As e-commerce continues to revolutionize the way we shop, the Automotive & Vehicle industry in the United States is not far behind. With the emergence of new trends and technological advancements, the landscape of online automotive shopping is evolving rapidly. In this blog post, we will explore three key trends that are shaping the industry in 2023, and highlight US businesses that are leading the way in embracing each trend.

Data shown is taken directly from the Grips Competitive Intelligence platform. When you’re ready to gain similar insights into the e-commerce performance of the competitors of your choice (and Grips reports on over 1,000 Vehicle & Automotive sites in the United States alone), create your free account and you’ll get immediate access, so you can start making data-driven business decisions right away.

Growing interest in performance upgrades

Performance upgrades for vehicles have always been popular, but there has been a recent surge in demand for these products among enthusiasts. Products such as aftermarket exhaust systems, air intakes and performance chips are in high demand as consumers look to boost their vehicle’s performance.

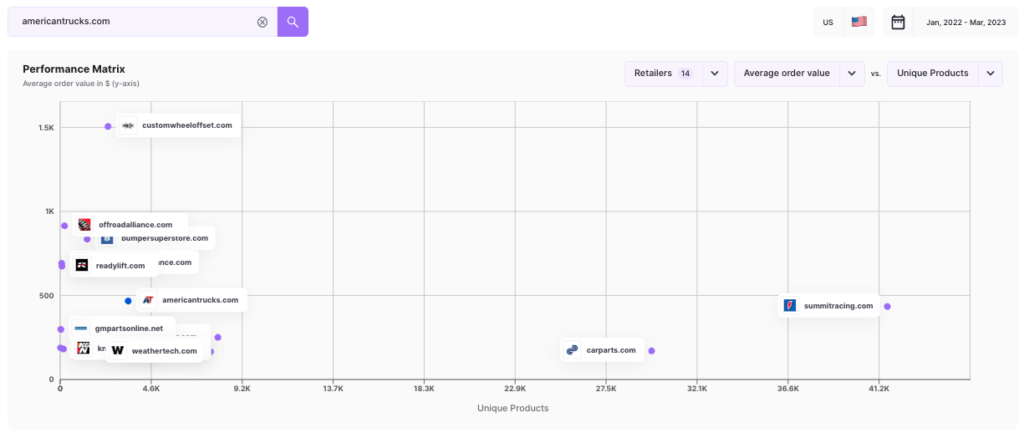

While there are retailers that look to offer every type of vehicle part under the sun, most focus on a more narrow segment, whether it’s a type of part or a type of vehicle. The chart below illustrates this by plotting some of the top parts vendors by the number of unique products they carry. SummitRacing.com lists over 40,000 different parts online and Carparts.com lists over 25,000. However, most sites, including AmericanTrucks.com, carry fewer than 10,000 unique products allowing them to focus on delivering high quality parts and expertise for a discerning clientele. Further, many of the sites that carry fewer items enjoy a higher average order value than those that try to cater to every need.

Rising interest in off-road and outdoor adventure

The pandemic has spurred a growing interest in outdoor activities such as camping, hiking and off-roading. This trend has led to increased demand for outdoor adventure products and accessories that cater to the needs of adventurous vehicle owners.

Quadratec (quadratec.com) is an online retailer specializing in Jeep and off-road accessories. Grips estimates that the site generated $104 million in revenue in the United States in 2022. The site offers a wide range of products, including roof racks, camping gear and off-road equipment, catering to outdoor enthusiasts and off-road adventurers.

Grips data can pinpoint which of those product categories are contributing the most to the company’s bottom line. Between April 2022 and March 2023, Grips shows that Tires represented just over a quarter of their e-commerce revenue with that share rising to roughly a third during the peak months of October and February when consumers typically look to change tires. Rims and Wheels accounted for the second greatest share of revenue in the last year, but this category contracts notably during colder months.

Understanding the source of revenue and seasonal shifts of your competition will help you stay ahead ensuring you’re stocking and promoting the right items at the right time of year to maintain and even grow market share.

Integration of augmented reality

Augmented Reality (AR) technology is revolutionizing the way customers interact with automotive products online. It allows customers to virtually view and interact with 3D images of products, visualize how they would look on their vehicles and even take virtual test drives. With specialty auto parts especially tricky, consumers want to make sure they are ordering a part that they know will fit.

CJ Pony Parts (cjponyparts.com), which generated nearly $17 million in e-commerce revenue in the United States during Q1, is an online retailer specializing in automotive parts and accessories with a particular focus on Ford Mustangs. Partnering with leading manufacturers is one way that CJ Pony Parts ensures that customers have access to top-notch parts that meet their performance and quality standards. To take this to the next level, the site also has enabled 3D/AR views of nearly 2,000 products on the site giving consumers the ability to view a product from all angles.

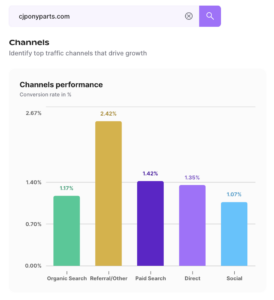

Dealing with such discerning customers means that many don’t go on to convert. In fact, Grips shows that only 1.2 percent of visits to CJPonyParts.com results in a sale. But traffic from referrals converts nearly twice the average rate. To boost overall conversion rates and, by extension, revenue, the site should focus on building out an even more robust network of affiliate parters to drive traffic and sales.

Want to learn more about the Automotive & Vehicles category in the United States, the best way is to register for your free Competitive Intelligence account. But you can also download our recent Automotive & Vehicles benchmarking report which provides insights into the overall category performance in the United States, top brands, fast movers and the role that mobile plays in their e-commerce performance.