In a down economy, dollar stores tend to perform better than average. And with most investors and economists still predicting the arrival of a recession, all eyes were on earnings reports for two of America’s biggest dollar stores: Dollar General and Dollar Tree. Investors hoping to see strong performances were disappointed as both companies underwhelmed market expectations, and stock prices plummeted as a result. On the day they announced Q1 earnings, Dollar Tree (DLTR) stock price dropped 12 percent and Dollar General (DG) fell 19 percent.

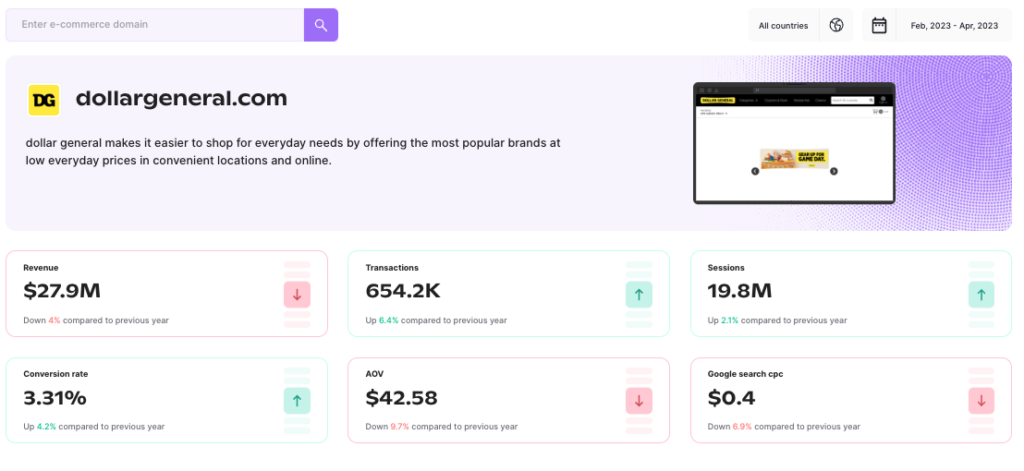

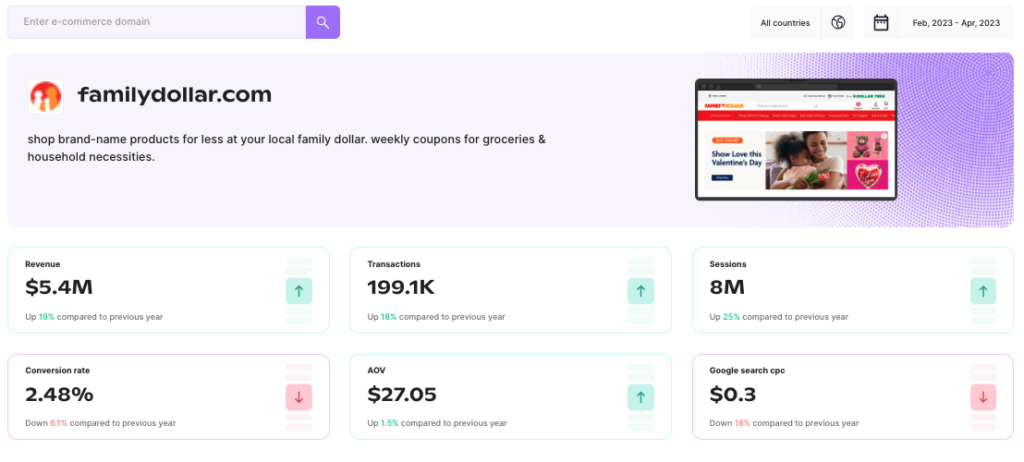

In the golden age of e-commerce these companies generate just pennies on the dollar from online sales. According to Grips, DollarGeneral.com generated an estimated $27.9 million in revenue across mobile and desktop devices during the three months ending April 2023 (the period aligned with their Q1 fiscal quarter) and FamilyDollar.com (owned by Dollar Tree) generated just $5.4 million in e-commerce sales. As a share of publicly reported sales, those revenues equate to less than half of one percent of total sales. By comparison, Grips estimates that Kohl’s receives roughly a quarter of their total sales from e-commerce.

Source: Grips Intelligence

So could e-commerce help improve dollar stores’ performance? Short answer: Yes…but. There’s a reason why dollar stores don’t generally generate a lot in e-commerce sales. Operating on thin profit margins, shipping and fulfillment costs may actually result in online sales that are a net drain on profit rather than a gain. Similarly, many consumers really enjoy the treasure hunt experience that they get when shopping at dollar stores. But like it or not, dollar stores are increasingly facing competition from sites like Target, Kohl’s and many others who are leaning into and promoting cheap finds both in-store and through their robust e-commerce platforms. That leaves Dollar General, Dollar Tree and similar companies little choice but to find a way to better embrace e-commerce.

What does the data say?

Let’s take a look at how these companies are performing today. Grips data shows that during FY Q1, DollarGeneral.com sales fell by a relative four percent year-over-year, a loss of $1.1 million in revenue. In the company’s Q1 report, Dollar General reported that same-store sales increased by 1.6 percent meaning that DollarGeneral.com is under performing relative to their same-store average and contributing a smaller share to overall sales than last year. At the same time, FamilyDollar.com sales rose by 19 percent year-over-year, an increase of $873,000. Family Dollar same-store sales grew by 6.6 percent, according to their quarterly report. So Family Dollar is not only seeing better growth than their chief competitor overall, their e-commerce performance is also outperforming their bricks and mortar growth while the opposite is true for Dollar General.

Source: Grips Intelligence

Furthermore, looking at each company’s ad spend reveals that Family Dollar is taking a more aggressive stance to drive visits. Grips data shows that Family Dollar outspent Dollar General by a margin of more than two-to-one on Google Paid Search (excluding PLAs) during FY Q1. Specifically, Family Dollar spent $71,200 versus Dollar General’s $27,800. Family Dollar also had a lower cost per click than Dollar General during the quarter ($0.30 versus $0.40).

That said, Dollar General still posts better site performance than Family Dollar on a number of key metrics. For starters, Grips reports that DollarGeneral.com posted a 3.3 percent conversion rate during FY Q1, about 30 percent better than Family Dollar which converted 2.5 percent of visits into transactions. Additionally, Dollar General saw its conversion rate increase by 13 basis points year-over-year while Family Dollar’s conversion rate fell by 16 basis points.

Not only does Dollar General do a better job ushering visitors to the digital checkout, the average order value (AOV) of purchases made on DollarGeneral.com was 57 percent higher than those made on FamilyDollar.com. Specifically, Dollar General posted an AOV of $42.58 versus Family Dollar’s $27.05 during Q1. But on this metric, the gap is closing. Year-over-year, Dollar General saw AOV decline by 9.7 percent or $4.60. Meanwhile, Family Dollar’s AOV increased 1.5 percent or $0.40. It’s not much, but it’s movement in the right direction.

Mobile is everything for dollar stores

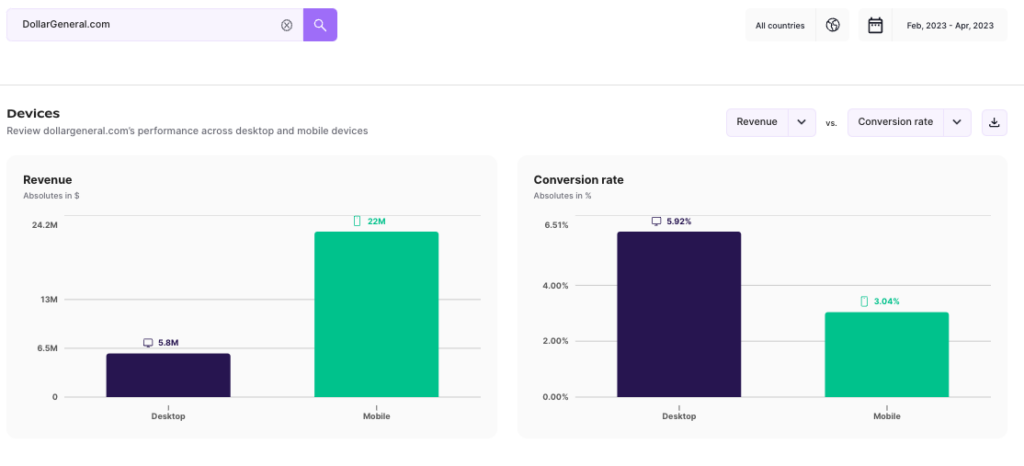

Both Dollar General and Family Dollar get a super majority of online traffic from mobile devices. In fact, roughly 90 percent of visits to both DollarGeneral.com and FamilyDollar.com come from mobile devices. Even though mobile conversion rates are nearly 50 percent lower than those on desktops (3.0 percent versus 5.9 percent on DollarGeneral.com and 2.3 percent versus 4.2 percent on FamilyDollar.com), both sites receive a majority of their e-commerce revenue from mobile phones and tablets. Grips estimates that 79 percent of e-commerce revenue for both Dollar General and Family Tree come from mobile transactions.

Source: Grips Intelligence

Both companies use their mobile sites to drive downloads of their mobile apps, but they serve different purposes. Dollar General, for example, forces customers to use their app if they want to take advantage of their order online/pick-up in-store service. Meanwhile, Family Dollar’s app does not include an e-commerce option. Rather, it’s focused on finding and clipping coupons that can only be redeemed in-store.

An important side note is that socio-economic factors are the likeliest driver of these high mobile rates. Households without computers, which are common among those on the lower income and education continuum, are more dependent on their phones for online activities, including shopping. But Dollar General and Family Dollar can serve as a guide for the future of all e-commerce sites, even those with more affluent customers, as the share of visits and conversions migrate to mobile across the board.

What are dollar store customers buying online?

Both Dollar General and Family Dollar have implemented tactics that intentionally make online purchases more difficult for consumers. Dollar General, for instance, offers a very limited array of products that consumers can buy online, preferring to show the in-store availability for many items rather than allowing them to add them to their cart. Additionally, Dollar General requires would-be buyers to provide their mobile number and then enter a confirmation code before they can complete an online purchase. Family Dollar makes more items available for purchase online, but requires consumers to buy multiples of many items raising the cost of each item. These tactics may be smart in ensuring that online sales are more profitable, but they send a clear message to consumers that their online business is less important.

After jumping through all these hoops, what exactly are customers buying from these companies online? Grips can shed some light, leveraging our Competitive Intelligence platform.

- Medical Tests: Products in the Medical Tests category, which includes pregnancy tests, are among the best sellers on both sites.

- Appliances: Small Kitchen Appliances rank high on both sites.

- Medicine & Drugs: Dollar General, which has its own private label health care line, counts Medicine & Drugs amongst its top revenue-generating categories. This category ranks considerably lower for Family Dollar.

- Seasonal Items: Family Dollar does better than Dollar General among seasonal items. During FY Q1 Grips found that Toys & Games, Outdoor Grills, Swimming Pools and Pesticides were some of the top performing categories.

Conclusion

So, can these two dollar stores make the change required and use e-commerce to help them grow? Almost certainly. The alternative is painting themselves into a bricks and mortar corner ultimately solidifying their position as a niche category. Currency economic factors may also make e-commerce more attractive for consumer experience. With a tight labor market increasingly resulting in unstocked shelves, long lines and other negative in-store experiences, e-commerce will provide dollar stores with a way to continue to deliver value to loyal customers from the comfort of their home–or anywhere else given their mobile dominance.

Grips can provide e-commerce managers with unrivalled competitive insights to allow them to build and refine a data-driven strategy. Ready to learn more? Book a free demo today and start gaining market share tomorrow.