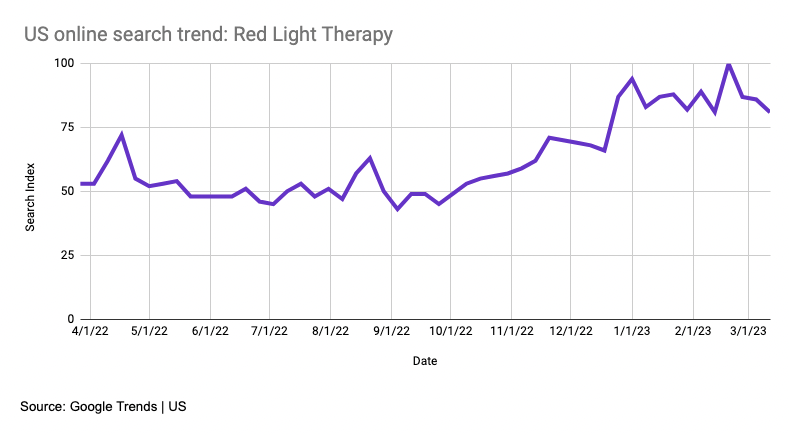

Infrared and red light therapy (RLT), a type of therapy that uses infrared radiation to penetrate deep into tissue to stimulate cellular activity at a molecular level, received a surge in consumer interest in 2022. The Google Trends chart below reveals that there was a spike in online search around the therapy in the United States last April and then a bigger, more sustained, rise in interest beginning in September and continuing into 2023.

One likely explanation for this surge in interest in red light therapy was Tucker Carlson’s controversial take on red light therapy on men’s, um, nether regions, which coincided with increased interest. (Here’s a little background.) No matter your predisposition on the validity of red light therapy, there is no shortage of content debunking, validating and even straddling the line between both criticism and pseudo-validation of red light therapy treatment.

“Interesting trend,” you might say. “But why is Grips writing about this?”

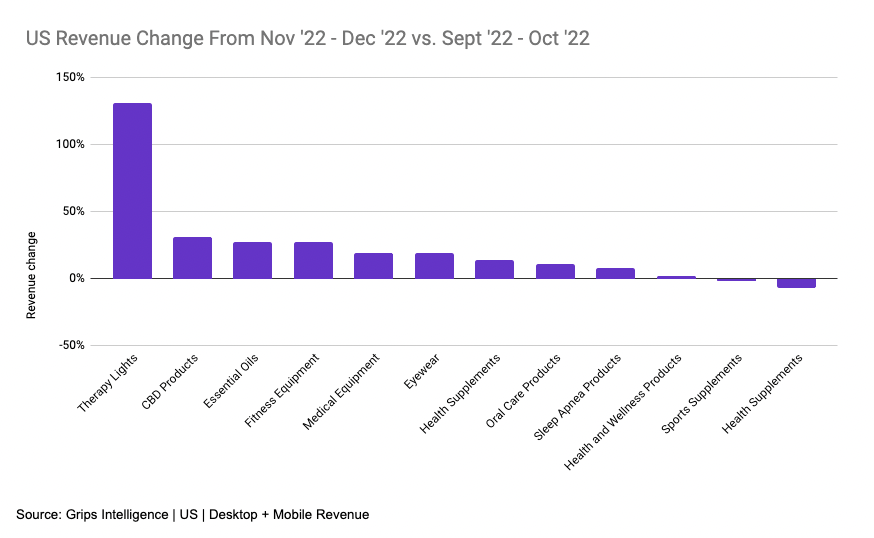

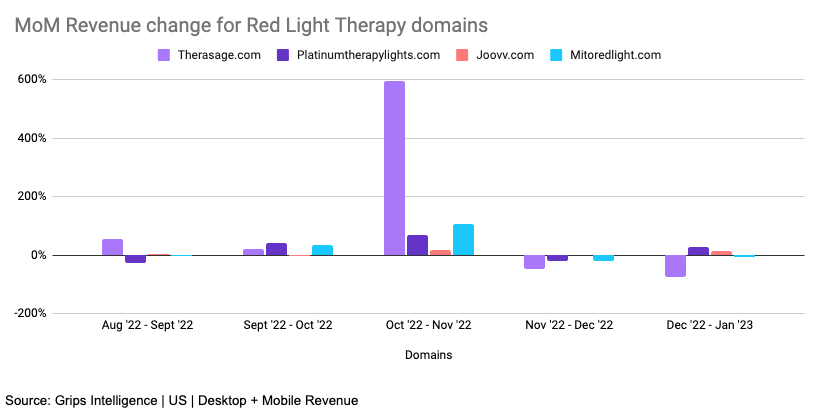

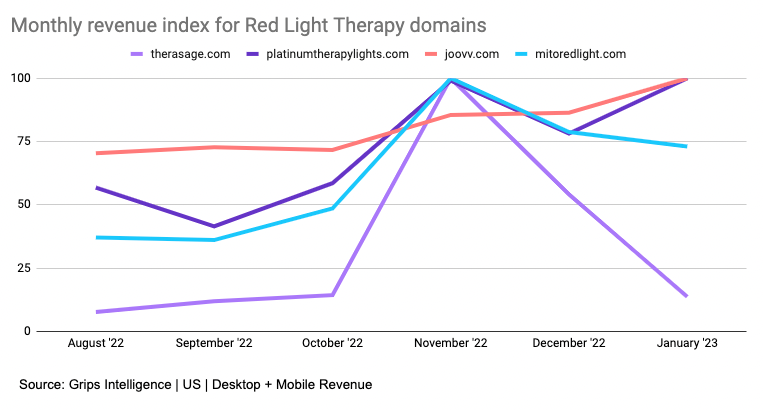

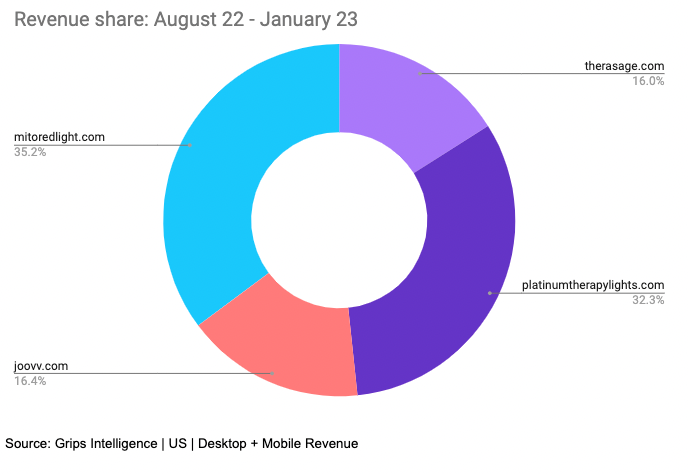

Well, it just so happens that Grips has some interesting transactional data relevant to the topic that we wanted to shine some light on. Specifically, Grips data shows that companies specializing in red light and infrared therapy were the fastest growing sub-segment of the Health category during the 2022 holiday season with revenues increasing by a factor of over 2X versus the previous two months. Furthermore, a new red light therapy report estimates that the light therapy market, which includes red, blue and white light applications, will grow to $1.2 billion by 2028. So we think you’re going to be hearing a lot about this treatment in the months and years ahead.