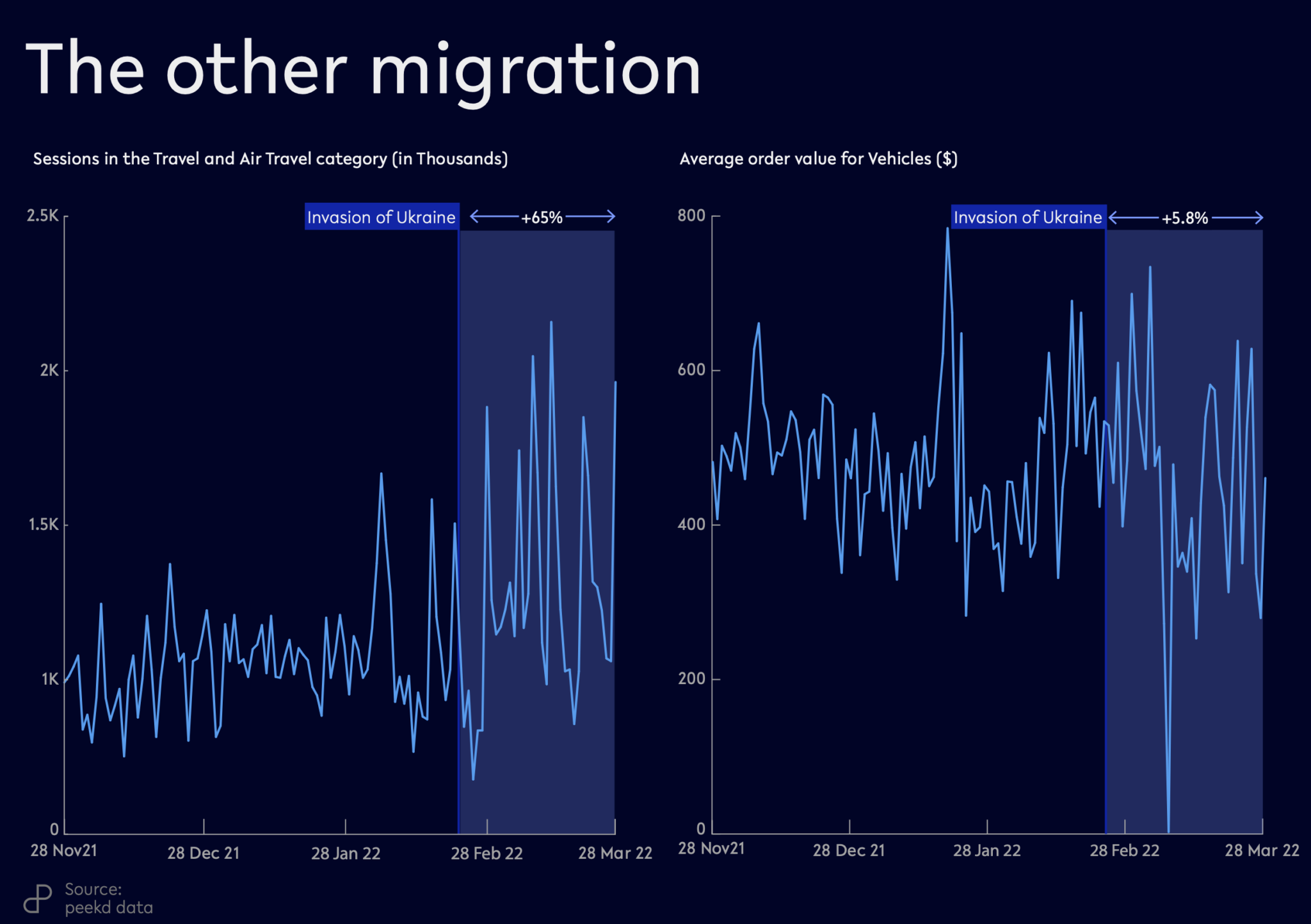

With more than 5 million Ukrainians fleeing the country, the reason for sustained demand 30 days later might be due to additional and onward journeys of those who fled the country.

If we look a bit further afield to bordering countries of Ukraine, notably Poland and Romania, we see data to support the above point, there was a clear rise in demand for Tickets and Travel. During the same period of when we monitored e-commerce data in Ukraine and Russia, we saw a 24% increase in Sessions for Tickets in Poland and a 31% increase in Sessions for Tickets in Romania.

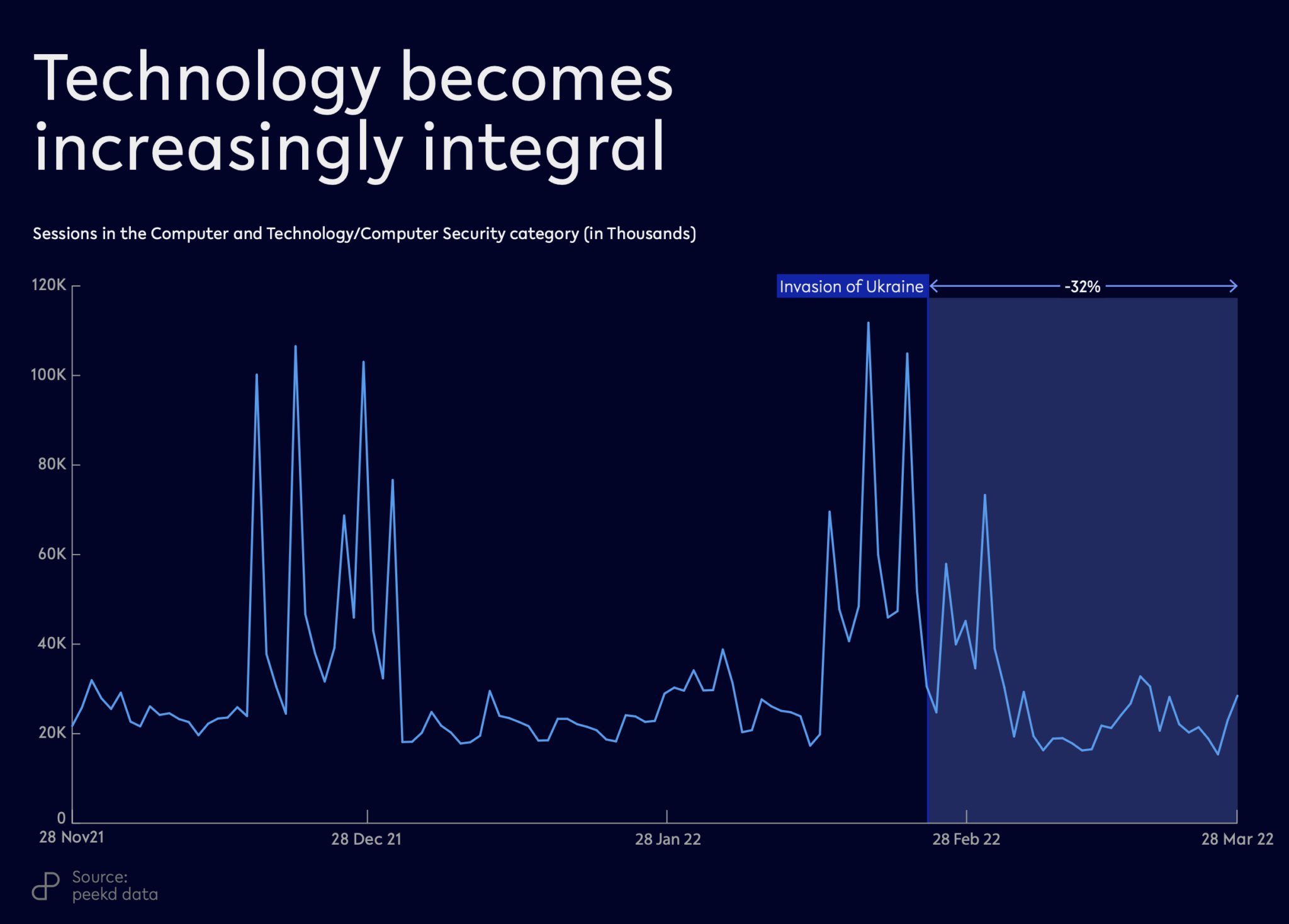

Despite the overall decrease trend in key e-commerce metrics, such as Sessions, Average Order Value and Transaction Revenue, there has been one area which has incurred a smaller percentage impact – the Computer and Electronic categories, which may be explained by consumers buying products, such as drones to support the Ukrainian army.

The categories, which include Computer Security, Web Hosting and Telecommunications decreased by 32%, a smaller drop when compared with the average.

With millions of Ukrainians fleeing the country, combined with frequent network outages, and the fear of cyberattacks, it has been imperative for the Ukrainians who have stayed behind to keep in touch with their family and friends, whilst also protecting their data. This may account for the lower than average drop for Computer and Electronic categories, with companies like Zoom, lifting their free 40 minute limit for Ukrainian citizens to make it unlimited.