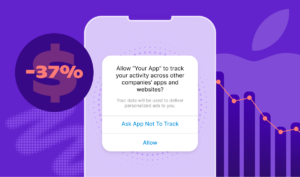

Apple’s ATT, introduced in 2021, marked a significant shift in the digital advertising landscape. The policy requires apps to obtain explicit permission from users before tracking their activities across other apps and websites. This change aimed to enhance user privacy by limiting the amount of third-party data accessible for targeted advertising. Companies dependant on Meta advertising or iOS users experienced a 37% drop in firm-wide revenue, highlighting the critical need for businesses to understand its impact.

The study reveals a significant decline in the performance of conversion-optimized Meta advertisements. These ads, which have traditionally relied heavily on third-party data for targeting and measurement, experienced a 37% reduction in click-through rates compared to click-optimized campaigns following the implementation of ATT. This decline underscores the critical role that third-party data played in the effectiveness of digital advertising. Without this data, advertisers face substantial challenges in reaching their target audiences with relevant ads, which in turn affects the overall success of their marketing campaigns.

Despite attempts to mitigate these effects, such as reallocating budgets from Meta to Google ads, the overall ad effectiveness did not recover over time. This further emphasizes the lasting impact of ATT on digital advertising strategies. The research highlights the necessity for businesses to adapt to this new landscape by exploring alternative advertising channels and optimizing the use of first-party data to maintain their marketing effectiveness.