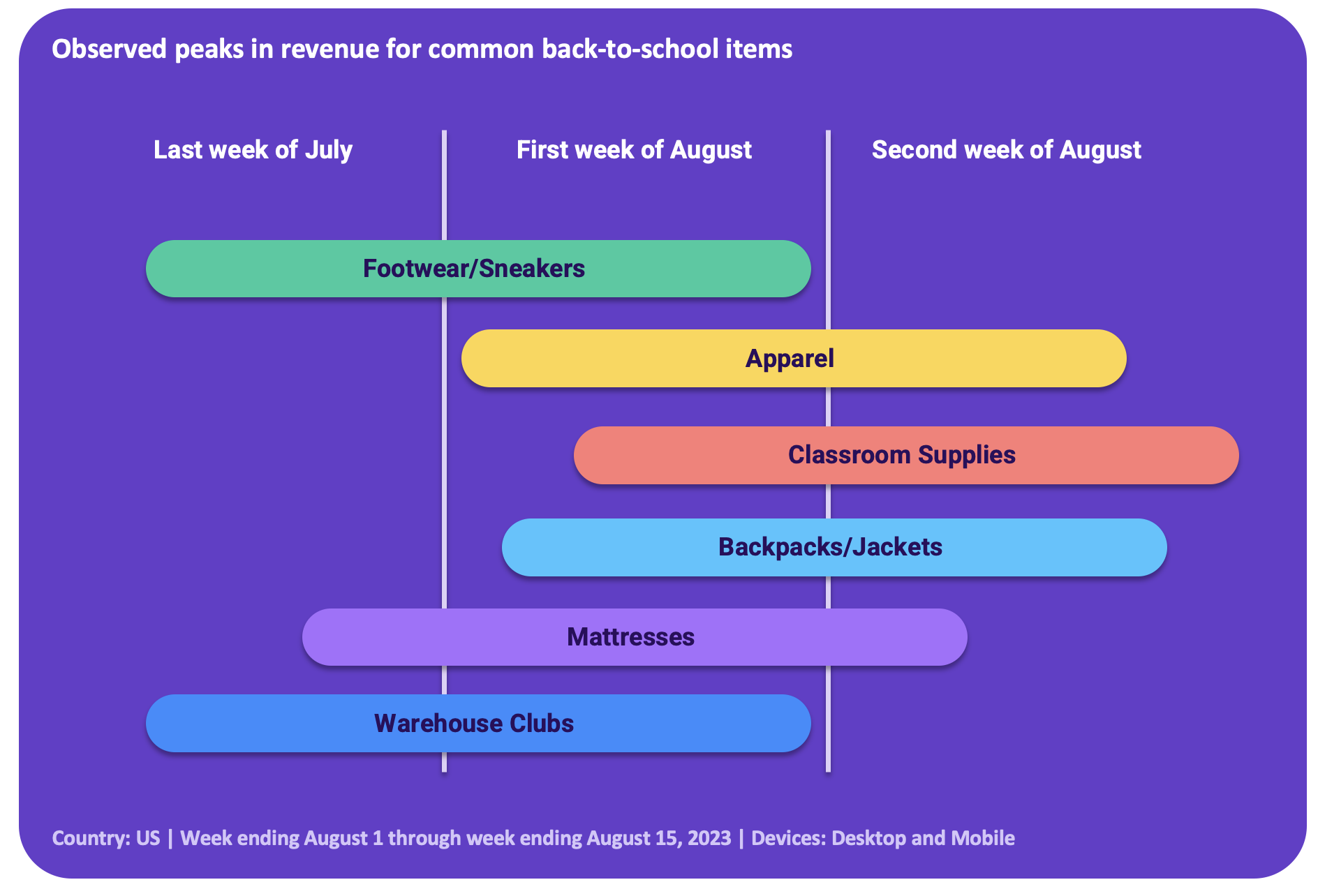

Millions of kids and teens across the United States have already returned to school while millions more count the dwindling days of summer. The drawn out back-to-school season means that back-to-school shopping also spans multiple weeks, if not months making it complicated for retailers seeking to optimize promotions.

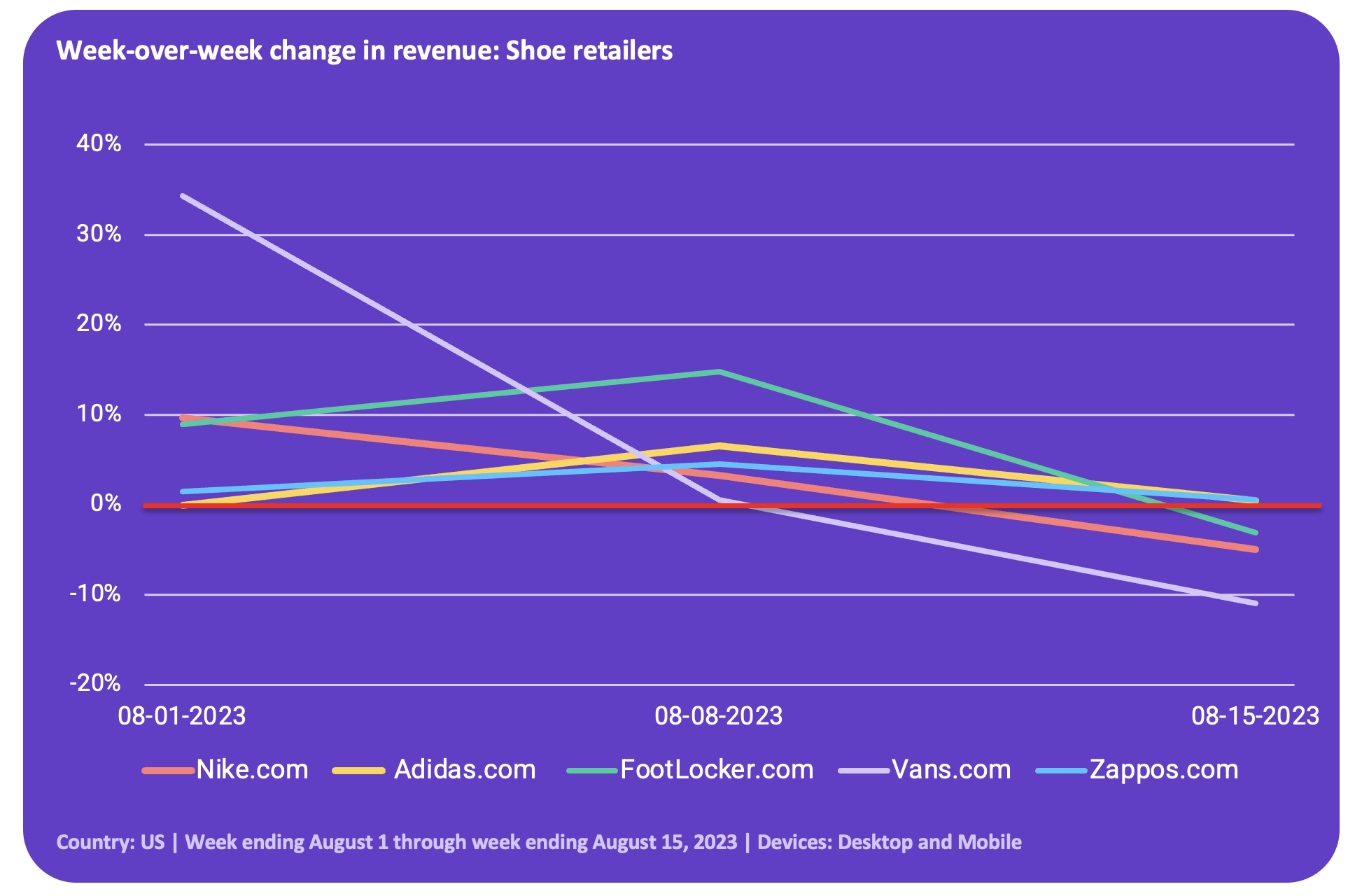

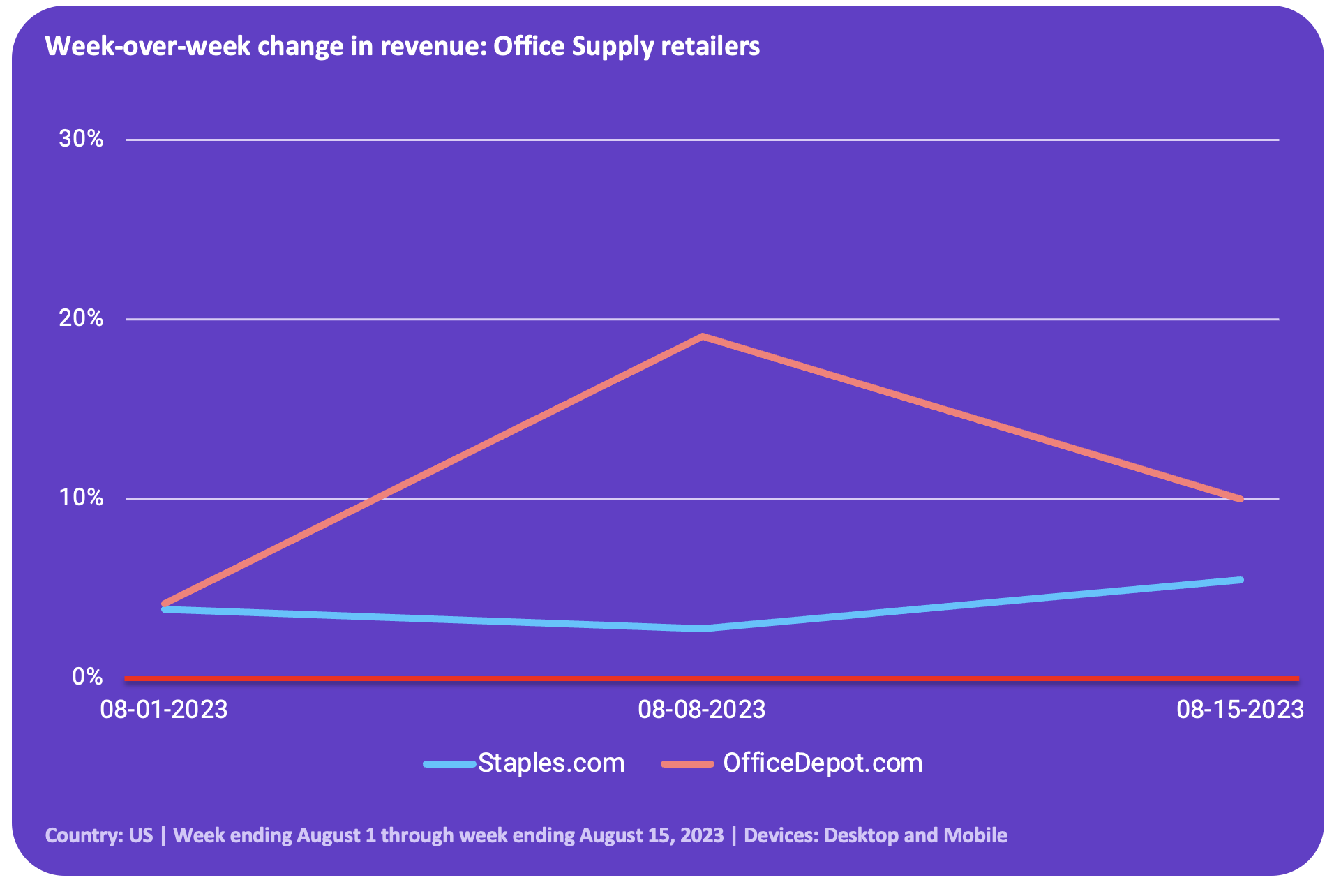

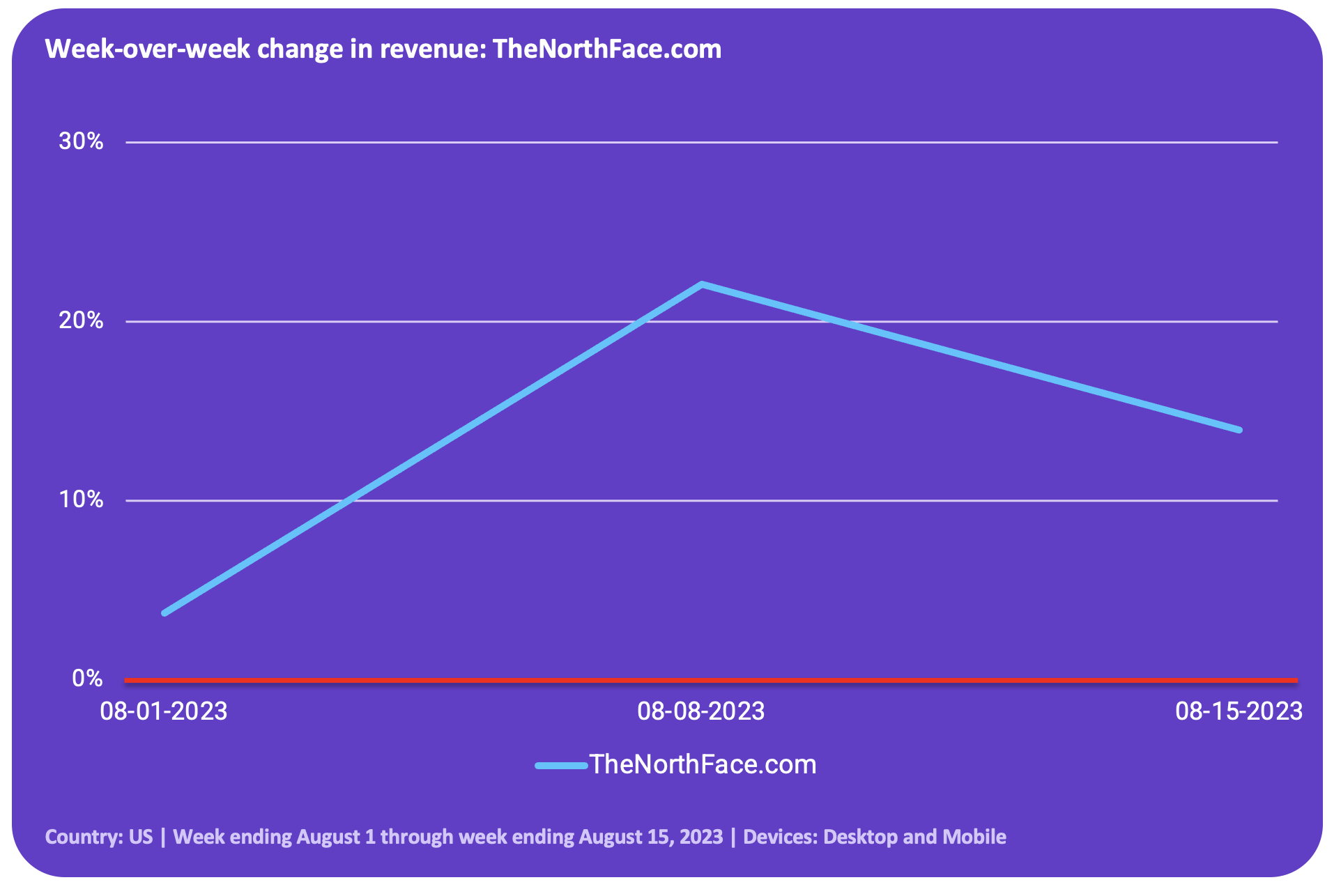

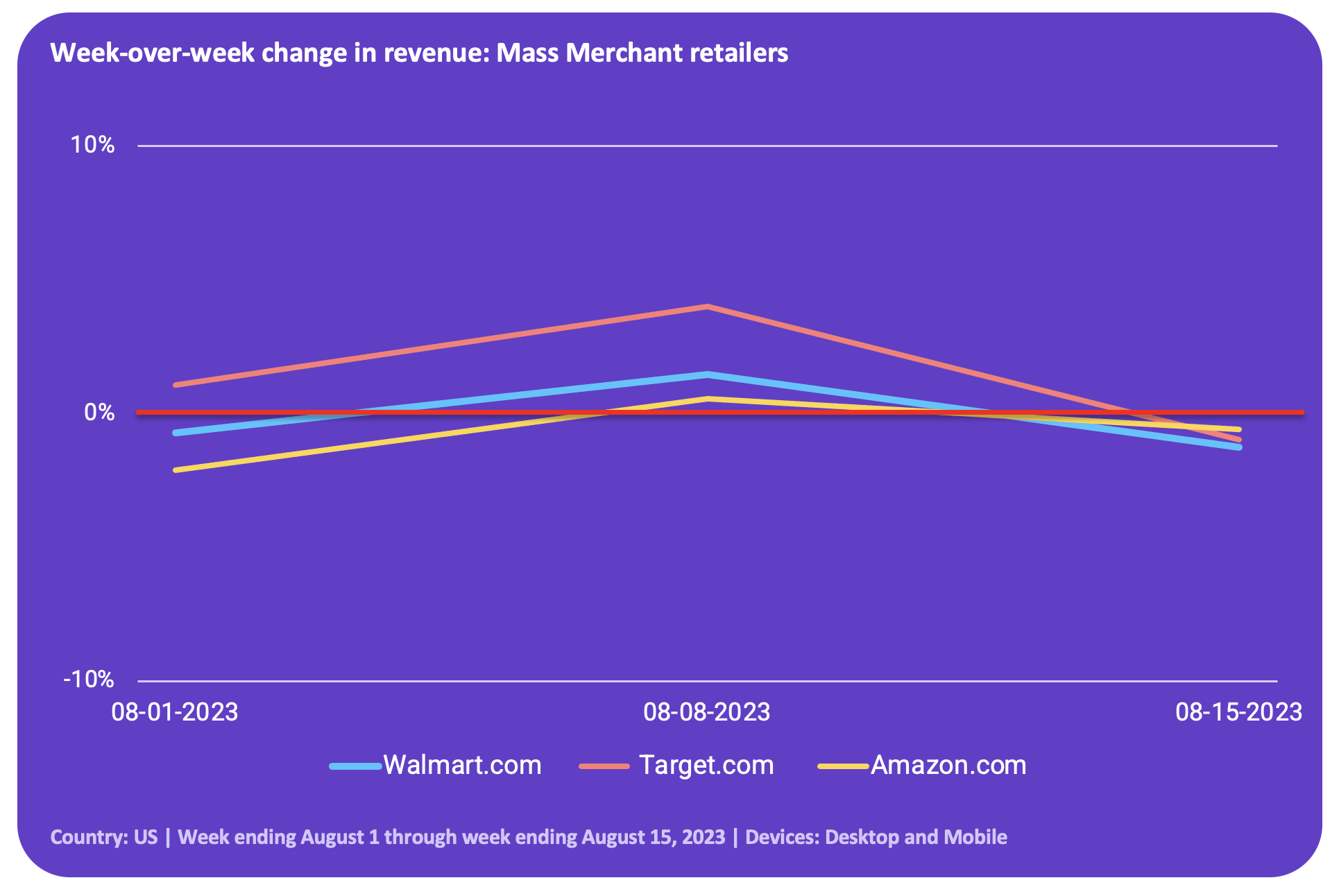

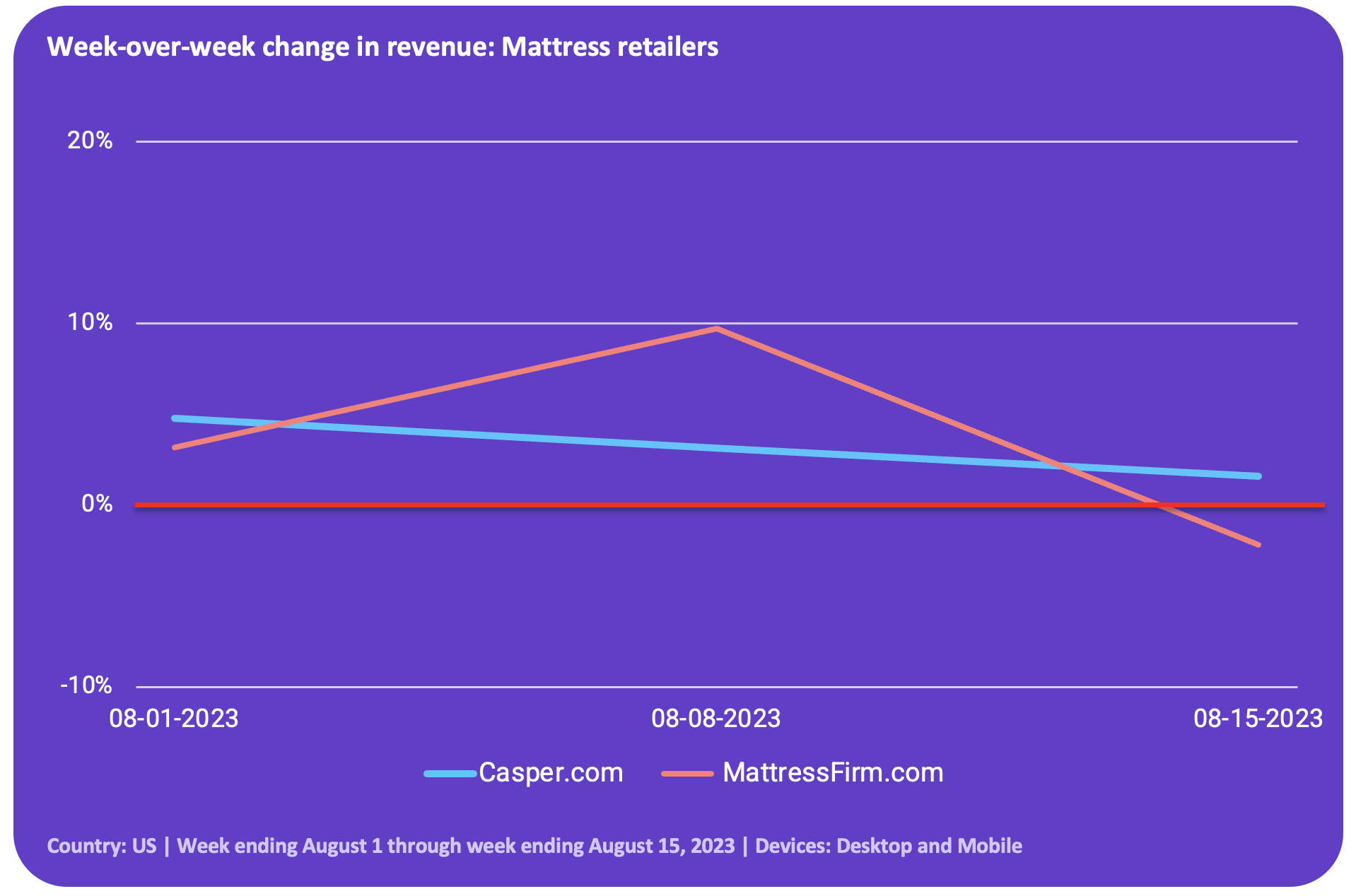

Grips analyzed our daily revenue metrics for several of the top US e-commerce retailers to better understand the week-by-week priorities of back-to-school shoppers in order to help retailers and brands benchmark their seasonal performance this year and inform their plans for the 2024 season.