Prime Day 2024 has solidified its position as a crucial event on the retail calendar, offering a wealth of insights into consumer behavior and market trends. This year, the event not only generated an impressive $1.25 billion in online revenue for Amazon.com—a 46% increase over the average Tuesday and Wednesday revenues from the previous four weeks—but also surpassed the combined revenue of Black Friday and Cyber Monday 2023 by 4%, or $48.7 million. For retailers, DTC brands, and Amazon sellers, Prime Day serves as a powerful indicator of which categories, brands, and products are likely to drive success during the upcoming Big Deals Days in October and the Black Friday/Cyber Monday period in November.

Prime Day Insights to Boost Your Holiday Sales Strategy

Overview

Download the Prime Day Insights report

Readers who are interested in Prime Day insights will appreciate our latest report identifying the top categories and subcategories, brands and SKUs from Prime Day. Download the report here.

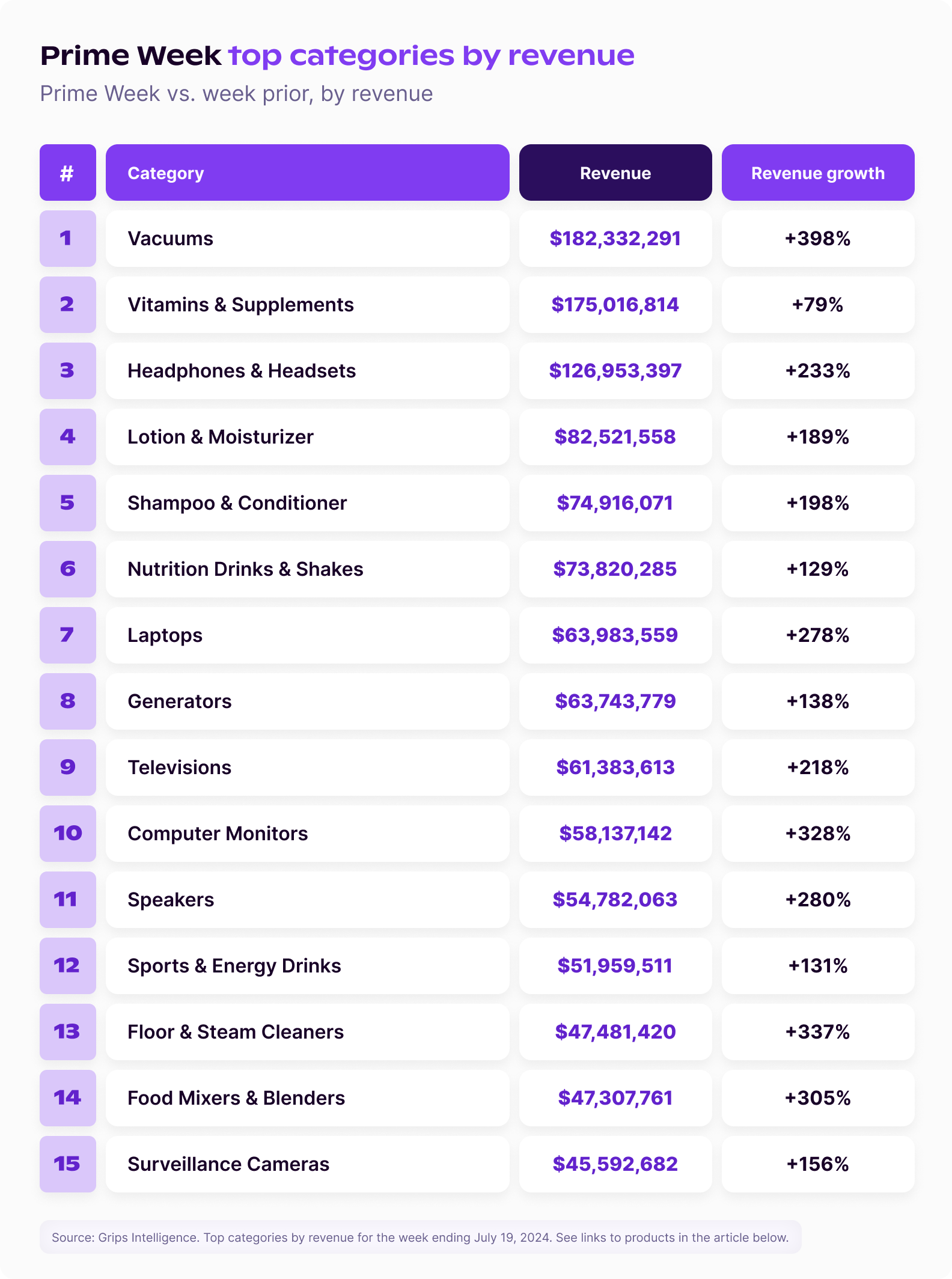

High-Performing Categories: A Glimpse into Consumer Priorities

Prime Day 2024 revealed significant shifts in consumer spending, with certain categories experiencing dramatic growth. For instance during the weekending July 19th, the Video category, which includes televisions, computer monitors and video games, saw a 200% increase in revenue and a 107% increase in units sold versus the week prior, reflecting strong demand for home entertainment products. This surge can be attributed to the rising consumer interest in upgrading home entertainment systems, possibly driven by new releases, enhanced technologies and competitive pricing. Consumers are increasingly investing in high-definition screens, sound systems and streaming devices as they seek to create cinema-like experiences at home. This trend suggests that home entertainment remains a priority for consumers, especially when presented with enticing deals.

Similarly, Household Appliances, including vacuums, air purifiers, humidifiers, etc. surged by 197% in revenue and 142% in units sold, indicating that consumers are keen on upgrading their homes during these sales events. The demand for smart home devices, energy-efficient appliances and high-performance kitchen gadgets is growing as consumers prioritize convenience and sustainability. These categories not only meet functional needs but also reflect a desire for products that enhance everyday life, making them particularly attractive during sales events where discounts lower the barrier to entry for premium products.

Other top categories posting strong growth over Prime Day include: Kitchen & Dining (+162% in revenue growth and +82% in unit sales), Personal Care (+131% in revenue and 91% in unit sales) and Power & Electrical Supplies (+112% in revenue growth and 53% in unit sales).

Analytical Takeaways:

- Target Popular Categories: Focus promotional efforts on high-demand categories like household appliances, electronics and kitchen items. These areas are where consumers are likely to spend more, especially when significant discounts are offered. Given the strong performance in these categories, it’s clear that consumers are willing to invest in products that promise value (either long-term or short-term) and improve their quality of life.

- Bundle Offers: Create bundled deals that combine popular items within these categories to drive higher average order values and increase overall sales. Bundling not only incentivizes larger purchases but also provides consumers with perceived added value, which can further enhance the attractiveness of the offer.

- Highlight Best Sellers: Feature top-selling items from these categories prominently in marketing materials and landing pages to capitalize on consumer interest. By showcasing products that have already proven popular, retailers can tap into existing demand and create a sense of urgency, encouraging shoppers to act quickly to secure these deals.

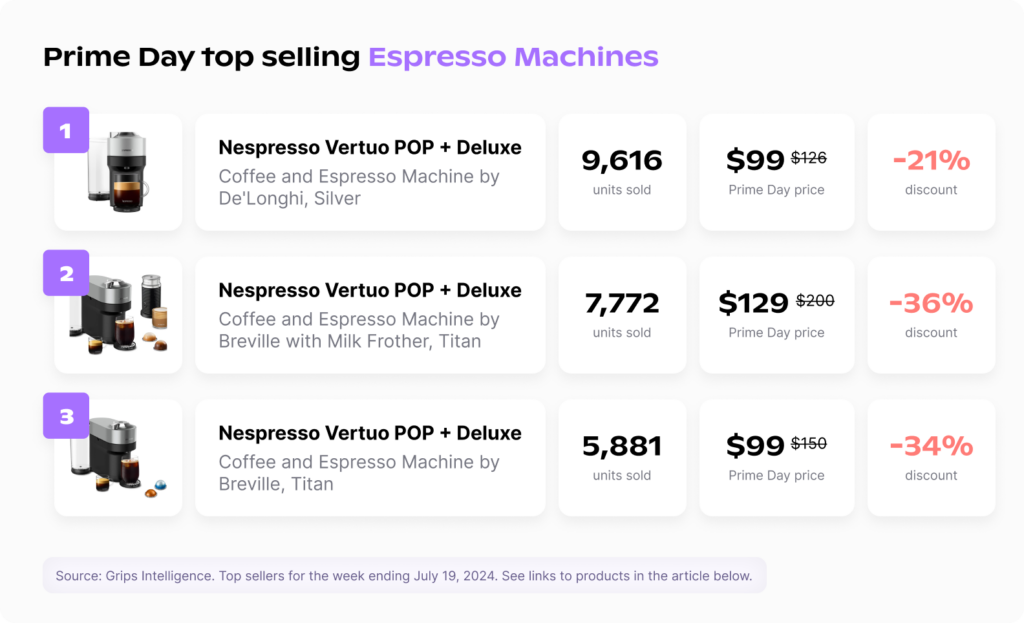

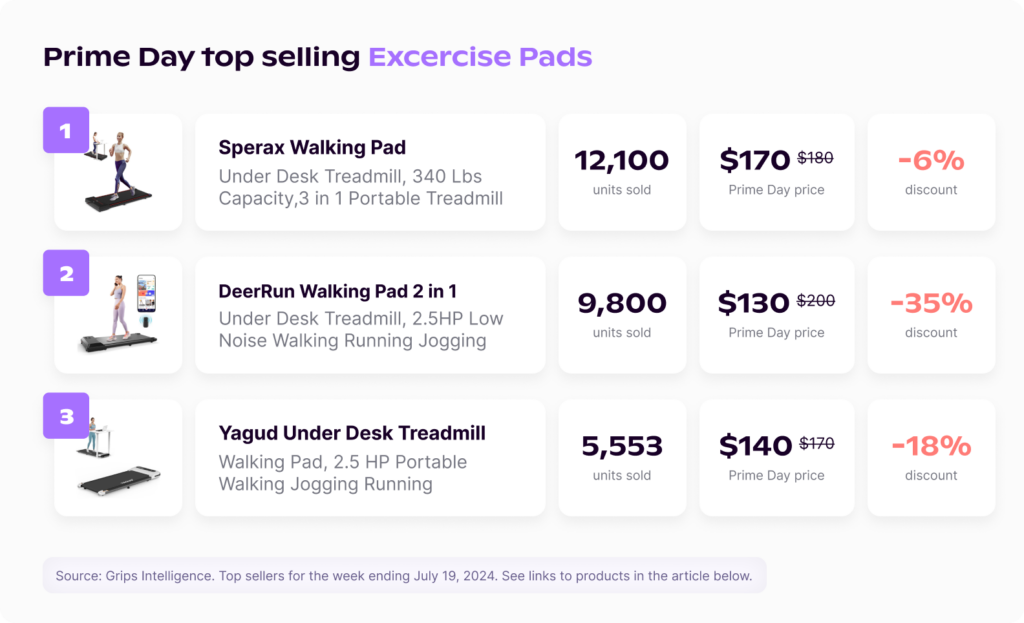

Fast-Moving, Niche Categories: Capitalizing on Specialized Demand

While major categories dominated overall sales, several niche markets also saw remarkable growth. For example, Espresso Machines emerged as a top performer, with the Nespresso Vertuo Pop+ Deluxe Coffee and Espresso Machine selling 9,616 units during the week ending July 19th at a Prime Day price of $99, a 21.4% discount from pre-Prime Day price. The strong performance of espresso machines reflects a broader trend of consumers investing in high-quality coffee experiences at home, perhaps driven by the continued popularity of coffee culture and a desire to replicate café-quality beverages without leaving the house. This trend has also been fueled by the availability of easy-to-use machines that offer a variety of drink options, making them an attractive purchase during sales events.

The Power Flossers category also saw significant traction, despite being a relatively new and emerging market. The recent entrance of low-cost brands fueled by viral social posts are challenging established (and expensive) brands like Waterpik and generating excitement in a category that was otherwise flat. This presents a unique opportunity for brands in this space to capture market share and establish themselves as leaders. The growth in this category suggests that consumers are becoming increasingly aware of the importance of oral health and are willing to invest in low-cost dental care tools. The top-seller over Prime Day cost just $23. The fact that power flossers were among the top-selling items during Prime Day is a good sign that they will perform well during Big Deals Days as well as Black Friday and Cyber Monday.

Analytical Takeaways:

- Spotlight Niche Markets: Highlight niche categories with fast-moving products in your promotions. These categories, though smaller, can drive significant revenue when targeted correctly. Given the growing consumer interest in specialized products like espresso machines and power flossers, brands that can effectively position themselves as innovators in these spaces stand to gain a competitive edge.

- Discount Strategically: Use substantial discounts, similar to those that drove success in these niche categories, to stimulate demand and outpace competitors. Since these markets are still emerging, aggressive pricing strategies can help brands quickly build a loyal customer base and increase market penetration.

- Leverage Exclusivity: Offer exclusive deals or limited-time offers in these niches to create urgency and drive sales. By emphasizing the limited availability of these products, retailers can encourage consumers to act quickly, which can help to clear inventory and boost short-term sales.

Essential Categories: Steady Growth Amidst Sales Events

Prime Day also underscored the importance of essential goods, with categories like Health Care and Household Supplies seeing robust performance. Health Care products, including protein supplements, nutrition bars and medical thermometers, among other items, saw an 83% increase in revenue during the week ending July 19th versus the week prior, driven by a 62% rise in units sold. This growth highlights the ongoing demand for savings on health-related products. Items such as thermometers, first-aid supplies and personal protective equipment likely drove sales in this category, reflecting a consumer focus on preparedness and preventative care. The steady demand for these items underscores their importance in consumer shopping habits, especially during sales events where they can be purchased at a discount.

Household Supplies also followed suit with a 58% revenue increase and a 45% growth in unit sales. This category includes everyday necessities like cleaning products, paper goods and kitchen essentials—items that consumers stock up on regularly. The consistent demand for these products during Prime Day suggests that consumers are using these sales events not only to splurge on luxury or instant-gratification items but also to secure essential goods at lower prices. Retailers that can effectively market these products as part of a broader sales strategy are likely to see continued success, particularly as consumers look to balance their spending between indulgence and practicality.

Analytical Takeaways:

- Promote Essentials: Ensure that essential goods are featured prominently in your promotional strategy. These categories drive consistent revenue, even during events focused on luxury or big-ticket items. By marketing these products alongside more glamorous offerings, retailers can attract a wide range of shoppers, from those looking for practical deals to those seeking indulgent purchases.

- Create Value Bundles: Combine essential products with trending or higher-margin items in bundled offers to increase overall sales and average order value. Bundling essentials with popular or trending items can help to move inventory while also providing consumers with perceived added value.

- Balance Promotions: Balance your promotions between essentials and more glamorous items to cater to a broader audience and maximize revenue potential. This approach ensures that you can meet the needs of both budget-conscious shoppers and those looking to make larger, more considered purchases.

Top-Selling SKUs: Insights into Optimal Discounting Strategies

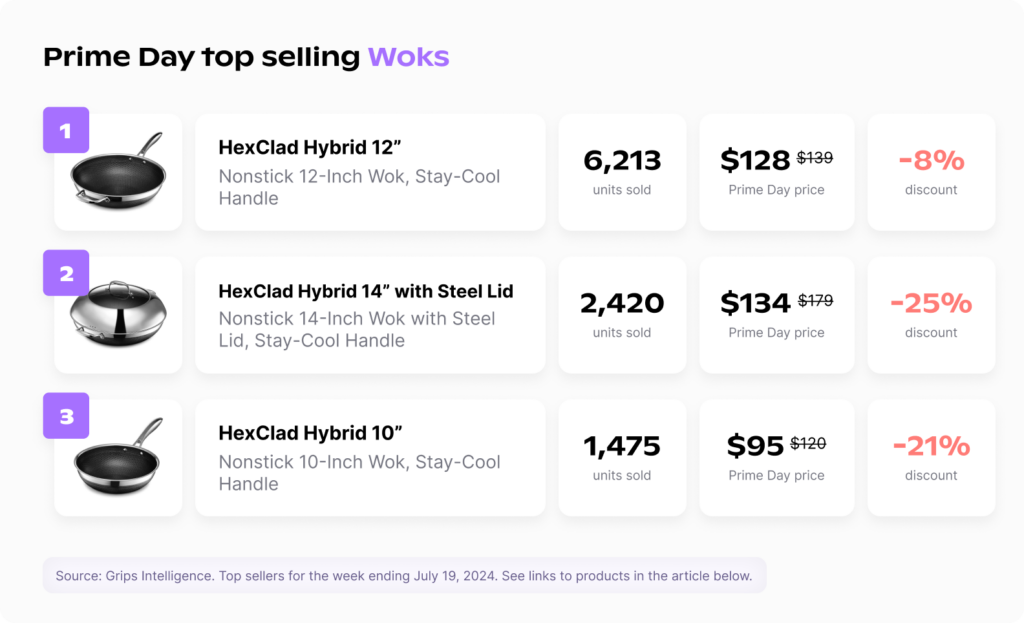

Prime Day 2024 not only highlighted high-performing categories but also provided a closer look at the specific products that drove sales within these categories. By analyzing the discounts offered on top-selling SKUs, we can glean valuable insights into how pricing strategies contributed to their success.

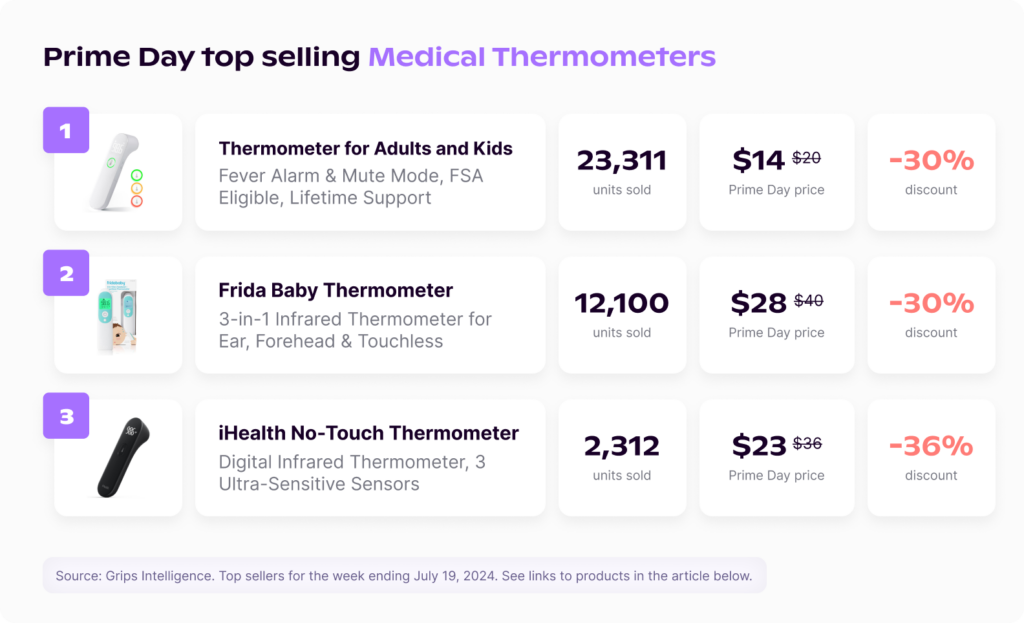

For example, in the Medical Thermometers category, the Frida Baby Infrared 3-in-1 Thermometer was a top performer, selling 12,100 units with a Prime Day price of $28—down from its previous price of $40, reflecting a 30% discount. This discount positioned the product as an attractive deal, especially for consumers who had been considering a purchase but were waiting for a more favorable price. The success of this SKU demonstrates how strategic discounting can drive significant volume, particularly in categories where consumers are sensitive to price but also value quality and brand reputation.

In the Power Flossers category, the lack of a dominant household brand meant that products could compete more effectively on price. The category saw substantial sales despite being relatively new, indicating that consumers are open to trying emerging products if the price is right. The discounts in this category were also significant, often in the 20-35% range, making these products accessible and appealing to a broader audience. This suggests that in emerging categories, where brand loyalty is still developing, aggressive pricing can be a key differentiator that drives consumer adoption and sales.

The data shows a consistent pattern: top-selling SKUs generally offered significant discounts, typically in the range of 20-35%. This level of discounting appears to be the sweet spot, making products appealing enough to drive high volume sales without severely impacting profit margins. The effectiveness of these discounts underscores the importance of pricing strategies in driving consumer decisions during major sales events.

Analytical Takeaways:

- Set Optimal Discounts: For the upcoming Big Deals Days and Black Friday/Cyber Monday, consider setting discount targets in the 20-35% range for products aimed at becoming top sellers. This discount level effectively attracts consumers while maintaining profitability. In categories where competition is high, ensuring that your discounts are compelling enough to stand out will be crucial to driving sales.

- Maximize Visibility: Ensure that these discounted products are prominently featured in marketing campaigns and on landing pages to maximize visibility and drive sales. The placement of these products, whether through email marketing, social media or on-site banners, can significantly influence their performance.

- Leverage Past Success: Use the insights from top-performing SKUs during Prime Day to inform which products to push during the holiday sales events, replicating successful discounting strategies. Additionally, consider expanding on these strategies by offering limited-time promotions or exclusive bundles that enhance the perceived value of the deal.

The Takeaway

Prime Day 2024 provided a wealth of data that can inform and refine strategies for the upcoming Big Deals Days in October and the Black Friday/Cyber Monday period in November. While some categories underperformed or grew at below-average rates, understanding these trends allows retailers to make strategic adjustments to maximize performance in the holiday season’s most critical sales events.

By focusing on optimal discount strategies for top-selling SKUs, enhancing promotions for underperforming categories, and differentiating in crowded markets, retailers and DTC brands can position themselves for success. Leveraging these insights from Prime Day will be key to capturing consumer demand and driving significant revenue during the upcoming holiday shopping season.

Leverage Grips for Unmatched E-Commerce Insights This Holiday Season

Understanding the ever-changing landscape of e-commerce is critical, especially during high-stakes sales events like Big Deals Days, Black Friday and Cyber Monday. With Grips, you gain access to unrivaled insights into e-commerce transactions across more than 65,000 domains, including daily, weekly and monthly revenue reports. Our platform provides a comprehensive view of your market, enabling you to track trends, monitor competitor performance and identify opportunities and challenges as they arise.

One of the most powerful features of Grips is our SKU-level sales reporting, available for over 10,000 domains—including Amazon. Knowing which SKUs are driving sales can make or break your holiday strategy. By tracking top-selling products, Grips allows you to respond swiftly to market demands, optimize your inventory and adjust your promotional strategies to maximize sales.

The holiday season is too critical to leave anything to chance. With Grips, you have a tool that ensures you’re always informed and ahead of the curve. Whether you’re tracking daily revenue or analyzing the performance of specific SKUs, Grips provides the actionable insights you need to make data-driven decisions that will drive your holiday success.

Don’t miss out on the opportunity to elevate your holiday performance. Book a demo with Grips today and equip your team with the insights necessary to maximize your revenue this season.