After the holiday surge in spending, the first weeks of a new year can be challenging for retailers, but what does consumer spending patterns in the US, UK and Germany teach us about consumer spending patterns for 2023 so far.

Here are four trends that we discovered in our March heatmaps report:

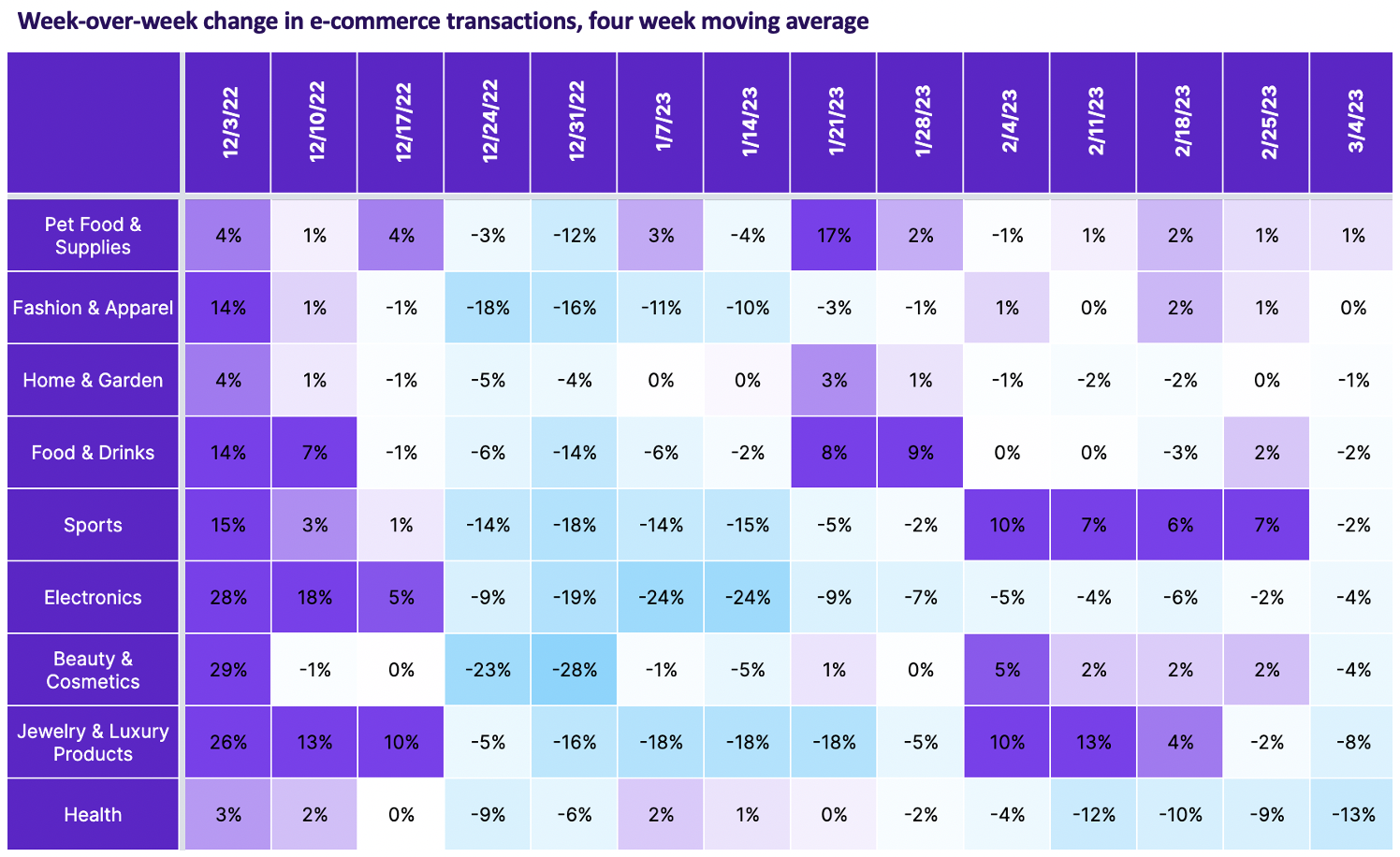

The Super Bowl and Valentine’s Day helped kick-start e-commerce in the US

In the US, the Sports, Beauty & Cosmetics and Jewelry & Luxury Products saw week-over-week increases in transactions throughout February where the two events converged. While the Super Bowl was not so much of an event in the UK or Germany, the latter saw a rise in the Beauty and Jewelry categories during the week of Valentine’s Day.

Inflation continues to impact online shopping

In the three countries that Grips tracked, we saw the continued impact that inflation was having on e-commerce across categories. Only one or two categories in each country saw average order value (the amount a consumer spends per order) actually outstrip inflation. This is concerning for e-commerce retailers, as ultimately it affects their profitability.

Inventory could become an issue for German and UK e-commerce retailers

UK and German e-commerce performance is down on last year in our year-over-year comparison. In multiple categories we saw double-digit declines in e-commerce transactions, which could have unintended consequences for retailers who may be faced with excess inventories, if demand continues to drop at such a rapid level.

Some categories have not started 2023 on a good foot

In each of the three countries, there were multiple struggling categories, from Electronics and Home & Garden in Germany to Jewelry & Luxury Products in the US. While the reasons for such declines will vary from in-person shopping growth to more pressing consumer priorities, it will be important for retailers to closely monitor these categories in the coming weeks and months.

To discover more insights about consumer spending through the beginning of March, download our latest heatmaps report here.