According to a new benchmarking report from Grips, consumers in the United States purchased more jewelry online in Q4 2022 than they did a year prior.

But, despite transactions increasing in the category, US consumers spent less per order in 2022, causing a knock-on effect on the revenue performance of Jewelry and Luxury Products e-commerce retailers.

Grips data showed a noticeable drop in e-commerce revenue in 2022 generating $2.5 billion in the US, down from $2.6 billion in 2021, perhaps reflecting the need for brands and retailers to offer more affordable jewelry to consumers.

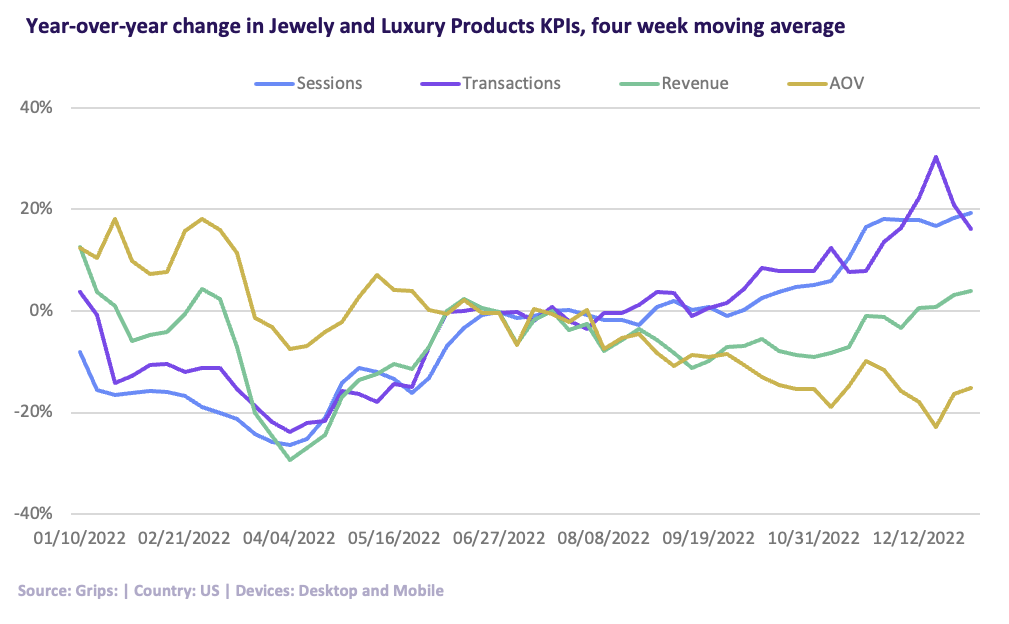

In the chart below, we can see that the category had a tumultuous year in 2022. Each metric that we tracked (sessions, transactions, revenue and average order value) has seen positive and negative trends throughout the year. But, as the year progressed and as consumers tightened their budgets, average order values began to fall ultimately crossing into negative territory in the summer months.

With average order values down, transactions started to rise. Revenue figures struggled to post Year over Year gains for most of the year, but returned to growth in November.

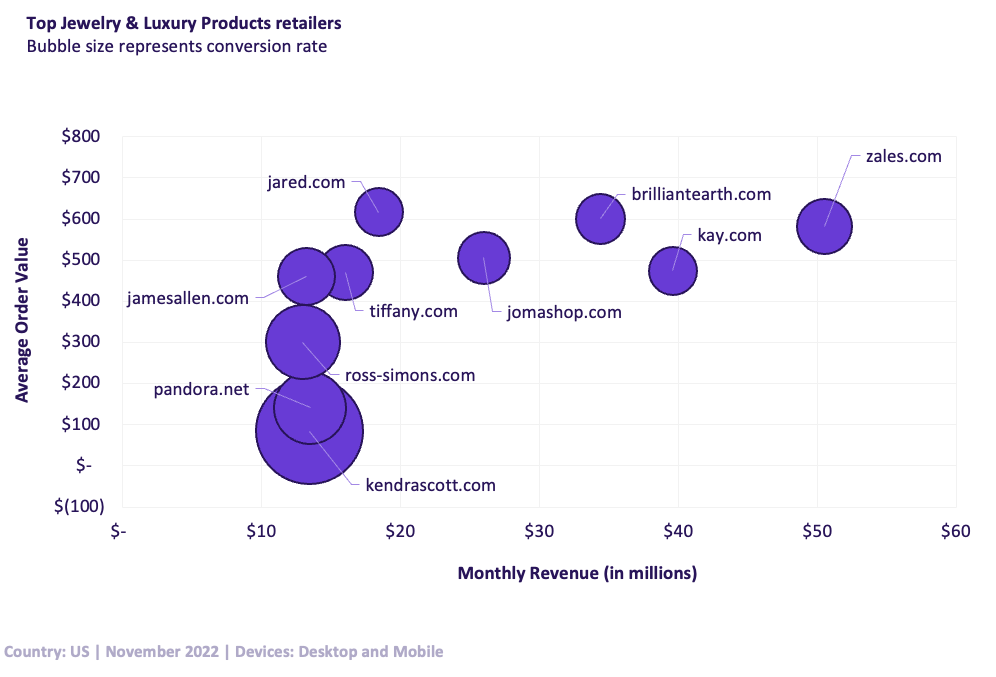

While the holiday season was good for Jewelry and Luxury Products overall, retailers like Kendra Scott and Pandora posted lower AOVs, but saw higher-than-average conversion rates and strong revenue growth during the holiday peak, surpassing the category average.

In fact, between October and November, Kendra Scott’s e-commerce revenue grew to 13.4 million nearly doubling its share of category revenue.

Retailers will need to continue to strike a balance between price and value to ensure continued growth in 2023, but having access to competitive insight tools like Grips will help stay on top of the competition.

To learn more about top retailers, the best marketing channels generating revenue and transactions, ad spend and key audiences in the Jewelry and Luxury Products category, download our latest free benchmarking report.