Amazon may own the rights to the “Big Deal Days” name, but Kohl’s owned the event. With an astounding 47% week-over-week increase in transactions on day one of the two-day event and a 62% increase on day two, Kohl’s saw, by far, the greatest boost in sales during Big Deal Days among top US retailers.

Not content playing by Amazon’s rules, Kohl’s saw Amazon’s two-day event and countered with their own three-day “Deal Dash” promotion which ran from October 9th through 11th and featured “incredible deals on thousands of items across holiday-favorite categories including toys, tech, kitchen appliances, decor, apparel, and more.” This gave Kohl’s a one-day head start on Amazon whose transactions on the 9th were flat compared with the Monday prior. Meanwhile, Kohls.com transactions increased by a relative 24% over the previous week and then rose dramatically with each subsequent sale day, an indication that shoppers liked what they saw and kept coming back for more.

In addition to the success enjoyed during the Deal Dash promotion, expect to see Kohl’s post another spike in sales around the 20th of the month as shoppers race to redeem the Kohl’s Cash they earned during the Deal Dash, which are deemable between October 16th and 22nd. In the past when the retailer offered Kohl’s Cash during other sales events, Grips observed a comparable spike in transactions toward the end of the redemption period. This essentially stacks a bonus sale on the Deal Dash resulting in a multiplying effect for Kohl’s already enormous success.

Lesson: Don’t let your competitor set the rules

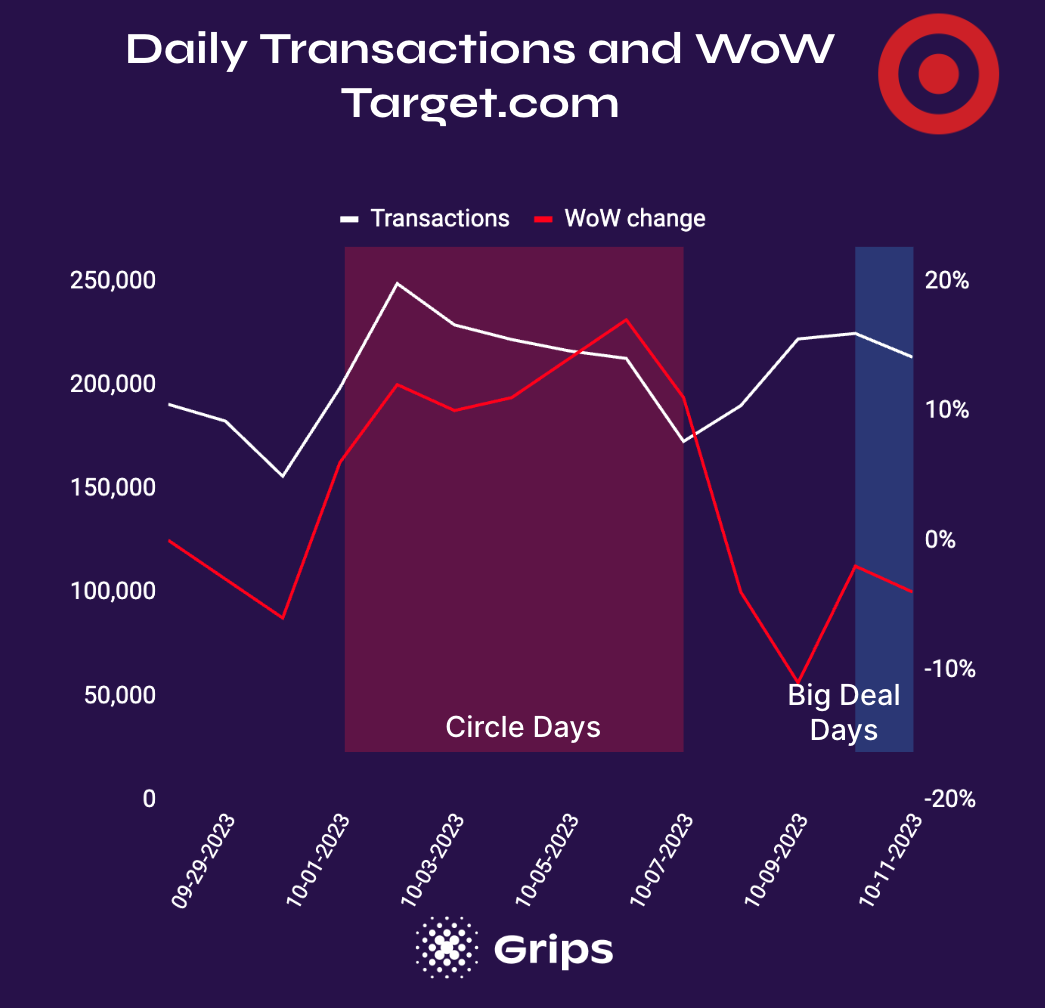

To fully appreciate Target’s success, we need to look at the 14 days ending October 11th (including the full Circle Week sale and Big Deal Days). Doing so reveals that Target.com saw transactions increase a full six percent over the two weeks prior making them one of Big Deal Days’ biggest winners. Only Kohl’s (+13%) saw a bigger increase in sales during this same period. Meanwhile Amazon (+3%), Walmart (+4%), Best Buy (+5%) and Macy’s (+1%) saw a smaller increase. Furthermore, most of their competitor’s gains were concentrated during the narrow two-day sale window. Interestingly, Wayfair actually saw overall transactions decline by 1% compared to the period before Big Deal Days.

To fully appreciate Target’s success, we need to look at the 14 days ending October 11th (including the full Circle Week sale and Big Deal Days). Doing so reveals that Target.com saw transactions increase a full six percent over the two weeks prior making them one of Big Deal Days’ biggest winners. Only Kohl’s (+13%) saw a bigger increase in sales during this same period. Meanwhile Amazon (+3%), Walmart (+4%), Best Buy (+5%) and Macy’s (+1%) saw a smaller increase. Furthermore, most of their competitor’s gains were concentrated during the narrow two-day sale window. Interestingly, Wayfair actually saw overall transactions decline by 1% compared to the period before Big Deal Days.