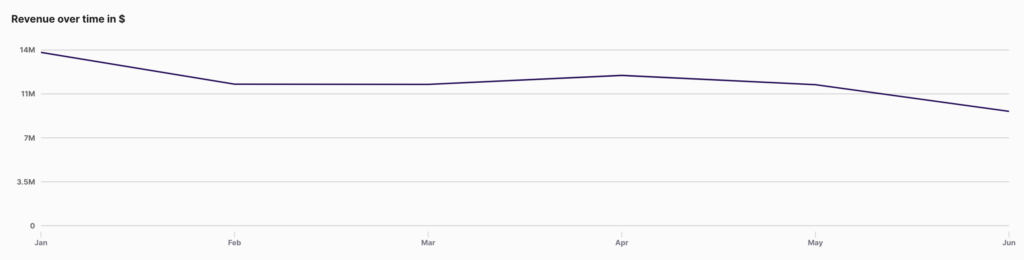

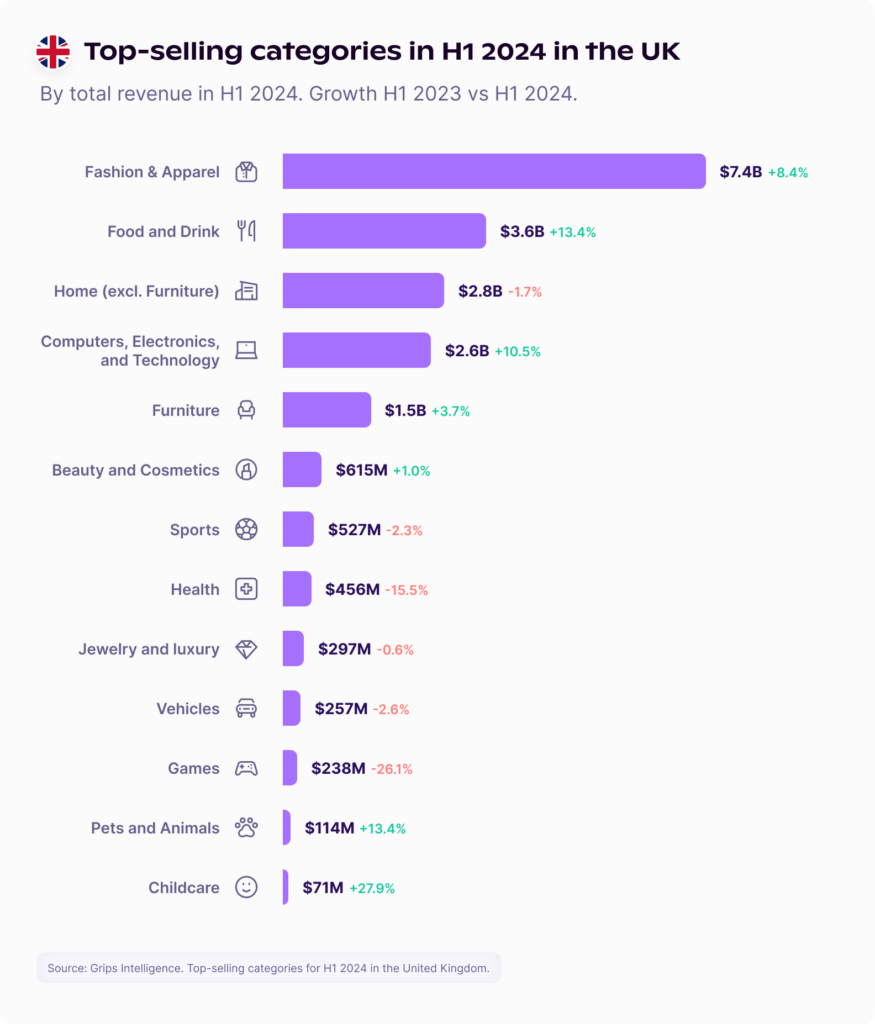

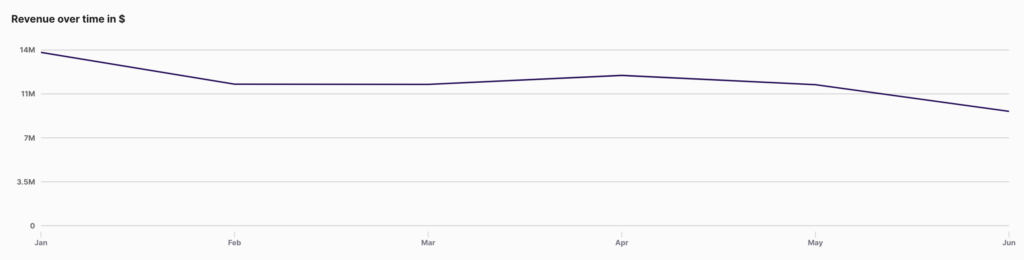

Fashion and Apparel

Fashion and Apparel in the UK experienced a healthy growth of 8.41%, with revenues rising from $6.8 billion in H1 2023 to $7.4 billion in H1 2024. This increase underscores the ongoing consumer demand for online fashion shopping, driven by a combination of trends and convenience. E-commerce businesses should leverage this momentum by offering personalized shopping experiences, sustainable fashion options, and exclusive online collections to keep the category thriving.

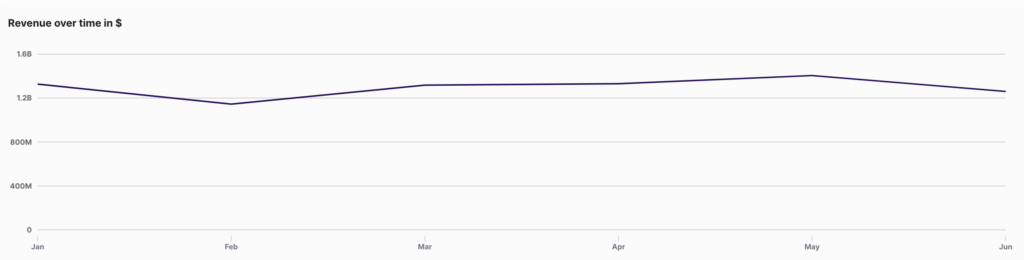

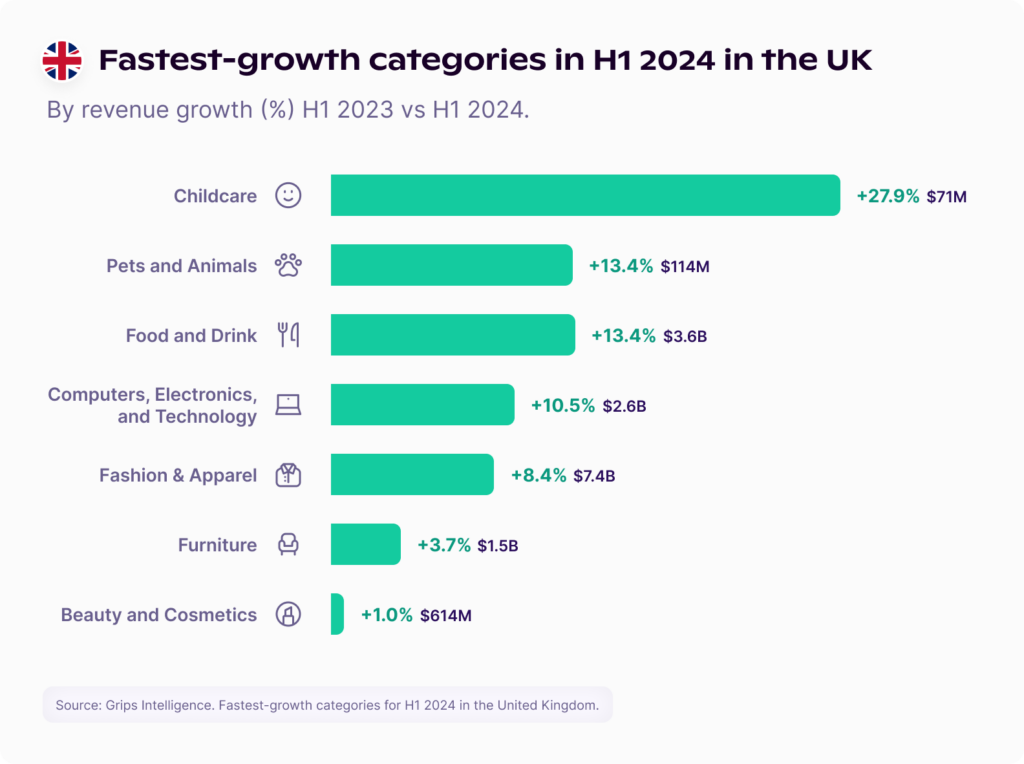

Food and Drink

The Food and Drink category saw a robust growth of 13.35%, increasing from $3.2 billion in H1 2023 to $3.6 billion in H1 2024. This surge reflects the rising consumer preference for online grocery shopping and meal delivery services. To capitalize on this trend, retailers should focus on expanding their product range, offering more specialty and gourmet items, and optimizing their logistics for faster, more efficient deliveries.

Home (excluding Furniture)

Home and Garden (minus Furniture) experienced a slight decline of 1.73%, with revenues falling from $2.9 billion in H1 2023 to $2.8 billion in H1 2024. The category’s small dip might be due to market saturation or a shift in consumer spending priorities. Retailers can counter this trend by promoting seasonal home improvement projects, expanding into eco-friendly products, and offering targeted promotions that appeal to DIY enthusiasts.

Computers, Electronics, and Technology

The Computers, Electronics, and Technology category in the UK showed a strong growth of 10.45%, with revenues climbing from $2.3 billion in H1 2023 to $2.6 billion in H1 2024. This growth indicates a sustained demand for tech products, particularly as more consumers invest in home office setups and smart technology. E-commerce leaders should continue to innovate by introducing new tech products, bundling popular items, and enhancing customer service to retain and attract customers.

Furniture

The Furniture category saw a modest growth of 3.68%, with revenues increasing from $1.4 billion in H1 2023 to $1.5 billion in H1 2024. This growth suggests that consumers are still investing in home comfort and personalization, despite economic pressures. Retailers should emphasize customizable furniture options, sustainable materials, and home design trends to maintain this positive trajectory.

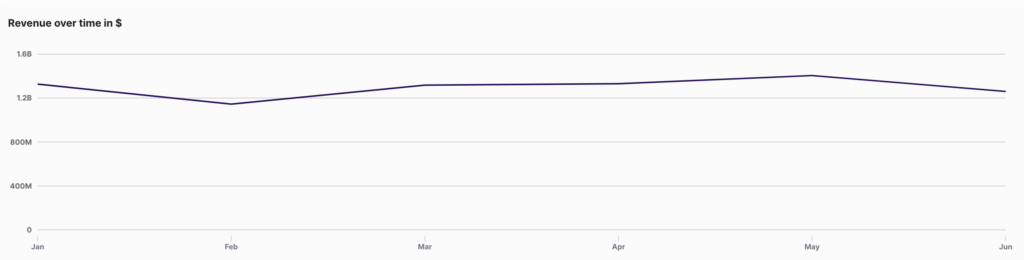

Beauty and Cosmetics

Beauty and Cosmetics in the UK experienced a slight growth of 1.03%, with revenues rising from $608.5 million in H1 2023 to $614.8 million in H1 2024. This marginal increase may indicate a stable yet competitive market. To stand out, businesses should focus on offering innovative and sustainable beauty products, personalized skincare routines, and leveraging digital marketing to reach a broader audience.

Sports

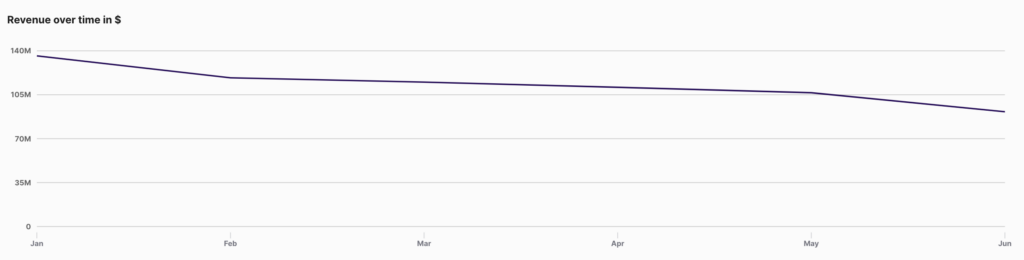

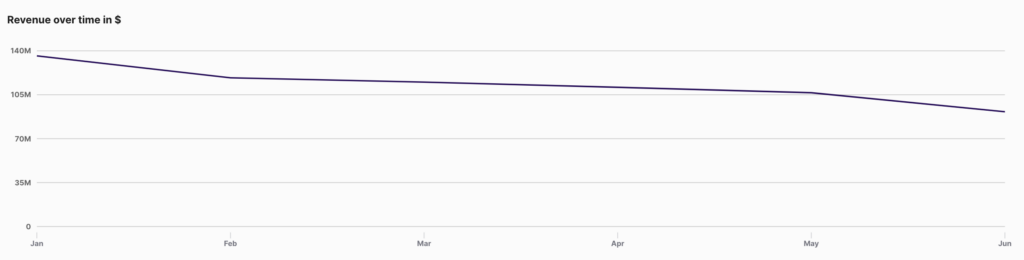

The Sports category saw a slight decline of 2.27%, with revenues dropping from $538.8 million in H1 2023 to $526.6 million in H1 2024. This decline might reflect a shift in consumer priorities or a temporary lull in spending on sports equipment. E-commerce businesses can revitalize interest by offering exclusive sports gear, engaging in community-building initiatives, and promoting active lifestyles through targeted campaigns.

Luxury

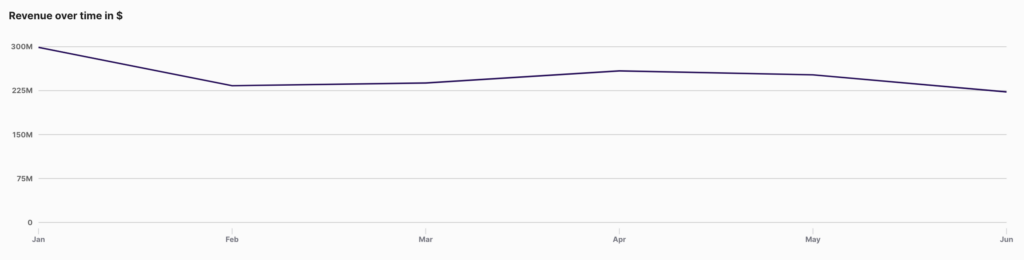

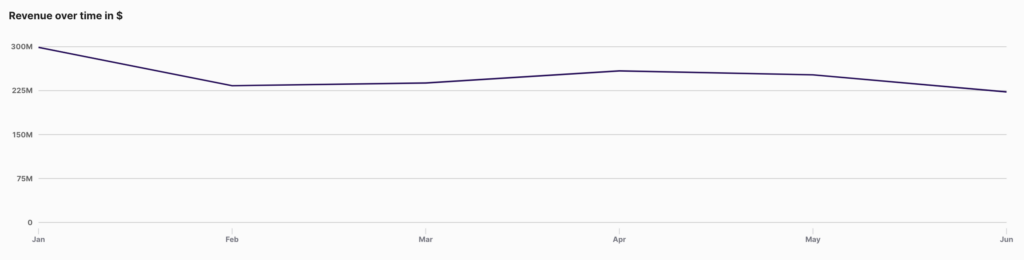

The Jewellery and Luxury Products category experienced a slight decline of 0.61%, with revenues decreasing from $299.2 million in H1 2023 to $297.4 million in H1 2024. Despite the slight dip, the market for luxury goods remains resilient. Retailers should focus on highlighting the craftsmanship and exclusivity of their products, offering personalized shopping experiences, and exploring new marketing channels to attract luxury consumers.

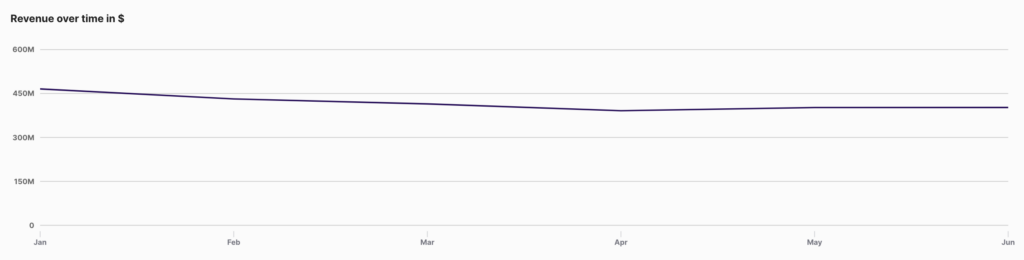

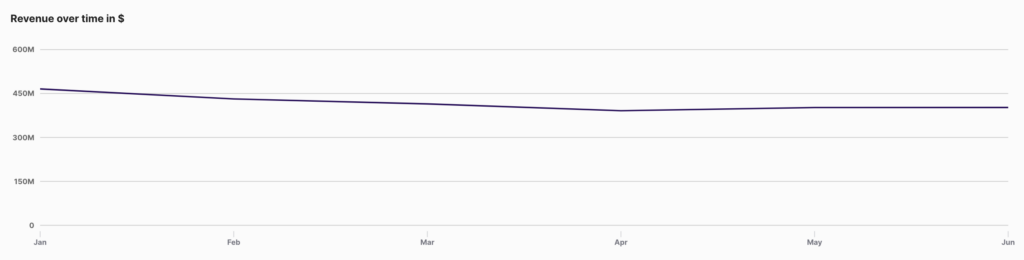

Health

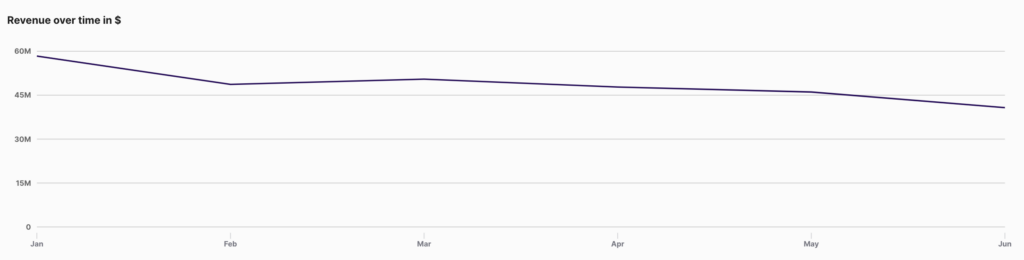

The Health category saw a significant decline of 15.46%, with revenues dropping from $539.3 million in H1 2023 to $456.0 million in H1 2024. This decrease could be due to a reduction in pandemic-driven demand. To reignite interest, e-commerce businesses should diversify their offerings, focusing on wellness products, mental health solutions, and niche health markets that cater to specific consumer needs.

Vehicles

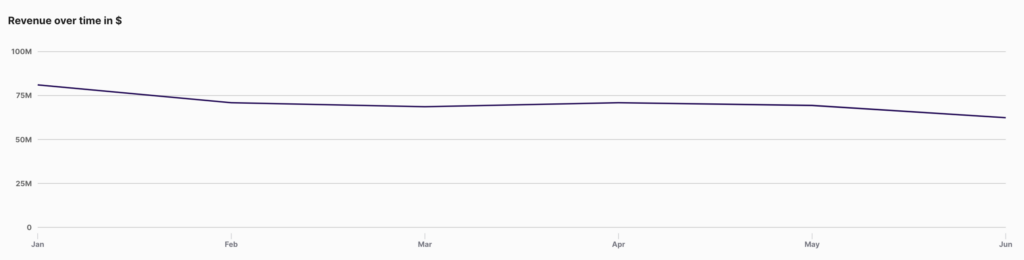

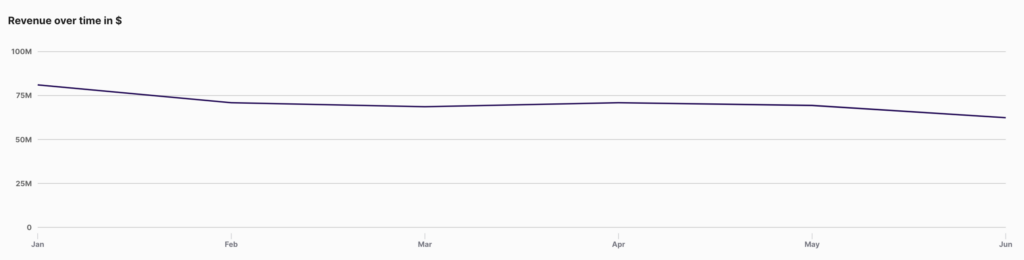

The Vehicles category experienced a decline of 2.61%, with revenues falling from $264.2 million in H1 2023 to $257.3 million in H1 2024. This decrease might be attributed to economic uncertainties or reduced consumer spending on high-ticket items. Ecommerce leaders in this sector should consider offering flexible payment options, expanding into the pre-owned vehicle market, and enhancing the digital car-buying experience to drive growth.

Pets and Animals

Pets and Animals saw a notable growth of 13.42%, with revenues rising from $100.6 million in H1 2023 to $114.1 million in H1 2024. This growth highlights the increasing consumer investment in pet care. Retailers should focus on expanding their product range to include premium pet products, health-focused items, and eco-friendly options to tap into this growing market.

Games

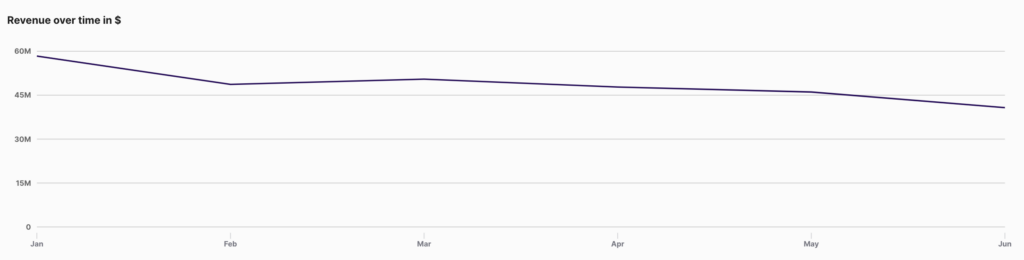

The Games category experienced a significant decline of 26.08%, with revenues dropping from $322.4 million in H1 2023 to $238.4 million in H1 2024. This sharp decrease could be due to market saturation or changing consumer preferences towards other forms of entertainment. To reverse this trend, ecommerce businesses should explore emerging gaming trends, such as mobile gaming and virtual reality, and consider offering exclusive content or bundles to attract gamers.

Childcare

The Childcare category saw impressive growth of 27.91%, with revenues rising from $55.2 million in H1 2023 to $70.6 million in H1 2024. This significant increase indicates a growing reliance on online shopping for childcare essentials. Ecommerce retailers should capitalize on this trend by offering a wider range of innovative and eco-friendly childcare products, as well as subscription services for recurring purchases like diapers and baby food.