The state of e-commerce in 2023 is complicated. With 2020 and 2021 seeing the biggest shift in online shopping in known history, 2022 suffered from heightened expectations, as real-world geopolitical and economic events affected buyer habits. This resulted in a deeply mixed, but difficult year for e-commerce brands and retailers.

Here are some trends that Grips found in our latest State of E-Commerce Report:

Global e-commerce was largely down in 2022

When we look at the global Grips data for 2022 (excluding China), we can see the impact that a tumultuous year had on e-commerce. Our data shows that between 2022 and 2021:

- E-commerce transactions fell 13 percent

- Revenue decreased by 11 percent

- Sessions fell by 10 percent

- Conversion rates dropped by six percent

- But…consumers were spending slightly more per e-commerce transaction, with the average order value up by two percent.

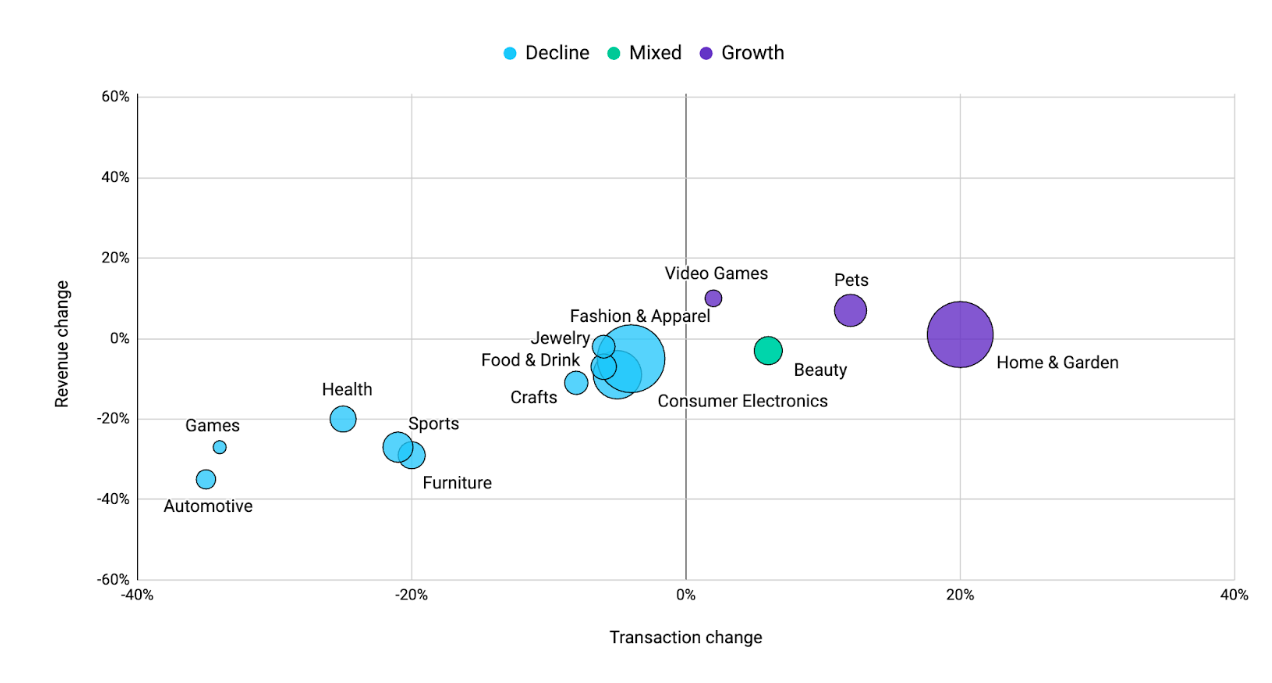

Category performance was similarly disappointing, with only two categories on a global level seeing growth in year-on-year transactions and revenue. But, there were signs of optimism when we looked at individual countries’ category performance, as seen in this US example:

Year-over-year change in category transactions and revenue

(Bubble size reflects 2022 revenue)

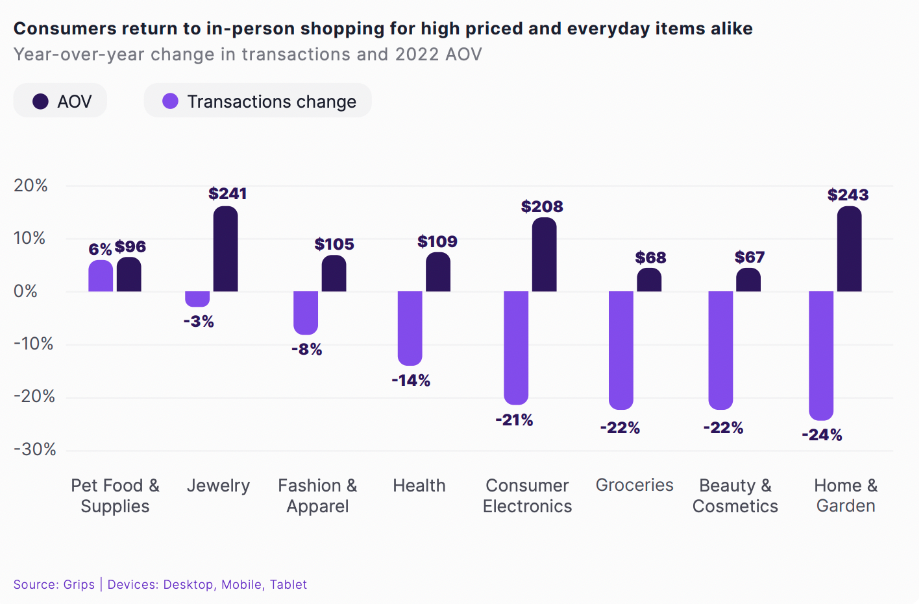

The return of brick and mortar impacted e-commerce

After two years of lockdowns and restrictions, consumers seemed anxious to flock back to in-person shopping. In our data, Grips saw categories that have products with higher price points post drops in transactions and revenues in 2022. Categories like Groceries with lower AOVs also declined, but for a different reason as consumers returned more to brick and mortar stores for everyday items.

The biggest knock-on effect for offline retail returning so strongly has been for online-only retailers, which saw substantial declines in their revenues, partly due to dwindling demand and excess inventory. This has led to retailers needing to offer heavier discounts and for longer periods, including Amazon, who for the first time in their history hosted two Prime Days in the year.

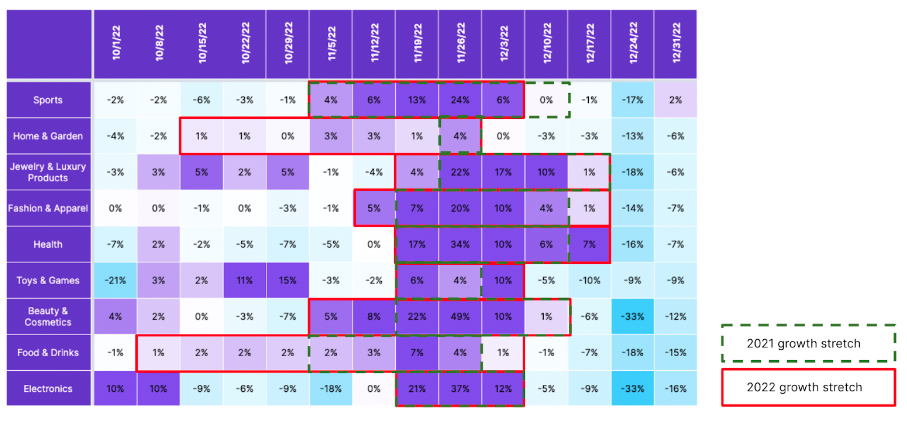

Retailers discounted for longer periods

With e-commerce struggling throughout 2022, Grips saw in our data that retailers were discounting for longer, particularly over the holiday season. Traditionally, the holiday spending period for consumers is concentrated on November and December, but in 2022 that changed, with retailers beginning their discounting much earlier to try and extract as much revenue as possible out of consumers.

And, it appeared to work. Consumers started shopping earlier in 2022 and in some cases kept shopping later.

Week-over-week change in UK e-commerce revenue for key retail categories

In our data from Cyber Week for example, we saw consumer behavior change from spending primarily on one or two days (Black Friday and Cyber Monday) to the entire week. In fact, Black Friday in the US accounted for a lower share of Cyber Week’s revenue than it did in 2021.

And, the same trends could be seen in the week-over-week comparisons, with consumers upping their Cyber Week spending in many categories weeks before Cyber Week and continuing to increase their spending a week or two longer than in 2021. So, could this mark the end of marketing-driven shopping days, like Black Friday in favor of Cyber Month?